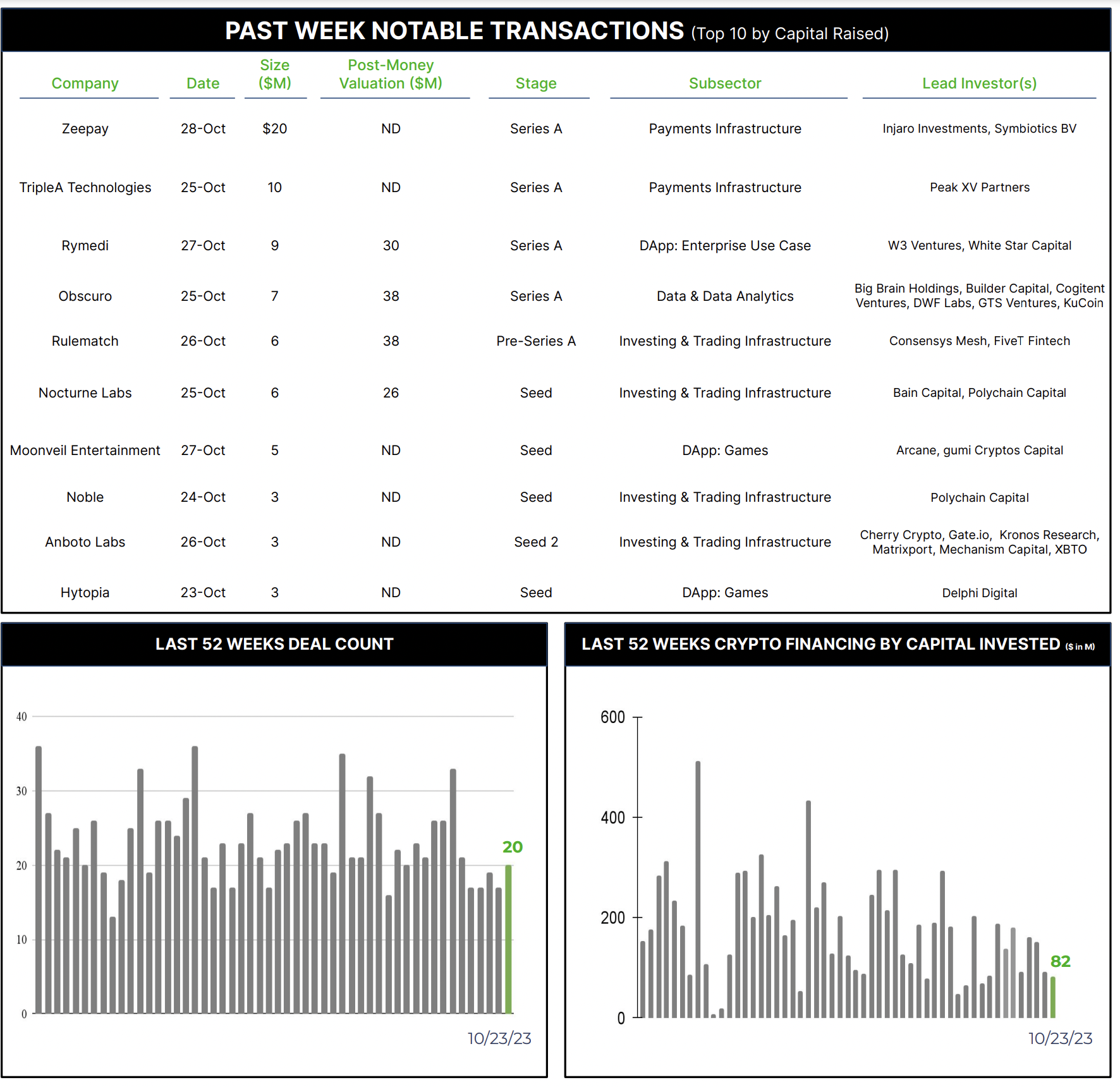

20 Crypto Private Financings Raised ~$82M

Rolling 3-Month-Average: $123M

Rolling 52-Week Average: $182M

Smaller and earlier-stage venture investments again dominated this week’s private investment landscape, with a slight deal count uptick to 20 financings, but proceeds remaining modest. Infrastructure remains the dominant theme, and the top ten included four trading infrastructure deals, two payment companies, two privacy-related initiatives and a med-tech platform for which privacy is an essential tenet.

Selected Highlights

Rymedi, a South Carolina-based med-tech team, closed a $9M Series A co-led by RW3 Ventures and White Star Capital with participation from Blockchange Ventures, Avalanche’s Blizzard Fund, and strategic healthcare industry angels. Rymedi was founded in 2017 with early participation in an FDA-approved consortium to explore blockchain-enabled tracking and verification in drug transport and usage. Other early collaborations included using their global pharmaceutical compliance expertise to help the cannabinoid industry meet international regulatory needs, focused work with the WHO to address hepatitis C in Mongolia, and a recurring symbiotic affiliation with neighboring Clemson University. At the height of COVID, Rymedi was able to quickly deploy its digital workflow platform in testing and treatment initiatives. And immediately prior to their latest round, Rymedi migrated to Avalanche, using three avalanche sub-nets to separately solve for identity (privacy), transaction and compliance monitoring.

Why Notable?

The Rymedi story has combined deep industry compliance expertise with blockchain technology to solve notoriously tricky and competing mandates in healthcare – the transfer of health records, and automate patient testing, treatment, and monitoring to optimize outcomes with greater speed and reduced cost, while preserving security and privacy of patient data. What has emerged is a nimble and scalable enterprise platform with numerous real-world healthcare applications, from drug tracing and tracking to testing and treatment of infectious diseases, that now serves 1M+ patients in 1200 locations across US, Africa and Australia.

Nocturn Labs, the developer of an Ethereum-based privacy protocol, raised $6M in seed funding led by Bain Capital Crypto and Polychain Capital, with notable support including the Ethereum ecosystem and co-founder Vitalik Buterin, and Bankless Ventures. The protocol is expected to launch in late November using zero-knowledge proofs and stealth addresses to facilitate private account activity on a public blockchain.

Why Notable?

There has been significant recent traction of institutional initiatives using private permissioned blockchains, particularly within the traditional finance world where privacy, security and control are paramount. Preserving privacy on public blockchains is oft-cited as a barrier to mass adoption or migration onto public chains, which many feel offers more complete and scalable benefits. Over time there may be diminishing distinctions as cross-chain solutions and interoperability become more refined over time. Solving for privacy is a critical component in the evolution.