November 11 – November 17 (Published November 20th)

PERSPECTIVES by Todd White

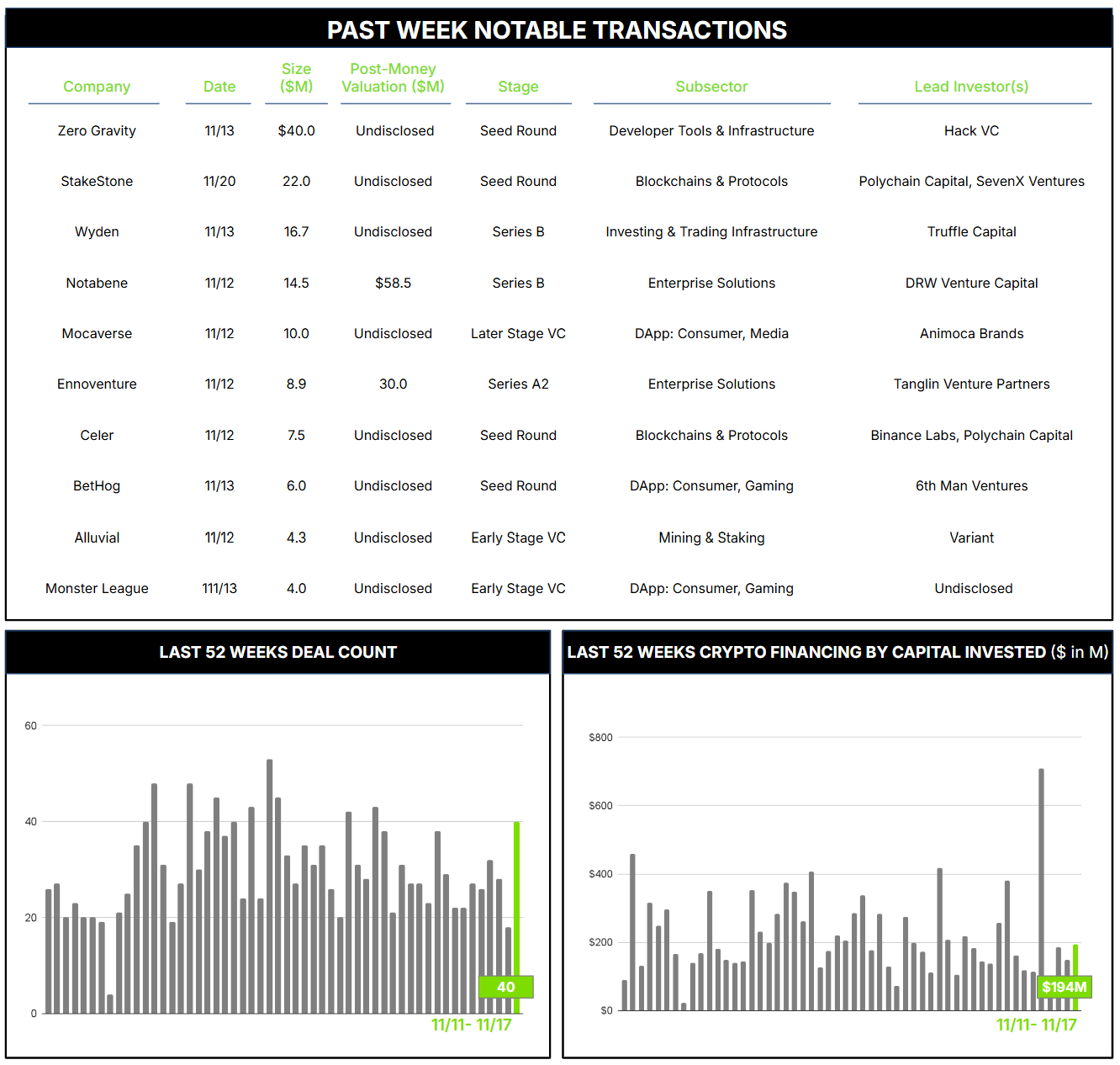

40 Crypto Private Financings Raised: $194M

Rolling 3-Month-Average: $220M

Rolling 52-Week Average: $220M

Zero Gravity Labs (0GL), a team developing a decentralized AI operating system, closed a solid $40 million seed round last week, coupled with a $250 million token purchase commitment for digital asset liquidity. The team envisions their operating system providing blockchain-based infrastructure for decentralized AI applications.

To many, AI and crypto seem to be natural, perhaps even mutually dependent, bedfellows. AI may need blockchain to authenticate outputs and ensure data integrity, provide transparency and security, assure the provenance of both content and creations, protect against (or at least identify) deep fakes, and efficiently manage the massive amounts of data processing that AI engines require.

Crypto can also benefit from AI’s ability to process vast amounts of data, automate complex processes, and augment human developers’ ability to conceive and develop new tools. Numerous use cases are emerging, such as enhanced data training and zero-knowledge machine learning. More fundamentally, AI “agents” may emerge to become dominant users of on-chain and cross-chain tools, with a unique ability to quickly learn their way around a notoriously clunky crypto user experience.

Integrating this mutual dependence into a platform for mutual growth could prove synergistic. 0GL’s dAIOS (decentralized AI operating system) will deploy a modular and layered approach to reduce costs and complexity in processing vast amounts of data and managing computational complexity, while keeping datasets decentralized. The current financing round follows their $35 million pre-seed announced in March. These are big numbers for early rounds, reflecting both the cost of developing first-of-a-kind technology and some leading investors’ willingness to fund the burn.

The convergence of AI and blockchain seems well underway, with competitors such as EigenLayer and Celestia also gaining momentum this year. Time will tell how truly complementary the match between AI and crypto will be, yet the robust investor support for 0GL and others suggests that crypto-AI infrastructure is in vogue with investors.

Contact ryan@architectpartners.com to schedule a meeting.