Is M&A of blockchains a thing?

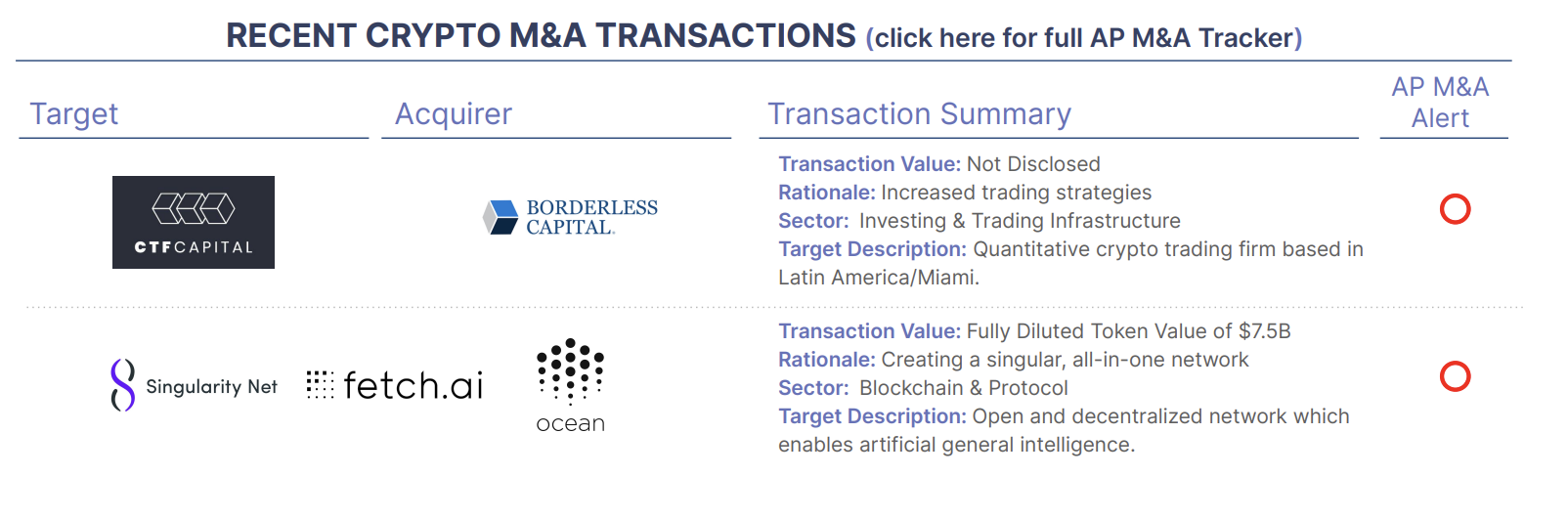

Yes. Over the past several years at least 9 significant “joining of community efforts” have been announced including Fei Protocol and Rari Capital, as well as Hermez and Polygon. This week this group was joined by a three way combination (“sort of”) SingularityNET, fetch.ai and Ocean Protocol. In all of these combinations, the associated publicly traded tokens were or are proposed to be merged into a single token via a token swap. Each featured notional value exchanged in $billions, this week $7.5B, catching deserved headlines. By most definitions, this is M&A, as defined.

So why do we continually be asked if blockchain protocol M&A is a thing? As M&A practitioners, protocol M&A raises a myriad of practical questions and some challenges. Just a few examples include determining pre and post-transaction governance, legal obligations of each party, disclosure requirements, how to incentivize or even force participation by token holders, how to value the token consideration, tax and accounting treatment for all participating parties, governing law, who has the right to make decisions on behalf of token holders and what standards of care do these individuals assume.

Much like in the ICO era, some will “just do it” with presumed good faith and address ramifications and incorrect assumptions through the process and perhaps later when regulators or plaintiff lawyers knock on the door.

We applaud these pioneers and are enthusiastic about the potential for Blockchain protocol M&A. However, many critically important topics must be addressed in a careful and prudent fashion. There are many rules of the road developed over decades. These have been formed by the triad of regulation, legal requirement and practitioner processes and techniques that result in successful outcomes judged by both the “deal” and perhaps more importantly “after the deal”. We spend our days at the intersection of the entrepreneur mindset of “break things and fix it later” and doing it right the first time. It’s a delicate balance.