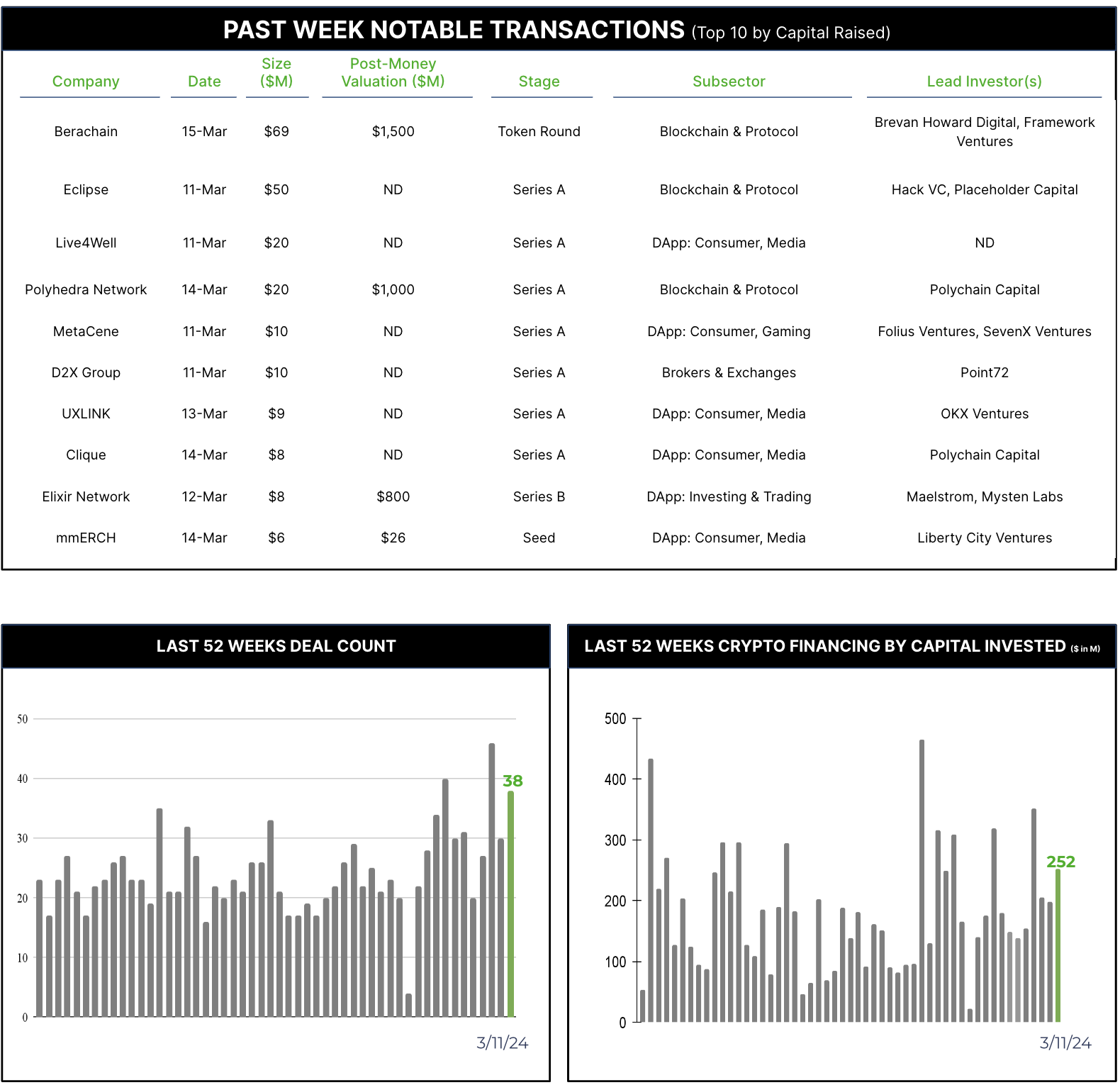

38 Crypto Private Financings Raised ~$252M

Rolling 3-Month-Average: $200M

Rolling 52-Week Average: $186M

After a few months of no disclosed investments, this week marked the reported return of Brevan Howard Digital (BH Digital) to the crypto ecosystem. The $40B Asset Manager was one of the first large-scale hedge funds to create a blockchain and digital asset focused fund. The group has invested in 20+ digital asset firms, focusing mostly on earlier-stage, larger-sized rounds. Their investment this week in Berachain was no exception. Berachain is reported by Bloomberg to have raised $69M in tokens at a $1.5B valuation with Framework co-leading alongside BH Digital. Berachain houses a blockchain ecosystem involving its own stablecoin, governance token, and gas token.

In other news, another large-scale hedge fund (~$35B AUM), Steve Cohen’s Point72, continues to show its proclivity towards digital asset investing. Following on its investments in late 2023 of Membrane Labs and GenTwo, Point72 invested in D2X Group’s $10M round. Common with previous investments, this was a Series A round, where Point72 took the lead position. D2X is a crypto derivatives exchange that has secured the first MiFID II license in the Netherlands, allowing for futures and options trading.