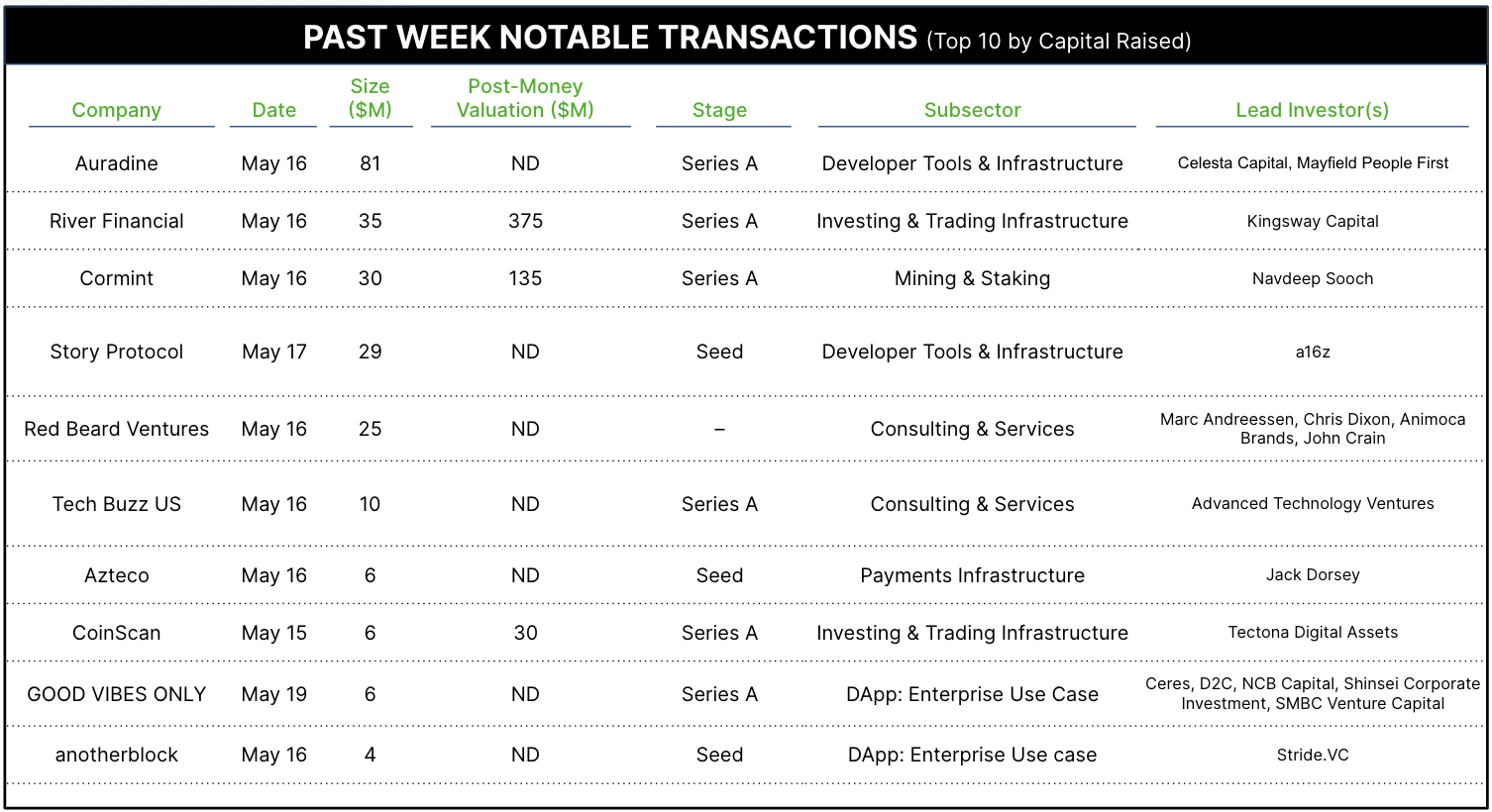

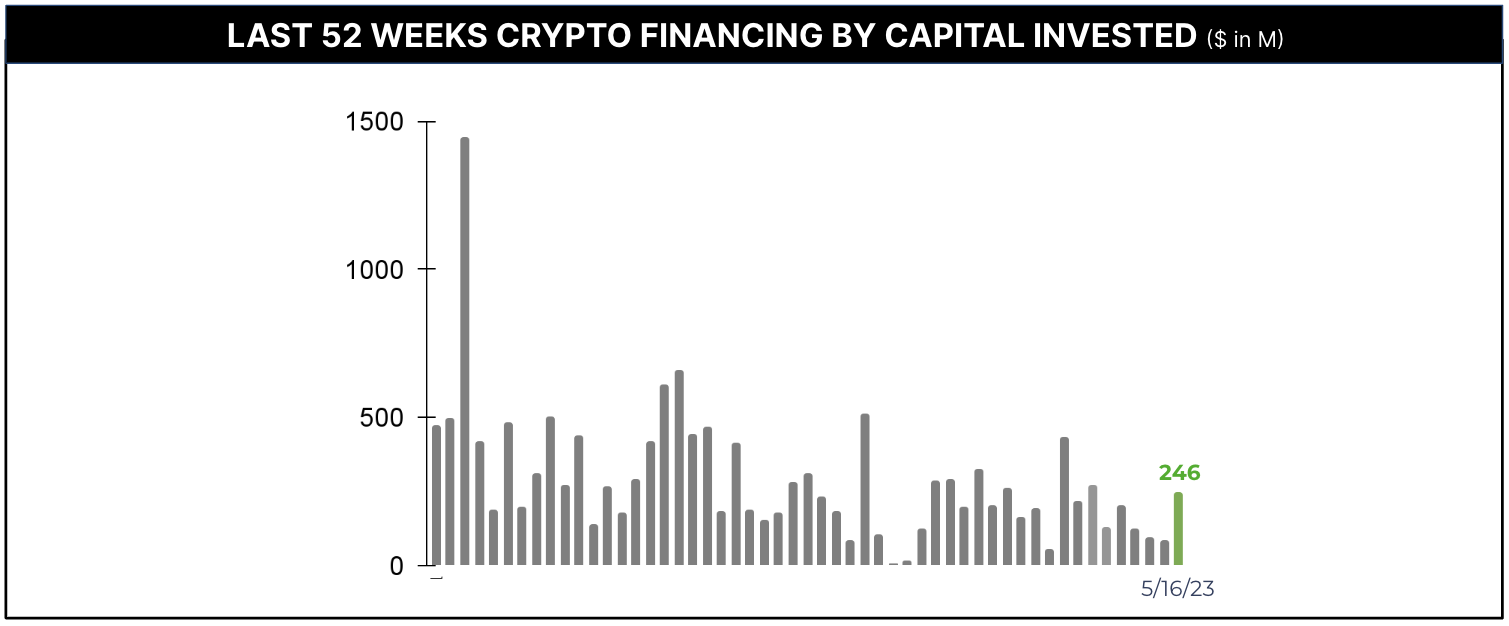

26 Crypto Private Financings Raised ~$246M

What a difference a week makes. Last week Architect tracked $246M in announced private financings in the crypto sector, probably the most active week in two months but still below the average week in 2022. Add in two large financings with unreported amounts (Lifeform raised at a $300M post money valuation led by IDG Capital; and Metagame Industries raised at a $100M valuation) and we’re roughly back at 2022 levels.

The theme here has to be continued early-stage building. The top ten announced financings were all Seed or Series A. This is consistent with a drastic across the board slowdown in later investing stages across tech. SaaS entrepreneur Jason Lemkin recently tweeted his guess at “how frozen the venture markets are, roughly, by stage:”

Crossover: 95%

Growth: 85%

Series C: 75%

Series B: 65%

Series A: 50%

Seed: 33%

And this is SaaS-centric – other segments are worse! On this basis, crypto financing levels are not particularly worse than venture in general.

The largest raise announced last week was by Auradine, raising $81M ($71M in equity and $10M in a line of credit, no tokens) in their first institutional round at a valuation reported by The Block at over $500M (note that this round closed last year before the FTX collapse, but was just reported). Auradine has not provided much info on their business, but it involves AI and blockchain applied to Infrastructure/security solutions. This one looks like a classic old-school deal, led by non-crypto-centric venture capital firms Celesta Capital and Mayfield. The highly experienced founding team has collectively had tens of billions in successful exits from NetBoost, Cavium, Innovium and Palo Alto Networks.