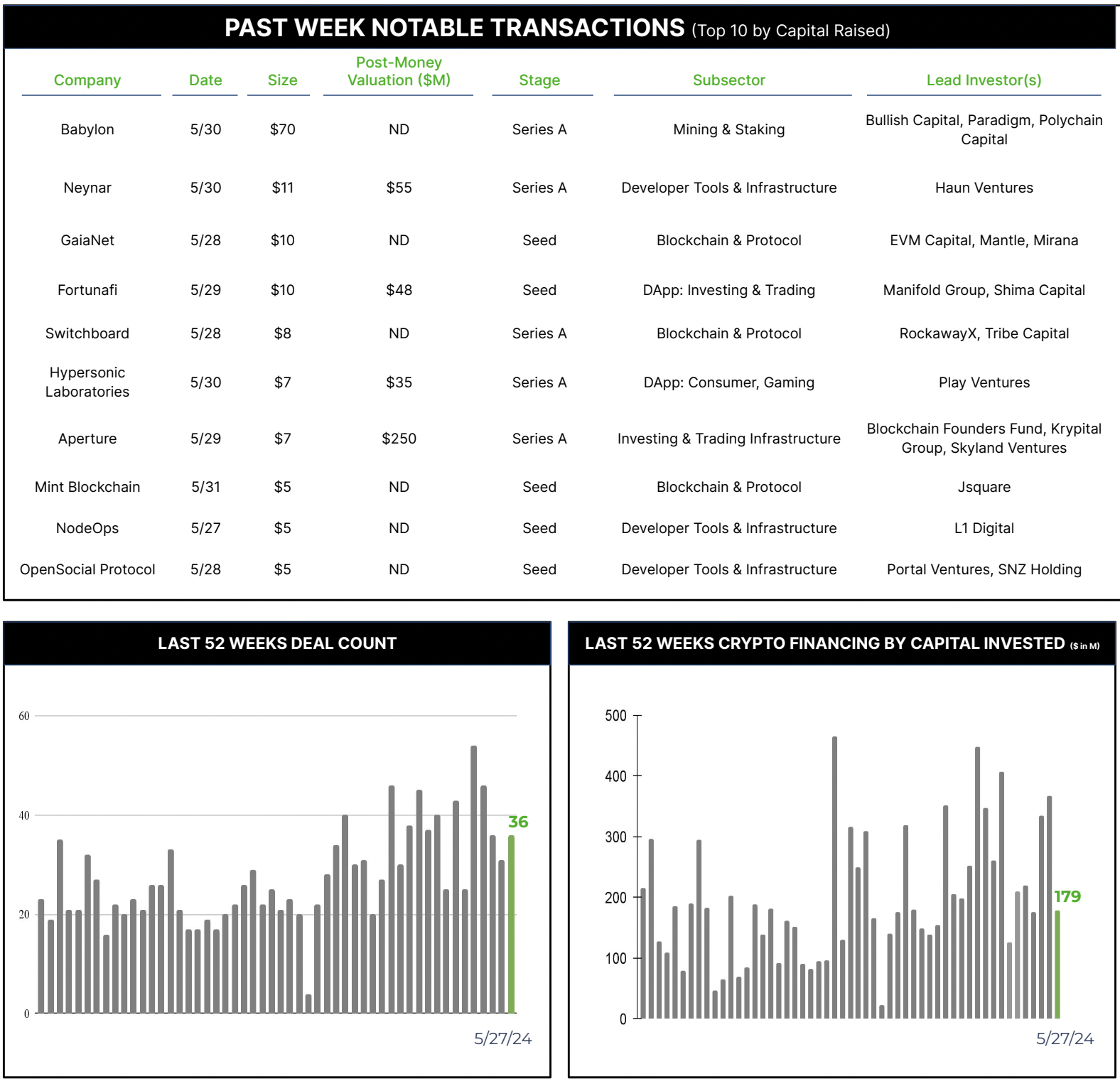

36 Crypto Private Financings Raised ~$179M

Rolling 3-Month-Average: $266M

Rolling 52-Week Average: $195M

With five months of the year behind us, it’s an instructive exercise to review the year to date, especially as it relates to 2022, the last year of “real financing” prior to the downturn in the crypto industry.

Crypto Investment Landscape Evolving in 2024

As the crypto market emerges from the prolonged downturn of 2022 and 2023, the investment landscape is undergoing a notable shift, reflecting the maturation and evolving priorities within the industry. A comparison of the top investment subsectors in 2022 and the first five months of 2024 reveals a realignment of investor focus.

In 2022, the top five subsectors attracting investments were (by funds invested):

- Brokers and Exchanges 19%

- Investing Infrastructure 16%

- Blockchains & Protocols 15%

- Data & Data Analytics 9%

- Developer Tools 9%

However, the top five subsectors attracting investments year to date in 2024 showcase a discernible shift (by funds invested):

- Blockchain & Protocol 18%

- Investing Infrastructure 14%

- Consumer Media 13%

- Gaming 9%

- Enterprise Use Case 9%

While brokers, exchanges, and investing infrastructure dominated in 2022, garnering a combined 35% of funds invested, the current year has seen a surge in interest towards blockchain and protocol projects, capturing 18% of investments. This shift underscores the growing emphasis on the foundational technologies underpinning the crypto ecosystem. As the market matures, investors are increasingly recognizing the pivotal role of robust blockchain protocols and infrastructures in driving innovation and adoption.

Emerging Sectors Gain Traction

Alongside this renewed focus on core technologies, previously underrepresented sectors are gaining momentum. Consumer media and gaming have now captured 22% of the funds invested in 2024. This trend highlights the increasing recognition of the potential for blockchain and crypto to disrupt and revolutionize consumer-facing industries. Moreover, the enterprise use case segment has emerged as a significant area of interest in 2024, reflecting the growing appetite for real-world applications of blockchain technology across various industries.

Early-Stage Investments Dominate

A striking aspect of the 2024 investment landscape is the continued overwhelming dominance of early-stage financing. With 677 deals and $4.25 billion invested in seed and early-stage projects, the blockchain/crypto market continues to be a hotbed for innovative ideas and startups. This trend underscores the industry’s ongoing evolution and the constant influx of new players and concepts.

In contrast, later-stage financing has seen a relatively modest 84 deals, totaling $844 million in investments. This disparity highlights the challenges faced by established projects in securing substantial funding, as well as the inherent risks associated with the crypto market’s volatility. As the crypto market navigates its way through this transformative period, the investment landscape is poised to continue evolving, reflecting the ever-changing dynamics and priorities within the industry. Investors and entrepreneurs alike will need to remain agile and adaptable, capitalizing on emerging opportunities while mitigating the risks inherent in this rapidly evolving space.