September 1 – September 7 (Published September 10th)

PERSPECTIVES by Todd White

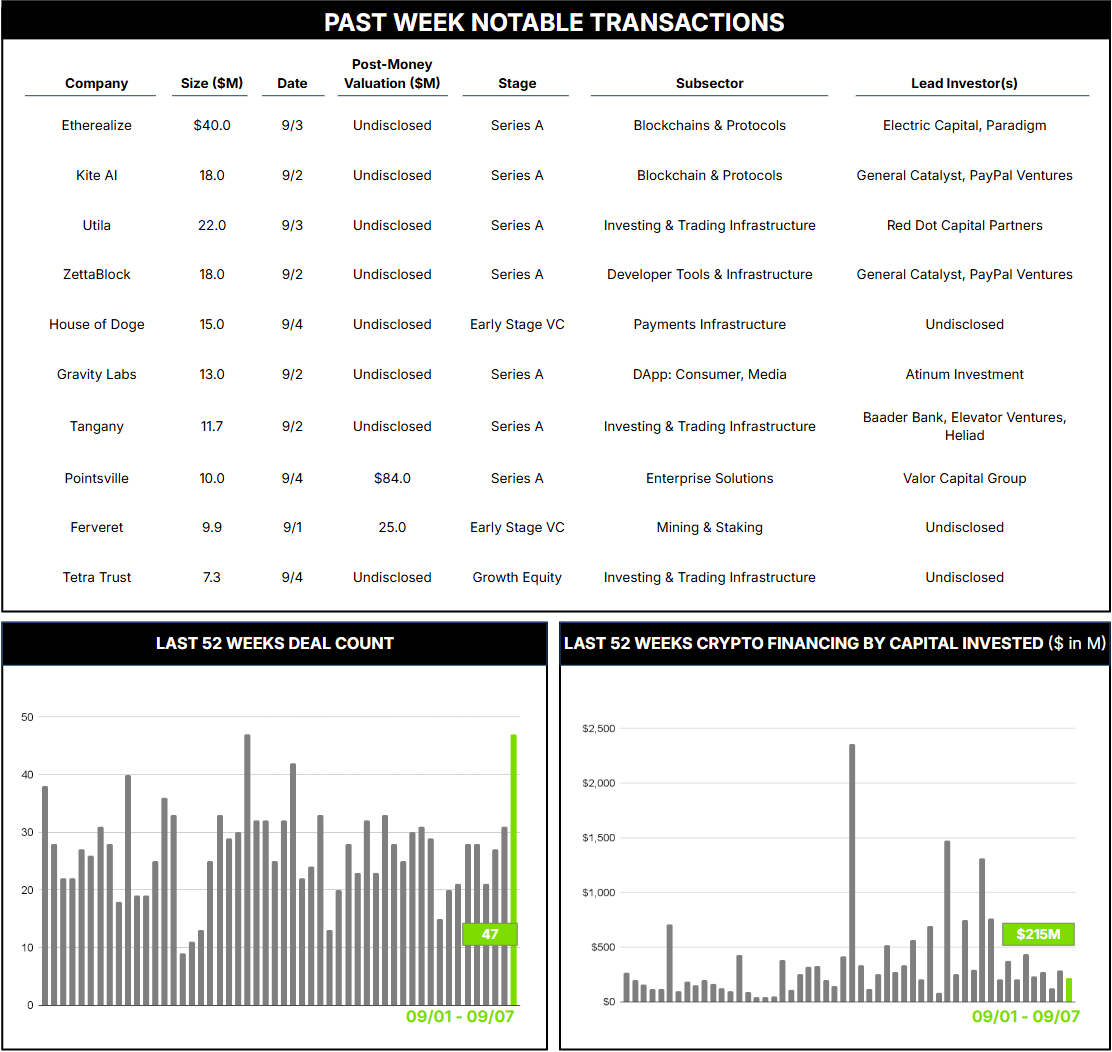

47 Crypto Private Financings Raised: $214.9M

Rolling 3-Month-Average: $393.0M

Rolling 52-Week Average: $351.3M

The crypto and digital asset infrastructure necessary to enable non-crypto-native users to migrate onto Web3 and digital-asset use cases is proving to be critical table stakes for institutional enterprises seeking to utilize blockchain-enabled technologies in their core businesses. These include fundamental functions such as the wallets (custodial and non-custodial) used to hold, transfer, and program digital assets; on/off-ramps that facilitate fiat-to-crypto (and vice versa) conversions; the payment rails to process digital transactions; and the compliance and security protocols needed to enable traditional institutions and enterprises to utilize the technologies.

As we’ve noted previously, investor support for such infrastructure has been relatively consistent throughout the last market cycle, with crypto payments recently receiving some of the most active attention. That trend continues this week, with the U.S.- and Israeli-founded crypto-infrastructure firm Utila receiving an additional $22 million in an extension of its March Series A round.

Utila is an enterprise-grade crypto-infrastructure firm specializing in digital-asset operations and stablecoin workflows for institutions. Offerings include MPC wallets; multi-chain support; APIs; on/off-ramps and permission systems for treasury and trading operations; and tokenization support for minting, custody, and smart contract management.

Utila fits squarely within the digital-asset infrastructure theme, though it is notable for several unique aspects. First, the extension was driven by unsolicited inbound investor interest, a rare signal that Utila’s metrics and institutional positioning have attracted broad attention, rather than by a need for capital or a fundraising push by the company. The company reports that most of its original Series A proceeds remain in the bank, yet it chose to extend the round to accelerate the capture of growing market demand. Further, the extension drew capital from strategic investors, including traditional names such as NFX (known for sound business judgment and regarded as thought leaders in emerging business models) and Wing Venture Capital (a firm known for its deep-tech acumen that avoids hype cycles). The fact that a cohort of deeply experienced Web2 investors made inbound investment proposals to move into the space is significant.

Digital-asset infrastructure is increasingly viewed as foundational for next-gen institutional adoption, which should catalyze follow-on capital raises and strategic partnerships for Utila and other leaders in the sector. We expect continued investor support for the best teams and businesses, as well as expanded M&A, as traditional institutions and enterprises recognize the opportunities that digital assets provide and the difficulty of trying to build the capabilities themselves.