March 03 – March 09 (Published March 12th)

PERSPECTIVES by Todd White

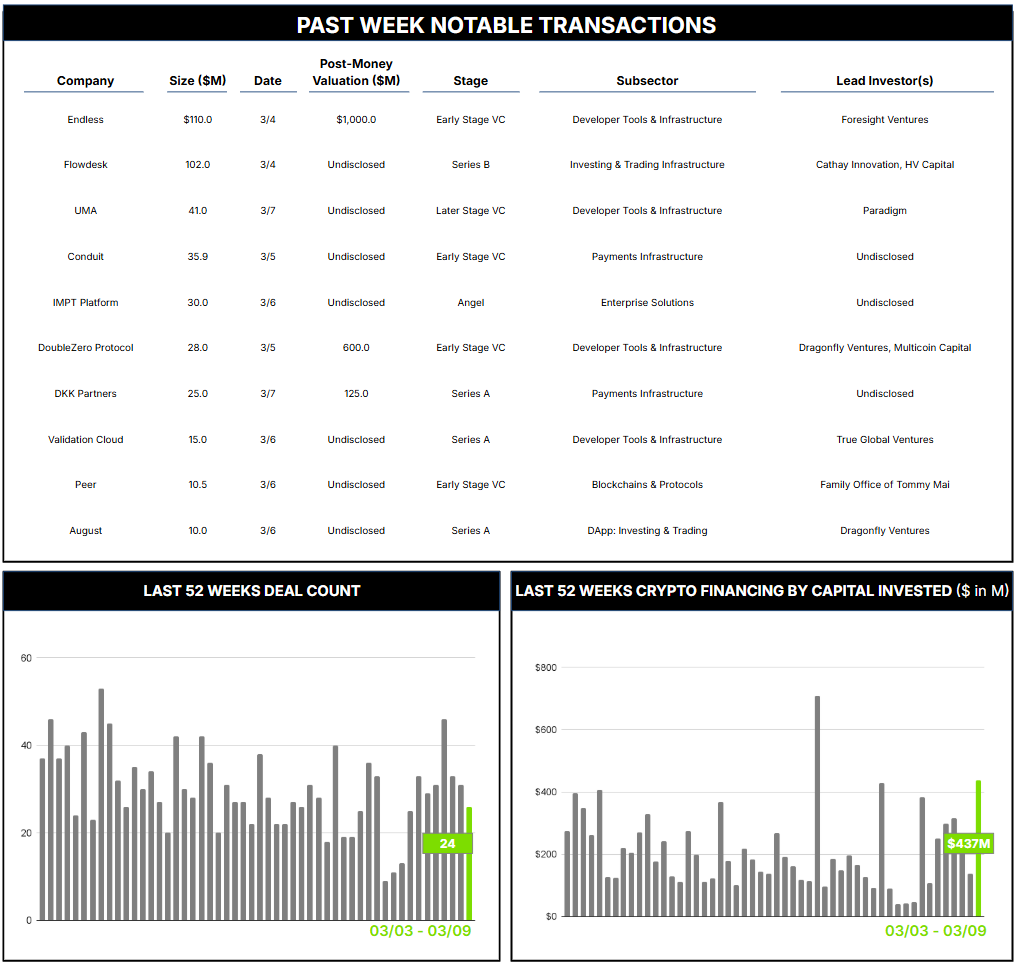

26 Crypto Private Financings Raised: $437.1M

Rolling 3-Month-Average: $197.5M

Rolling 52-Week Average: $211.6M

We believe four foundational factors are useful signals for assessing the innovation and maturation of emerging technologies: capital invested, number of users, value created, and corporate strategy enacted through M&A. In our “Family Ties” series, first published in January 2024 (here) and updated last month (here), we use these factors to compare the Internet and Crypto to reveal some striking conclusions. For example, we found that in 2024, the value created in the Crypto sector surpassed that of the Internet at the same stage in its respective life cycle—an exciting and potentially “breakout” moment for investors.

However, other factors continue to lag, most notably the number of users. There are, of course, myriad causes for this dearth of “useful things” beyond pure speculation. But the difficulty in transitioning practical everyday applications from Web2 to Web3 is likely high on anyone’s list.

The truth is that Crypto and blockchain present businesses with a thorny mix of technical, regulatory, and user-centric challenges to adoption. Chief among them is the sheer complexity of blockchain and dApps, which often requires specialized expertise and a steep learning curve, with both time and financial investments that can exceed the means of many businesses. Technical limitations, such as slower processing speeds and high transaction cost, also constrain scalability and adoption.

Regulatory uncertainty, particularly in the U.S., has created (unnecessary?) compliance risks and strategic hesitancy. While this may now be changing, the need to navigate unclear legal frameworks has complicated long-term business planning and adoption. The lack of intuitive user interfaces, closely tied to the technical challenges above, remains a persistent hindrance. The need to manage wallets, transaction fees, and blockchain interactions must be simplified to drive broader acceptance among non-technical users. Interoperability across chains and integration with legacy Web2 systems is another persistent challenge. The risk of disrupting critical workflows can incite caution and even fear of destabilizing core models for early movers seeking to adopt untested Web3 strategies.

Endless is a cloud-based protocol designed to simplify the transition to the Web3 world of decentralized blockchain technologies. Their platform combines essential Web3 components, such as blockchain networks, data storage, and messaging, with an AI agent toolchain and a simplified interface tailored for developers familiar with traditional web programming. Their goal is to accelerate adoption by lowering the technical barriers to entry for mainstream developers and businesses, with a system designed to handle large numbers of transactions quickly and at low cost.

Our analysis suggests this work is sorely needed. And investors seem to agree, supporting Endless this week with a $110 million funding round at a $1 billion project valuation. Now let us see if that elusive cohort of inchoate Web3 users agrees.

Contact ryan@architectpartners.com to schedule a meeting.