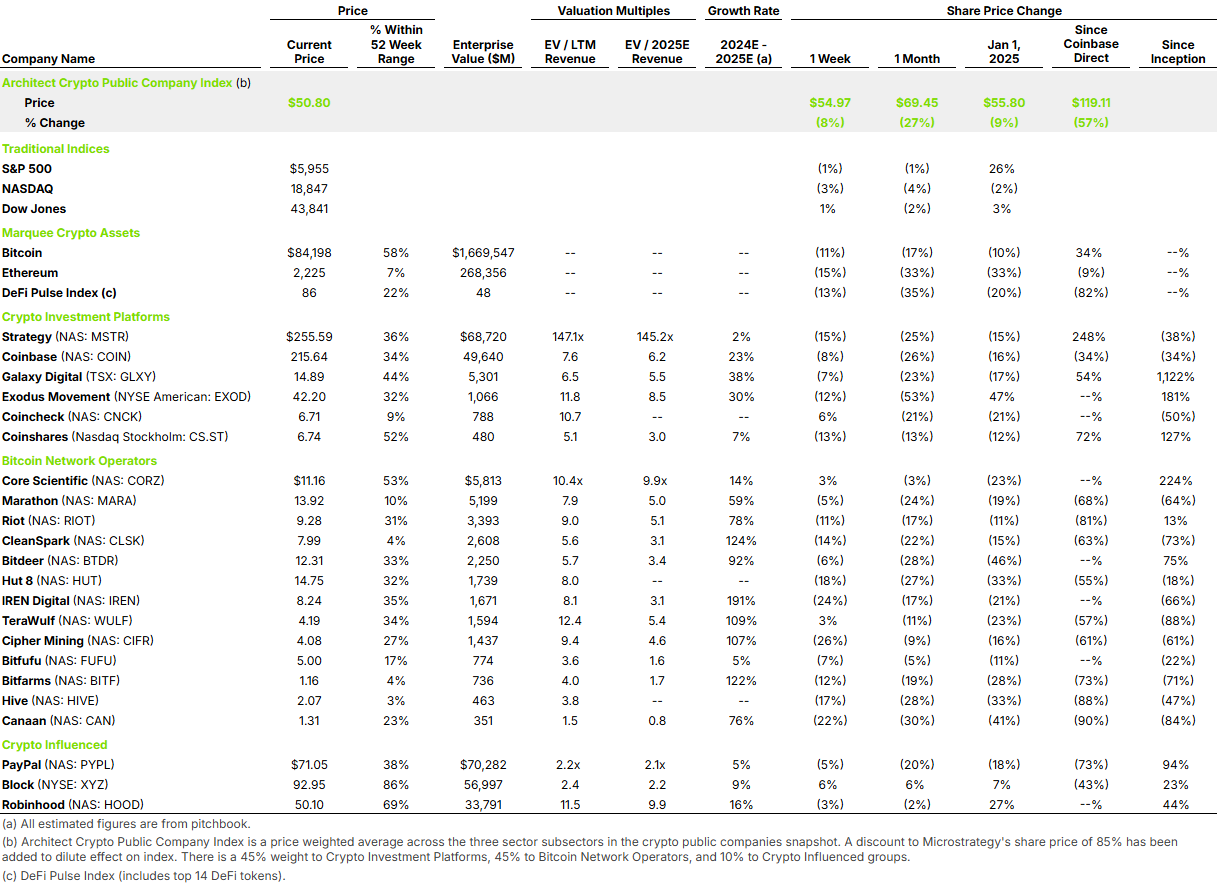

There’s no sugarcoating it: this week was brutal for nearly the entire industry, with the average crypto company in our index falling by 9%. What happened? It doesn’t seem to be one single factor, but rather a combination of them.

Bitcoin has fallen by 11% this week, and the decline in our crypto public company group appears directly correlated to Bitcoin’s price movement. On average, companies in this group fell roughly in line with Bitcoin’s decline.

The reported $1.5B hack of the major crypto exchange Bybit has sparked renewed fear among investors, reminding everyone that the industry still faces significant security challenges. Although these hacks are not indicative of issues inherent to blockchain technology, they do underscore the lack of robust security protocols across the crypto ecosystem.

Macroeconomic concerns continue to rise, with new tariffs being threatened or implemented almost weekly. As a result, the likelihood of a global trade war is increasing, pushing investors away from risk-on assets such as crypto companies.

Despite some negative headlines, there is still plenty of optimism in the sector. For example, Bank of America announced its intention to launch a stablecoin once regulatory clarity is achieved. We hope that regulatory clarity will be reached in the next 12 months, resulting in a monumental shift that enables all globally significant banks to take a deeper role in the sector.

We attended BTC Investor Week in NYC, and although the price action was intense, there was surprisingly little doom and gloom. Key topics included adding BTC to the treasury management strategies of publicly traded companies, exploring BTC use cases beyond simple store-of-value (such as payments, insurance, and lending), and dedicating an entire day to different BTC investment strategies and products.