May 26th – June 1st

PERSPECTIVES by Eric F. Risley

This past Tuesday, Circle announced its intention to proceed with its initial public offering at an expected pre-IPO enterprise value of $4.6 to $5.6 billion. Although not an M&A announcement, the transaction is another milestone for the crypto industry and offers insights and signals that affect the M&A markets.

Like many other businesses in the crypto sector, Circle is working its way back toward the valuation achieved in its last private financing. During the exuberance preceding the self-induced Crypto Winter, leading crypto companies set very high valuation marks. In April 2022, Circle completed a $400 million Series F preferred-stock financing at a $7.7 billion post-money valuation. The anticipated IPO valuation is 27 to 40 percent below that level. This gap has implications for employee-incentive plans and preferred-equity conversion rights, which can complicate or even preclude both IPO and M&A transactions. Circle has navigated these issues, but one use of proceeds will be the cost of restructuring its employee-stock plan.

While Circle’s expected IPO valuation is robust, market expectations are relatively conservative compared with financial metrics and comparable companies. If priced at the upper end of the range, Circle would trade at about 3 times last-twelve-month revenue and 16.9 times EBITDA. Coinbase, by comparison, trades at roughly 8.2 times revenue and 32.6 times EBITDA. The difference reflects company-specific factors, business-model distinctions, and broader market conditions, underscoring that each business has unique drivers when establishing “market-clearing” valuation.

Circle also illustrates the emergence of a proven use case for crypto assets: payments. Architect Partners is particularly enthusiastic about the use of crypto assets, especially stablecoins, for a variety of real-world payments by businesses and individuals. Our Architect Insight research series, “Crypto Payments and Infrastructure,” explores this opportunity; we published the first installment last week and will release additional reports over the coming weeks.

The acceptance of stablecoins, and of crypto as an asset class, is being codified rapidly by global regulators. Examples include the EU’s Markets in Crypto-Assets Regulation (MiCA), the Hong Kong Stablecoin Bill passed in May 2025, and recent efforts by the US Congress to pass stablecoin legislation. This regulatory clarity is significant given that stablecoins are explicitly 100 percent collateralized by fiat instruments such as government securities and cash. The integration of crypto and traditional financial assets continues apace.

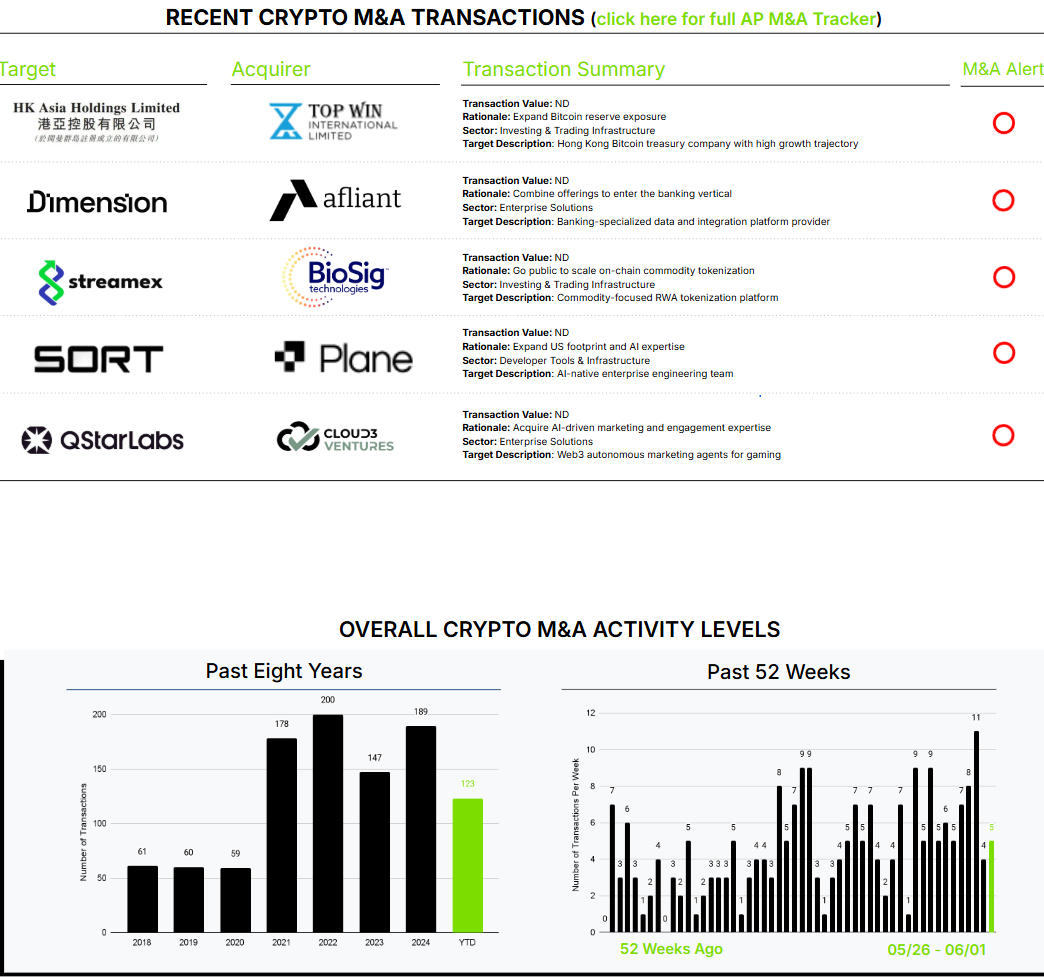

Public companies are generally more active acquirers than privately held businesses. One critical impediment to crypto M&A today is the limited number of premium-value acquirers. That should change in the coming quarters, driven by IPOs like Circle’s and, perhaps even more importantly, by the entry of a broad range of traditional financial-services firms seeking to move into the crypto markets in various ways.

More detail on the Circle IPO in our Architect Insights Financing Alert, here.