Download the full report above.

Crypto Mergers & Acquisitions

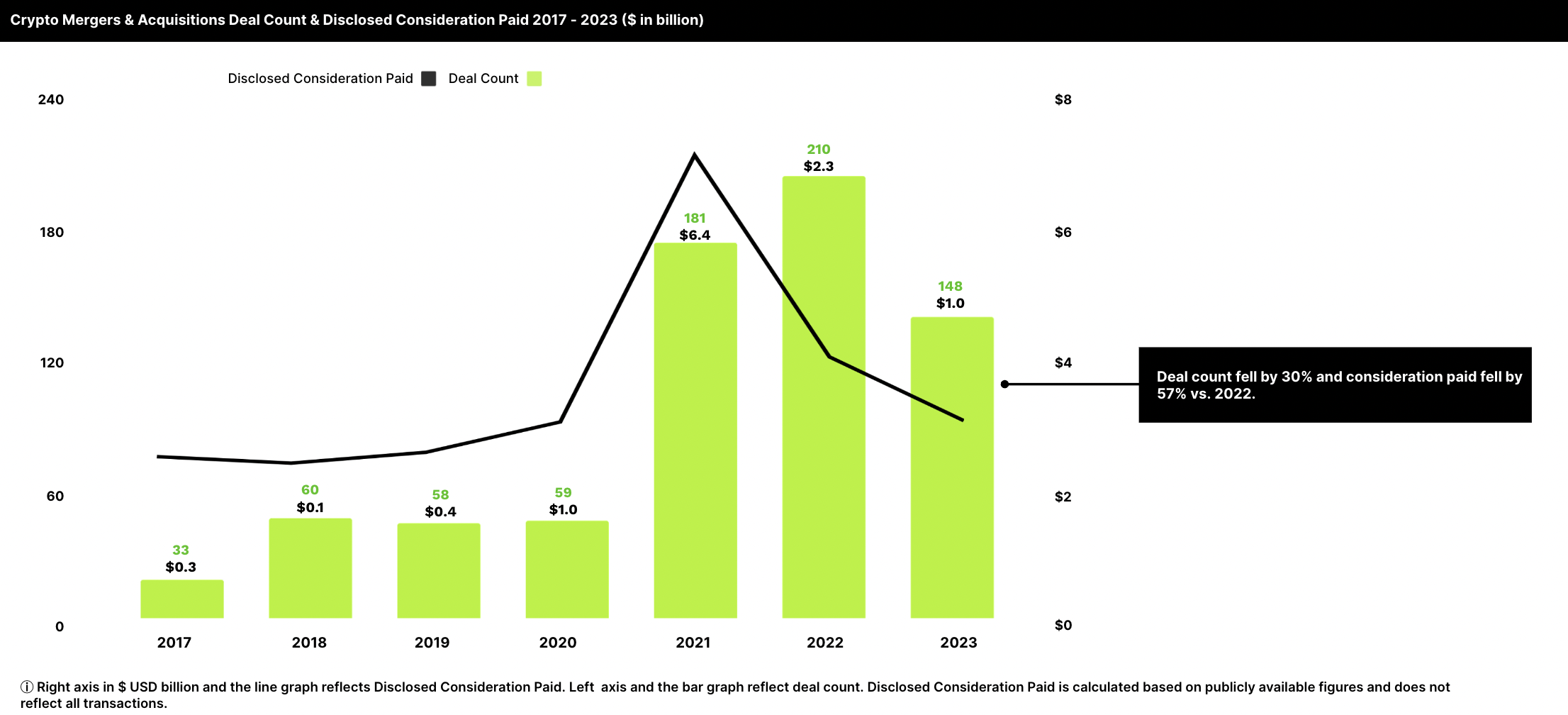

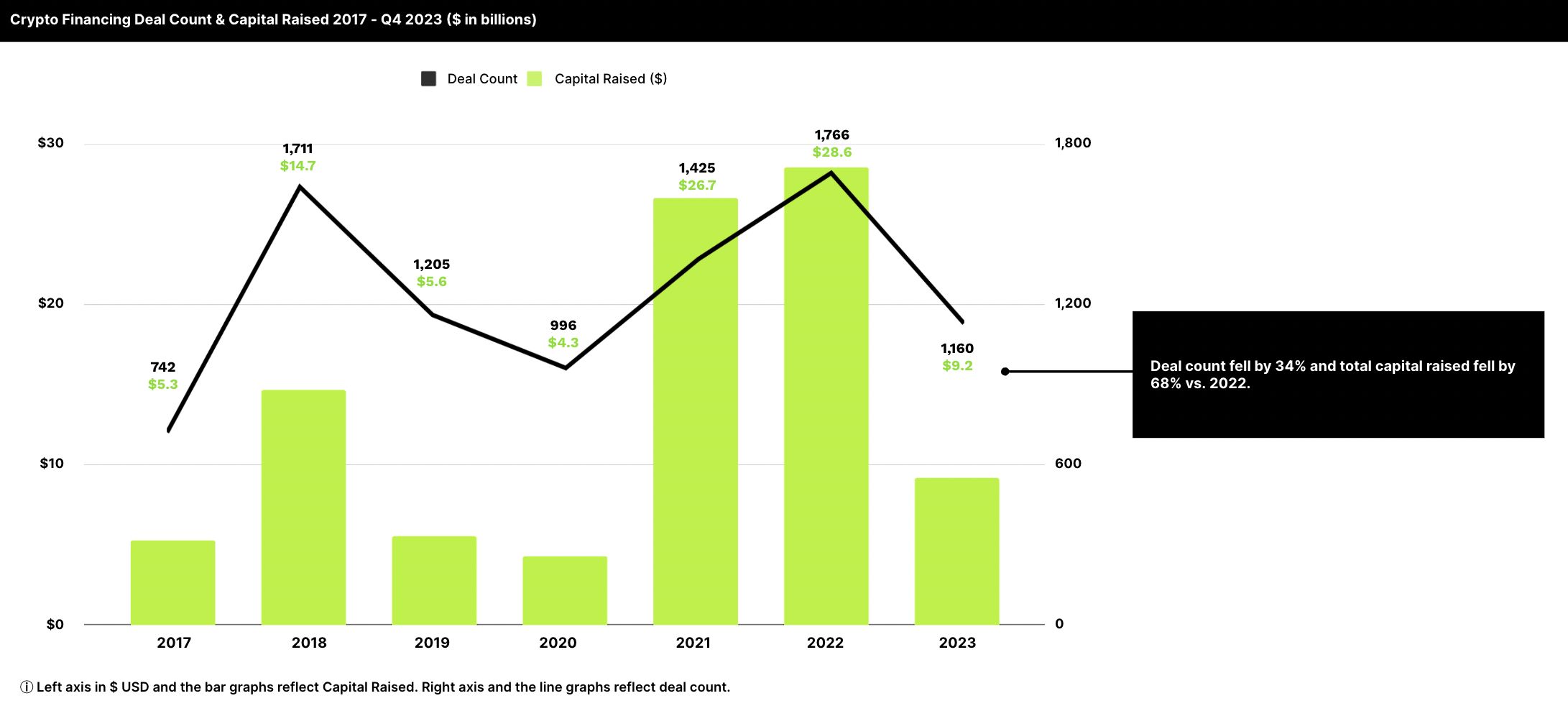

The 2022 hangover continued with announced transaction volume remaining muted, however, improving fundamentals over the past three months promise to reinvigorate M&A activity in 2024.

M&A activity in Q4 2023 was up modestly from the prior two quarters but remains 30% below the average pace of 2022.

Crypto is not alone, broader technology and financial services M&A have similarly suffered reduced activity levels as well.

Traditional financial services companies remained wary of crypto assets, driven by regulatory and compliance uncertainty and persistent legitimacy questions. However, digital assets, crypto’s cousin are attracting considerable attention.

The Brokers & Exchanges subsector and supporting Investing & Trading Infrastructure subsector continue to dominate representing 39% and 31% of Q4 and full year 2023 activity, respectively.

Headline transactions of 2023 were Ripple | Metaco, Coinbase | One River, DTCC | Securrency and Deutsche Borse | FundsDLT.