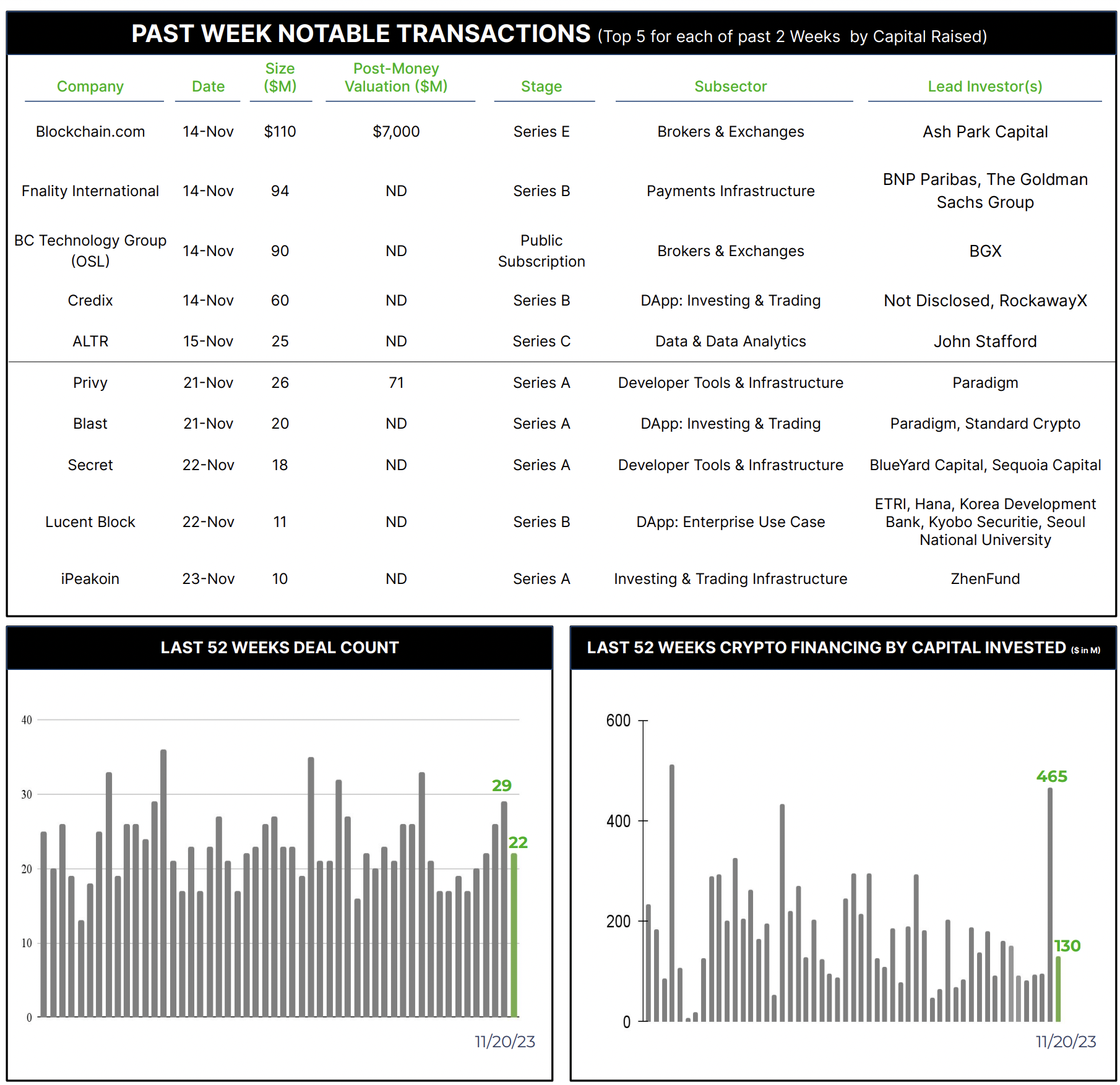

22 Crypto Private Financings Raised ~$130M (Week of November 20)

29 Crypto Private Financings Raised ~$465M (Week of November 13)

Rolling 3-Month-Average: $156M

Rolling 52-Week Average: $176M

Is this a signal that the crypto private financing market is turning the corner?

$465M is the most amount of weekly capital raised since Dec 12, 2022.

The three largest raises came from well-known, “OG” companies who learned from this last market cycle and are evolving their businesses into this next phase.

Blockchain.com, founded in 2011, is one of the originals and is refocusing on their core retail exchange business. As a sign of this refocus, Blockchain.com just announced a partnership with SoFi to transition SoFi’s crypto customers to Blockchain.com.

Fnality, founded in 2015 as Utility Settlement Coin, is one of the surviving consortiums and gearing up for its Sterling Fnality Payment System launch, which seeks to provide a global liquidity management network for wholesale payments and tokenized RWA. The participants in this network are impressive, featuring Goldman, BNP, DTCC, Euroclear and WisdomTree as investors, joining Santander, BNY, Barclays, CIBC, Commerzbank, ING, Lloyds, Nasdaq, State Street, SMBC, and UBS.

OSL, founded in 2018, is one of the two licensed exchanges in Hong Kong and is focusing its growth efforts in the region following investment from BGX, which is connected to Foresight Ventures that recently acquired The Block.

As our industry transitions from what I call The Great Purge to this next to-be-named phase, we expect many of the surviving “OG” companies to raise significant rounds and refocus their efforts on what got them to this point, secure their financial health by achieving sustainable profitability, and selectively assess expansion opportunities.