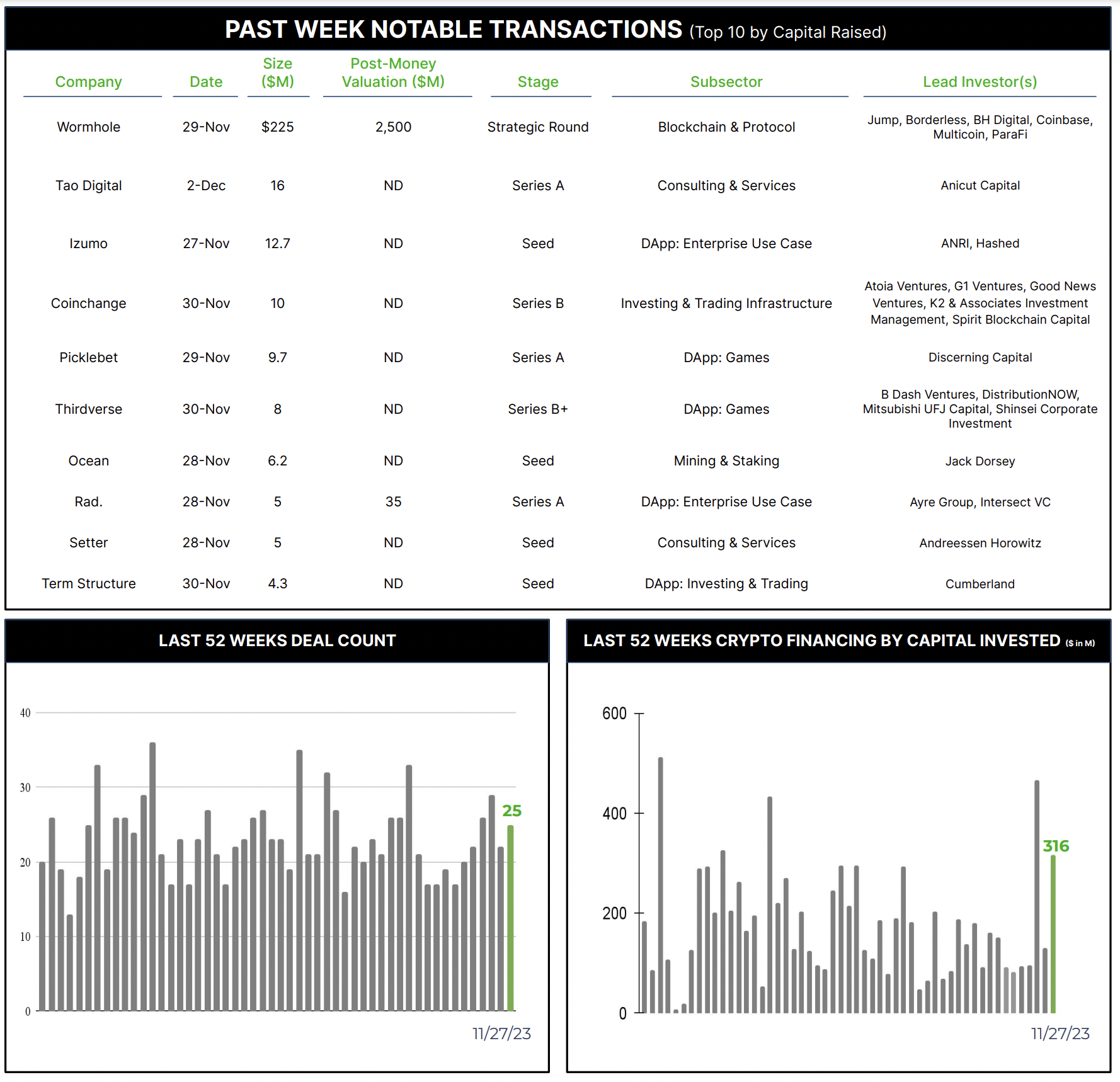

25 Crypto Private Financings Raised ~$316M

Rolling 3-Month-Average: $166M

Rolling 52-Week Average: $179M

The ability for different blockchains to communicate and transact with each other is one of the more critical infrastructure needs for the Web3 ecosystem to realize the full scale of its potential. Broadly one can think of such interoperability in two functions – communications and transactions or value flows across chains. Both are essential to eliminate fragmentation of the larger ecosystem among specific blockchain communities and initiatives.

Wormhole is a protocol launched in August of 2021 and incubated by Jump Crypto (the crypto arm of high-frequency trading firm Jump Trading) that, according to its press release, has won the trust of leading firms such as Circle and Uniswap, and facilitated over $35 billion in value transfer and regularly processes 2+ million daily messages across more than 30 chains.

This past week Wormhole built on its success with an impressive $225 million capital raise in exchange for a token warrant and at a $2.5 billion valuation. The deal is the largest single capital round so far this year, with the third-largest valuation for 2023. The round received diverse support, including Brevan Howard, Coinbase Ventures, Multicoin Capital, Jump Trading, ParaFi, Dialectic, Borderless Capital, and Arrington Capital. It also deployed an interesting structure for a deal of this size, offering token warrants instead of traditional equity stakes, more typical of smaller and earlier-stage projects in the Web3 space. Proceeds will be used to onboard additional employees, build out and develop the protocol, promote cross-chain activity and encourage developers to build on top of the protocol’s messaging technology.

There are several intriguing aspects here. It is the first external funding round after being incubated by Jump Crypto. The team concurrently launched Wormhole Labs to complete its spinout from Jump and provide product development and implementation capabilities. Purportedly the round did not have a “lead”, and achieved more equal and collaborative support among its investors. And of course, this is another example of teams building critical market infrastructure receiving solid investor support.

Relatively few companies have raised this year at valuations north of $1 billion. Coming on the heels of the largest total capital raised last week, Wormhole’s impressive financing round certainly has the hallmark of growing momentum for the sector.