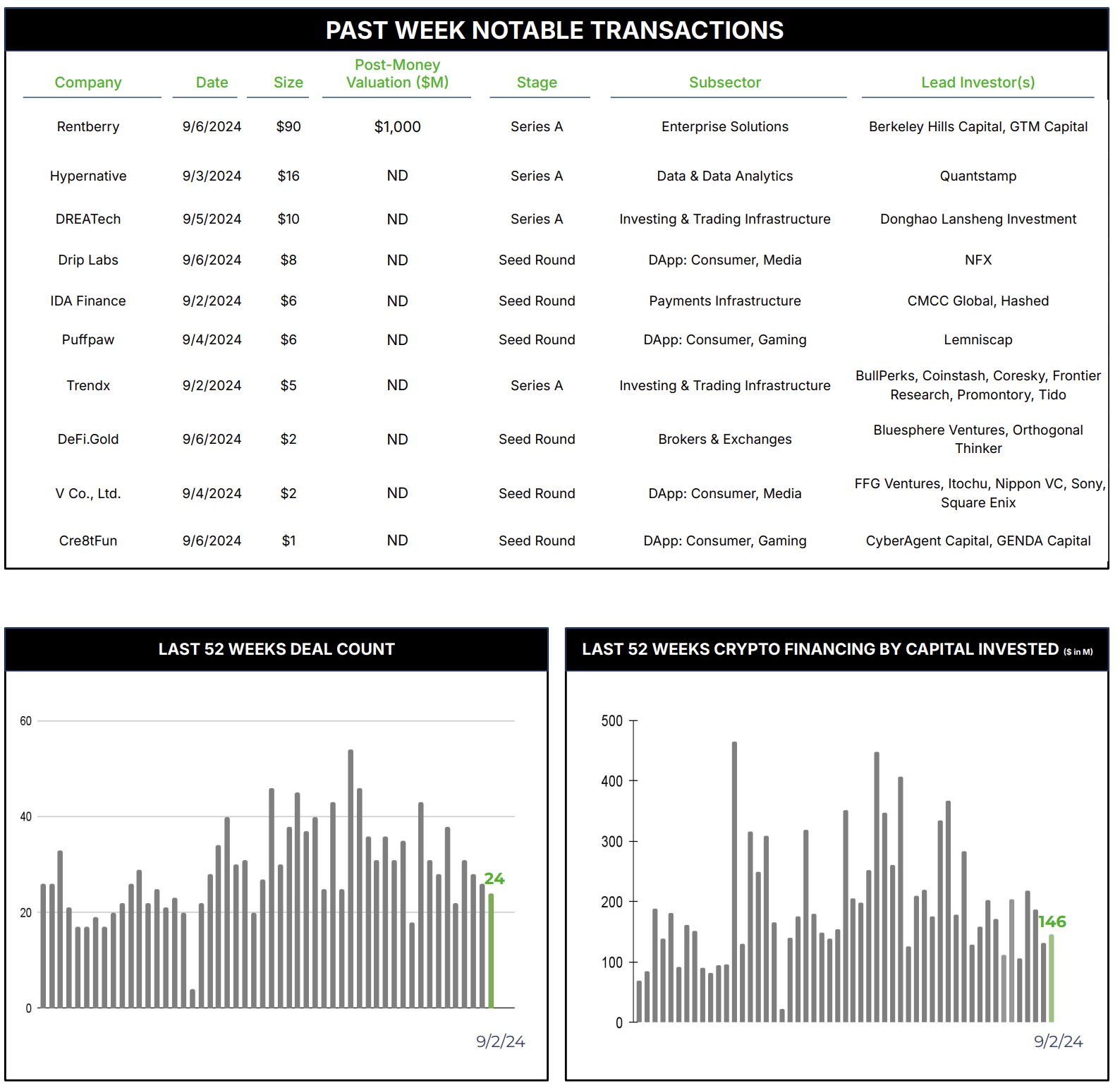

24 Crypto Private Financings Raised ~$146M

Rolling 3-Month-Average: $174M

Rolling 52-Week Average: $198M

As mentioned previously in this space, blockchain and cryptocurrency sectors continue to face headwinds in fundraising, with a mere $146 million raised last week. This tepid figure was largely buoyed by a single $90 million deal, underscoring the continued deceleration in venture capital activity within the space.

Several factors continue to contribute to this ongoing slowdown. The current economic climate coupled with uncertainty surrounding the upcoming US election, many generalist venture capital firms have pivoted and are increasingly allocating capital to burgeoning sectors like artificial intelligence, and the lack of successful exits has heightened investor concerns about liquidity risk. Compounding these issues is the persistent regulatory uncertainty surrounding cryptocurrencies and blockchain technologies.

However, this cooling period could ultimately lead to more sustainable growth and innovation in the long term, as investors focus on those believed to be the highest quality.

Blockchain technology has the potential to revolutionize the real estate market by enhancing transparency, efficiency, and security in property transactions and management. By leveraging decentralized ledgers and smart contracts, blockchain can streamline various processes involved in real estate deals, reducing the need for intermediaries and minimizing the risk of fraud.

Rentberry is one company bringing this potential to market, and according to Pitchbook, just closed a $90M Series A funding led by Berkeley Hills Capital and GTM Capital.

Rentberry offers significant benefits to the rental real estate market by leveraging blockchain technology to streamline and modernize the entire rental process. The platform provides a comprehensive ecosystem that connects landlords and tenants, offering features such as property listings, tenant screening, digital lease signing, and rent collection. This all-in-one approach reduces administrative burdens for landlords and simplifies the rental experience for tenants.

Rentberry’s platform also incorporates blockchain technology and smart contracts to enhance security and automate various aspects of property management. The use of cryptocurrency payments reduces transaction costs and minimizes the risk of late or fraudulent payments.

Now, Rentberry is introducing a new investment opportunity with crowdsourced security deposits. Investors will have the opportunity to fund the billions of dollars typically locked in rental deposits and earn interest on their investment. This process provides benefits to both landlords and tenants.