June 30 – July 06 (Published July 9th)

PERSPECTIVES by Todd White

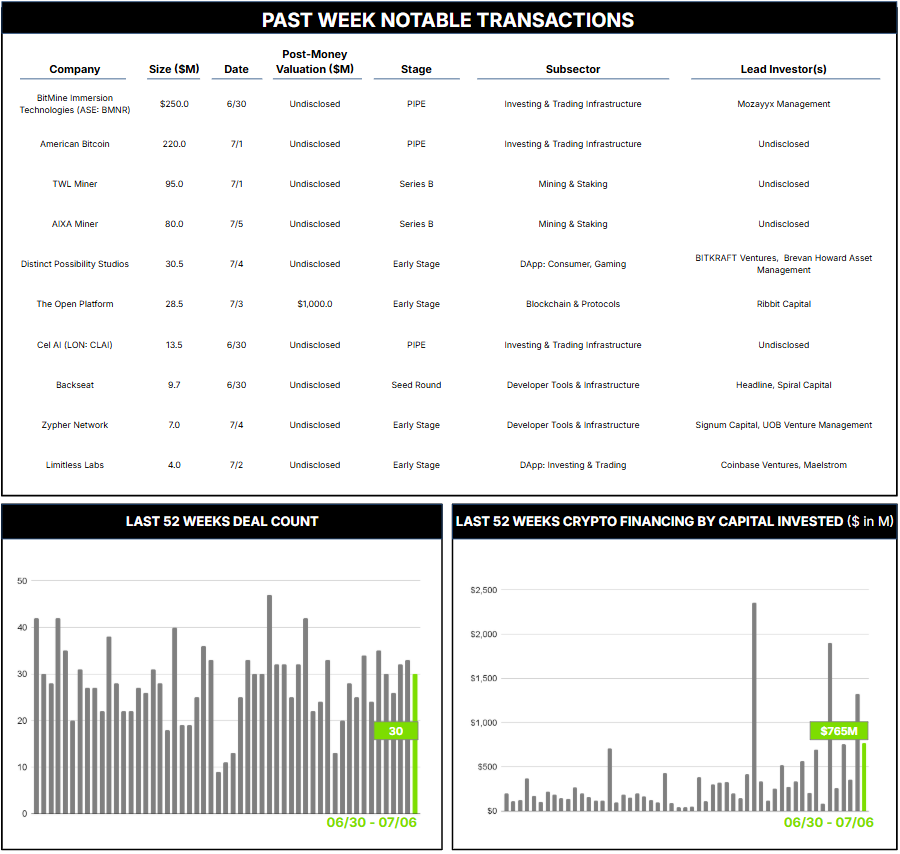

30 Crypto Private Financings Raised: $764.6M

Rolling 3-Month-Average: $544.4M

Rolling 52-Week Average: 326.6M

The Architect Partners Q2 2025 Crypto M&A and Financing Report was released yesterday and featured on CNBC. Much of the headline focus has been Q2 M&A activity, which marked the best quarter to date, with numerous sector records broken. Yet private-financing momentum is also solid: invested funds already exceed 80% of the 2024 total, even before including the recent spate of treasury-related PIPE transactions.

Two notable trends are developing. The first is that, within the persistent preference for infrastructure investments, payments-related initiatives have seen the most dramatic rise in support, with a 216% increase in funding activity from last year alone. The second is the earnest arrival of crypto treasuries and their associated PIPE transactions. Famously pioneered by Michael Saylor’s MicroStrategy, we have now seen, in 2025 alone, 109 public treasury-related announcements and follow-on offerings accounting for more than $72.5 billion in intended capital commitments toward crypto-treasury accumulation. When these are added to the traditional funding rounds cited above, aggregate year-to-date financing reaches $12.7 billion, well above the full-year totals of $10.7 billion and $9.1 billion for 2023 and 2024, respectively, and it is on pace to surpass their combined total if 2025 activity continues apace.

While these developments may appear disparate, they align in ways that create opportunities for companies positioned at or near the crossroads where the two converge. We have conducted deep research into the payments space (Part I: Why Crypto Payments, Part II: The Momentum is Building, Part III: The Market Map), and the prospect of the first entirely new system of payments infrastructure is enticing, though still early. We are also developing informed views of the evolving crypto-treasury space, where a common concern is the need for real business activity, beyond mere asset accumulation, to generate alpha. Shifting treasury focus to a crypto asset such as ETH or SOL, which offers additional utility and can generate yield through staking or other means, helps address that concern. Pivoting to an asset that sits at the nexus of other industry trends may unlock further opportunities.

BitMine Immersion Technologies (BMNR) may be doing just that. Historically operating as a Bitcoin miner that leveraged low-cost energy regions to maximize operational efficiency, BMNR has recently pivoted to an Ethereum-centric treasury strategy, aiming to become a public proxy for institutional ETH exposure. This shift coincides with the appointment of Fundstrat’s Tom Lee as board chair and reflects a belief in Ethereum’s role as the backbone of stablecoin settlements and DeFi. “Ethereum is the blockchain where the majority of stablecoin payments are transacted,” Mr. Lee has stated, “and thus, ETH should benefit from this growth.” The move to ETH therefore positions BMNR to capture additional value from the anticipated surge in stablecoin- and DeFi-related payment activity on Ethereum.

The move is not without risk, as there is no guarantee that Ethereum will maintain its dominance in stablecoin payment rails. Other groups, such as 1Money’s stablecoin-specific layer-1 blockchain, are vying for position in the coming payments wave. However, investors are supportive: BMNR secured a $250 million private placement last week in a round led by major investors such as Mozayyx, Founders Fund, Pantera Capital, Galaxy Digital, and Kraken. The capital is earmarked specifically for building a substantial ETH treasury, potentially increasing BitMine’s crypto holdings more than sixteen-fold. Public markets appear aligned as well, with BMNR’s shares enjoying a significant run in the wake of the announcement.