September 8th – September 14th

PERSPECTIVES by Eric F. Risley

Being publicly traded isn’t always what it seems.

An initial public offering (IPO) is an important and laudable milestone for a company; however, not all IPOs are equal. The U.S. capital markets remain the gold standard, with the broadest institutional and retail participation, translating into active trading volume (i.e., liquidity) and the ability to raise significant capital, both at IPO and in subsequent follow-on offerings. In fact, absent very unusual situations, a fair rule of thumb is that there are simply no viable alternatives to being publicly traded in the U.S., and more specifically, on the New York Stock Exchange or the Nasdaq Global Select Market (the most stringent Nasdaq listing tier).

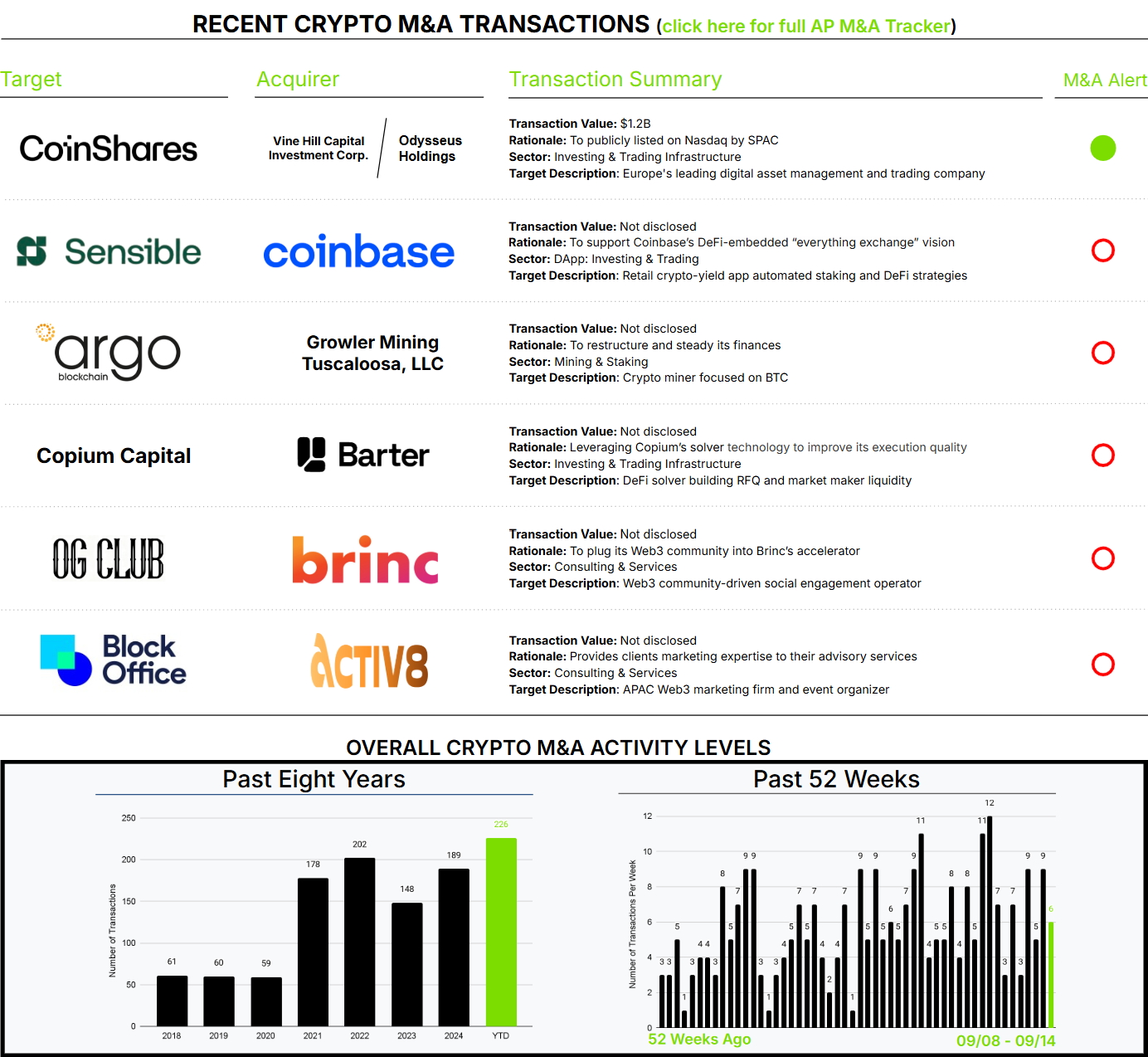

The crypto industry has seen a number of companies choose less attractive alternatives, with generally poor results. Examples include Exodus Movement and Galaxy Digital, both of which spent years pursuing U.S. listings. This week, CoinShares joined this group, albeit in an unusual way.

As a rule, special purpose acquisition companies (SPACs) target private businesses. Their value proposition is to provide a faster, more cost-efficient path to a public listing and an active secondary market. We’ll leave the “regular-way” underwritten IPO vs. SPAC-merger debate for another day; both can achieve the desired outcome. That said, a SPAC acquisition of an already-public company is very rare.

This week, CoinShares, currently listed on Nasdaq Stockholm, announced that Vine Hill Capital Investment Corp., a SPAC, will acquire it for roughly $1.2 billion (a ~30.6% premium to the pre-announcement share price). More in our M&A Alert here.