November 25 – December 1 (Published Dec 4th)

PERSPECTIVES by Todd White

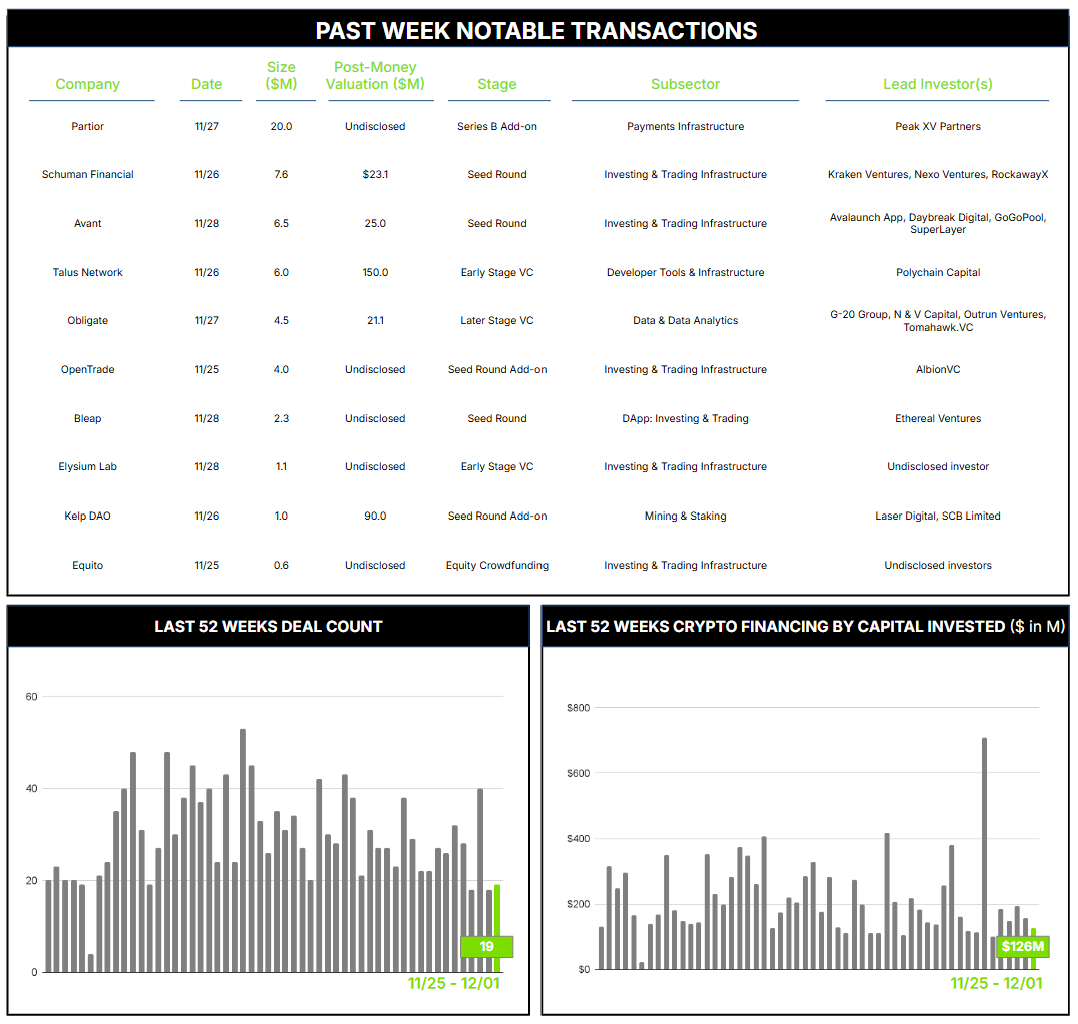

19 Crypto Private Financings Raised: $126M

Rolling 3-Month-Average: $220M

Rolling 52-Week Average: $216M

Last week, I needed to make a payment to Switzerland. The invoice included a convenient QR code to make a nearly instantaneous transfer from my phone—had I been in Switzerland. However, because I was in the U.S., it took my bank four days, several emails, and a hefty fee to process and confirm the payment. Ugh.

Cross-border payments, global money transfers, and bank settlements are areas fraught with friction and complexity. Much of this stems from the way traditional stewards of our money—banks—interact with each other. For banks that hold direct accounts with each other, i.e., have direct mutual relationships, transactions are relatively simple and can be managed with straightforward instructions. Yet they are often still quite slow. When there is no direct relationship, they must transact through an intermediary or “correspondent” bank with whom both have a relationship, adding both time and cost to any exchange. If multiple currencies, parties, payment time requirements, or any other myriad factors arise, the relative complexity can increase geometrically. This adds more time, more cost, and more potential points of failure.

For these reasons, the allure of instant, immutable, and trustless settlement through blockchain networks has been palpable for years. Many believe disintermediation is the key—reducing the middlemen reduces the time and cost. Others favor wholesale disruption—eliminating the middle entirely and going peer-to-peer. Indeed, this latter sentiment spawned much of what we now call crypto in the first place. But adoption has been slow and often seemingly resisted by some of the most important institutions.

Yet the promise is real, and progress is happening. JPMorgan famously launched their JPM Coin in 2019 for internal use among account holders, and later its permissioned blockchain, known as Kinexys (formerly Onyx), which claims $1.5 trillion in notional value processed to date. Earlier this year, the Bank for International Settlements—a clearinghouse of sorts for national central banks—published a white paper envisioning a blockchain-enabled “Finternet,” an ambitious plan requiring broad collaboration among public and private institutions. There are numerous other initiatives, both large and small, seeking to augment or disrupt institutional capabilities—through stablecoins, on/off ramps, peer-to-peer payments, or DeFi protocols.

One of these projects, Partior, landed $20M from Deutsche Bank last week in follow-on to its June Series B. This brings total Series B proceeds to $80M and adds Deutsche Bank to ranks that include JPMorgan, DBS, Temasek, and Standard Chartered (who led their $31M Series A in 2022). Partior’s goal is to reduce friction and delay in cross-border payments, trade, and FX settlements through its “global unified ledger” settlement network—an on-chain bridge for real-time clearing and settlement among financial institutions.

I can’t say how soon this or other systems will help me send money quickly and cheaply to Switzerland. But it certainly sounds like progress.

Contact ryan@architectpartners.com to schedule a meeting.