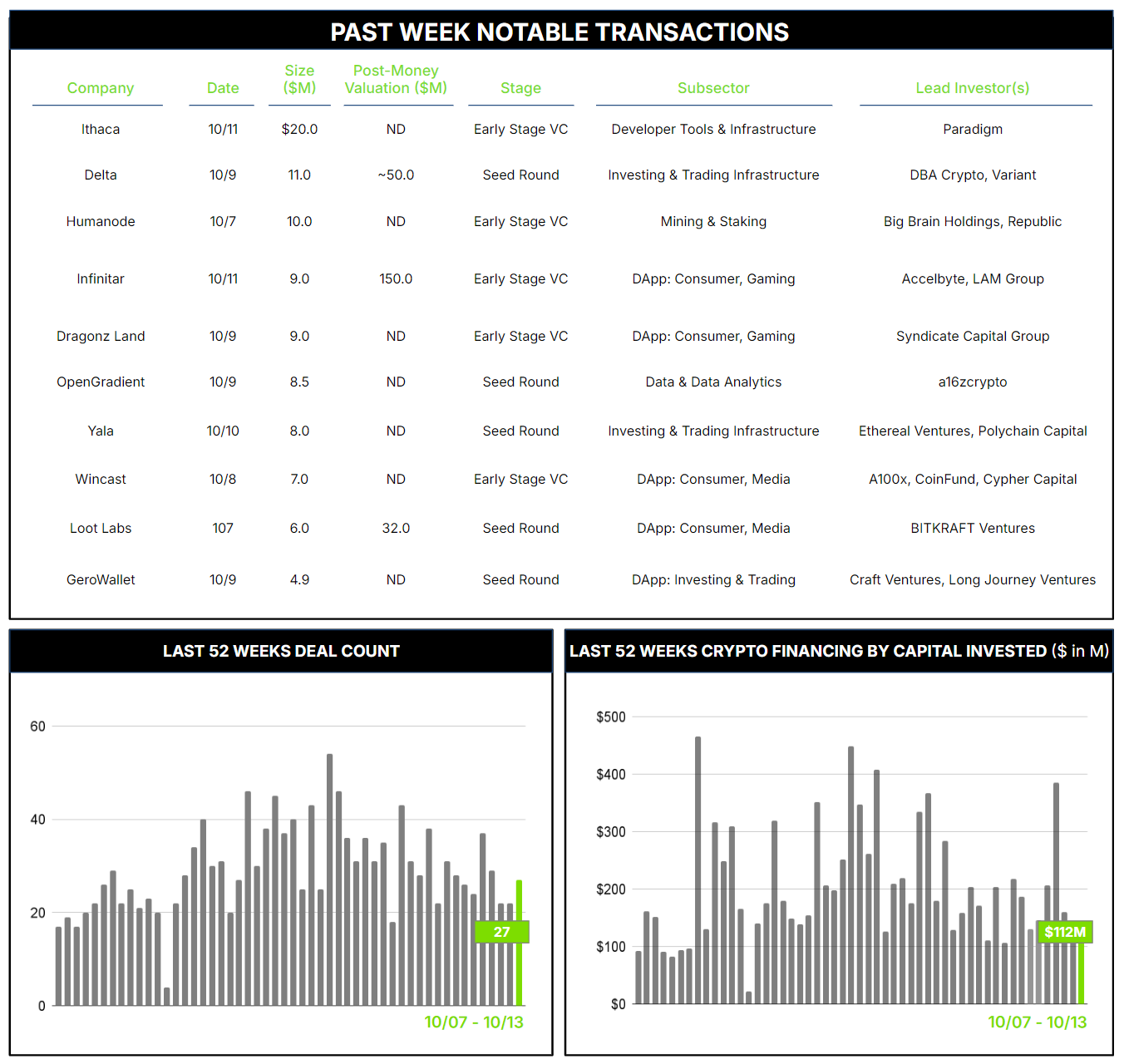

27 Crypto Private Financings Raised: ~$112M

Rolling 3-Month-Average: $173M

Rolling 52-Week Average: $206M

The widespread adoption of crypto and blockchain-based use cases has faced numerous challenges, with speed and a frictional (at best) end-user experience being at the top of the list.

The issue of speed arises in two areas: transaction processing and settlement time, as well as the slow pace of development and the launch of useful tools. Additionally, the notoriously clunky user experience (UX) of crypto applications is a well-known, persistent barrier, especially for non-crypto-native users who struggle to understand what a protocol is, let alone how to use it.

Layer 2 networks—built on top of primary blockchains—have attempted to solve these issues by improving usability, scalability, and processing times. Some examples include the Ethereum-based Polygon and the Bitcoin-based Lightning Network. However, they have achieved only limited success.

A recent initiative, launched with $20 million in funding this week, may help address these concerns. Ithaca, a spinoff from Paradigm, is building a Layer 2 blockchain called Odyssey. According to their press release, Ithaca aims to “enable consumers to fully leverage crypto with fast, cheap, global, and private experiences.” They hope to differentiate the Odyssey L2 by launching with new features from the Ethereum roadmap that are not available elsewhere, such as powerful smart contract wallets to facilitate user onboarding to address the complexity and poor UX associated with migrating to crypto.

The new project will be led by Paradigm CTO Georgio Konstantopoulos, who will take on the role of CEO while maintaining his position and duties at Paradigm. With this spinoff, Ithaca joins an impressive lineup of Paradigm’s portfolio companies, which include Coinbase, Uniswap, and Flashbots, supported by a substantial $20 million injection for the fledgling L2.

Ithaca’s ambitions are not unique – many L2’s have attempted to address scalability, speed, and UX complexity with innovative new tools. We hope the Ithaca team’s technical acumen and pedigreed Paradigm backing will position them for success.

————————————

Meet Architect Partners at these upcoming events:

- Money2020 (Oct 27 – Oct 30)

Contact ryan@architectpartners.com to schedule a meeting.