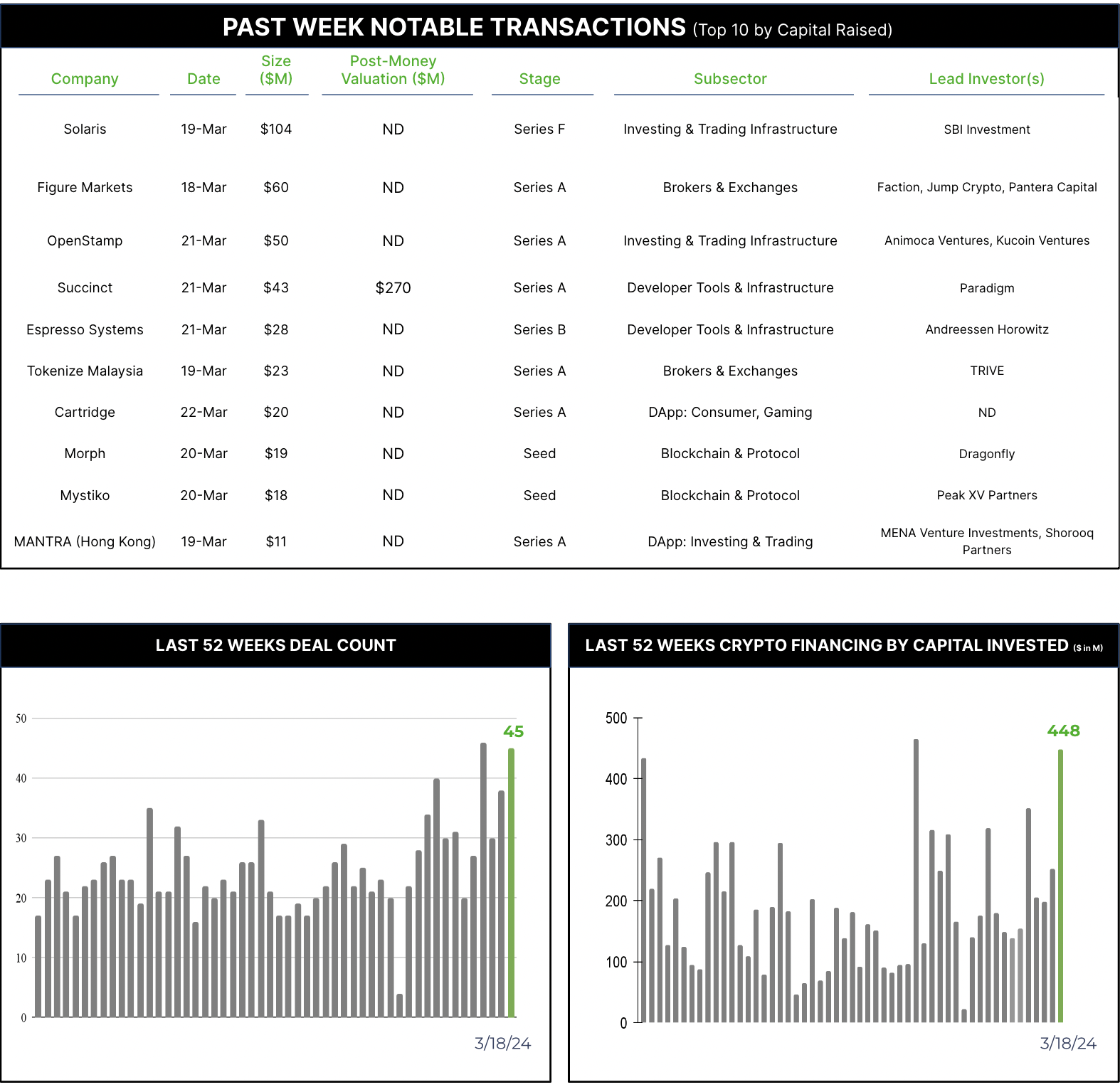

45 Crypto Private Financings Raised ~$448M

Rolling 3-Month-Average: $226M

Rolling 52-Week Average: $181M

The theme in this month’s writings has been the wait for real crypto growth rounds. The type of round that signifies noteworthy capital ($100M+), at a later stage (Series C+), from credible investors. This week, we got one, with a caveat.

Solaris, a banking-as-a-service platform offering cards, payments, lending, and traditional banking services, was one of the first Fintechs to offer regulated crypto custody. This week, they raised €96M ($104M) from SBI Holdings, with Banco Bilbao Vizcaya Argentaria, Lakestar, HV Capital, La Maison Partners, yabeo Capital, FOX Group and Decisive Capital Management participating. The caveat with this growth round is that these are existing investors, except for La Maison Partners and FOX Group. New growth investors remain inconspicuous.

In other news, Figure Technologies has decided to launch a blockchain-based trading platform & exchange called Figure Markets. Figure is a blockchain infrastructure company, which has raised over $1.5B to date, that is behind the Provenance Blockchain and is now a lender in the HELOC space. The raise for the Markets business was for $60M and was led by Faction, Jump, and Pantera.