It will happen soon, hopefully…

Crypto as an industry is perceived by most laypersons (and many in our industry) to be all about novel assets called tokens. Of course, perfectly natural given collectively tokens of all forms represent well over $1 trillion in U.S. Dollars. However, tokens are only a feature of something far bigger, a collection of technologies that form a new platform upon which to build applications. Applications are simply software and online services that “do something useful” for people as individuals and as members of companies (and perhaps AI as well!). Chris Dixon, in his book “Read Write Own: Building the Next Era of the Internet”, describes this new platform as “Blockchain Networks” or “Blockchain” and others call it “Web3”. So far these labels seem to come up short but the combination of technologies which comprise blockchains like Bitcoin, Ethereum, Solana, Avalanche,… offer “Web3” application developers a platform upon which to build applications that promise capabilities and features that are “better” than existing applications. Chris Dixon cites examples including games and social networks. “Better” are games where users actually own the in-game assets they earn from gameplay and can easily convert these assets to money useable both inside and outside the game. Another example of “better” is social networks where the users directly benefit financially from their “social graph and persona” rather than Facebook keeping all the benefits (roughly $140 billion in annual revenues or $45.00 per active user) in return for offering a “free” service.

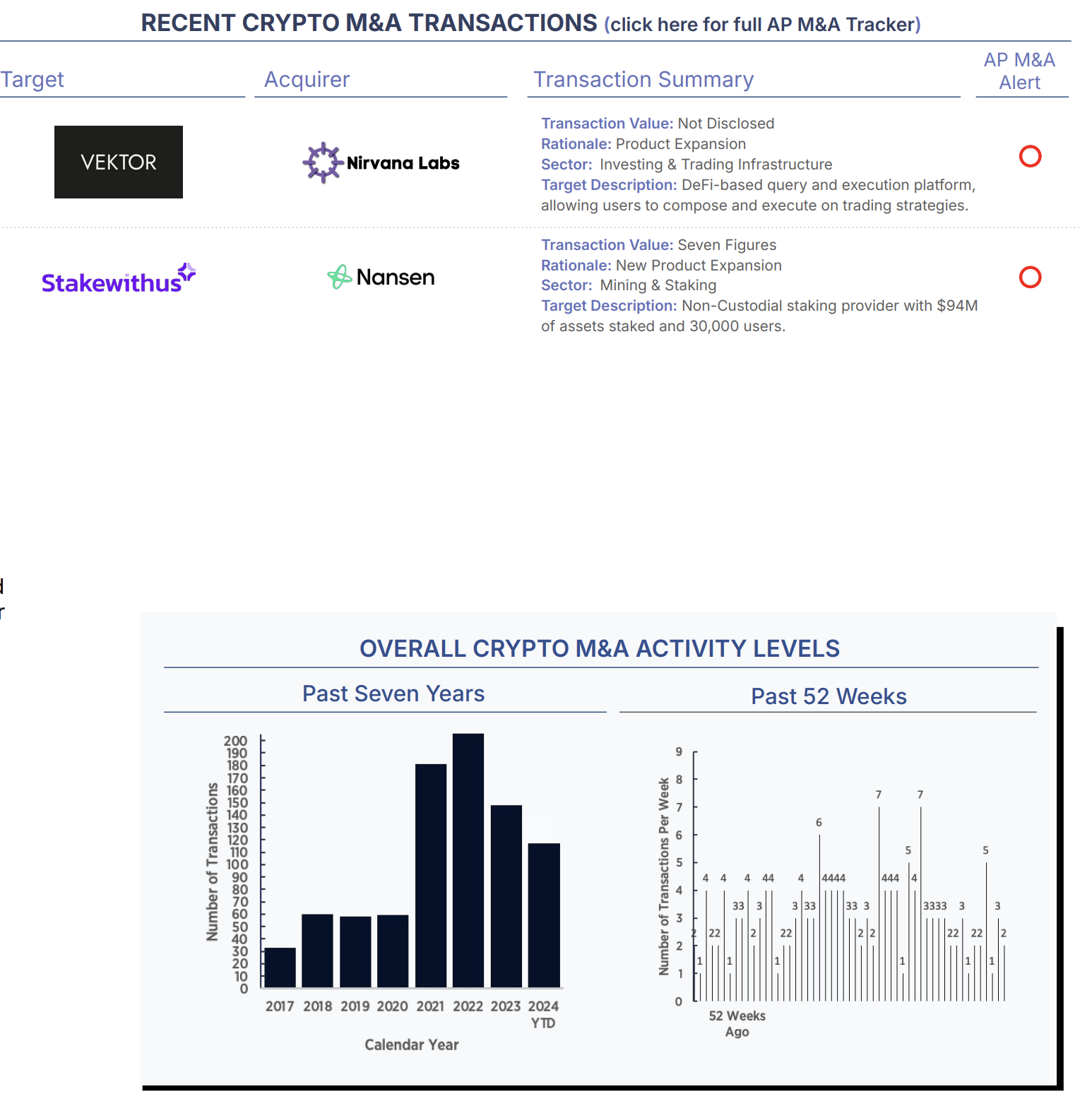

There are thousands of Web3 application developers working to discover where the capabilities offered by Blockchain Networks make better or allow a new class of applications and services to emerge. There are also many companies and foundations who are supporting various blockchains dedicated to assisting these developers to make it easier to build. A small subset includes companies like Alchemy, Consensys, Forte, Blockdaemon, Amazon Web Services and blockchains such as Ethereum, Base, Solana and Avalanche. Each caters to developers as their customer. Each offers a variety of solutions, some unique and many overlapping. This week a relatively newer entrant to this effort, Nirvana Labs, announced an acquisition of Vektor. Nirvana Labs is offering a Web3 application optimized version of Amazon Web or Google Cloud Services.

We will see if this rapidly developing ecosystem of Web3 development tools and services allows Web3 application developers to discover the big breakout Web3 application(s) that shift our industry’s focus from token value speculation to real-world applications that “do something” of value.