April 7th – April 13th

PERSPECTIVES by Eric F. Risley

With the recently introduced economic uncertainties, it’s a good time to step back and discuss the current state of the crypto M&A (and financing) markets.

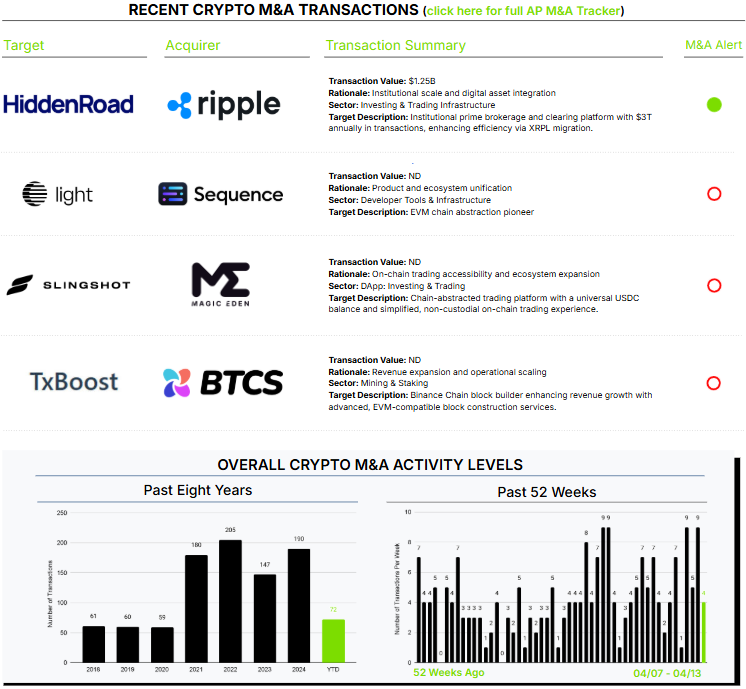

However, we first saw another “premium-value” M&A transaction with Ripple announcing the acquisition of HiddenRoad. HiddenRoad is an institutional investor–focused prime broker with business in both crypto and traditional assets. The firm has built its capabilities using the structure, risk management techniques, and standards of traditional securities markets. Here is our M&A Alert with more details and the strategic rationale underlying the transaction.

As highlighted in our Q1 2025 Crypto M&A and Financing Report published less than two weeks ago, the crypto M&A markets have been improving over the past six months and continue to demonstrate strong momentum, nicely evidenced by the aforementioned acquisition. Our direct conversations with market participants—both acquirers and sellers—continue to be characterized by a general sense of prudent optimism and the recognition that crypto assets, in their various forms and use cases, are a legitimate and important asset class and set of technologies. This includes both crypto-native and traditional financial institutions in their various forms. All recognize that crypto is relatively early in a long-term maturation cycle, so medium- and long-term strategy drives thinking, less impacted by daily headlines. Perhaps even more critically, none of our active transactions have been slowed or paused due to economic uncertainty or recent headlines.

Financing markets have demonstrated similar momentum and the beginning of the return of growth equity capital, which has been virtually absent for the past 10 quarters.

The most adversely impacted financing market may prove to be the IPO market. IPO markets have generally been fickle for some time, and economic predictability and public market price stability are important. A reasonably well-functioning IPO market is critically important for both crypto M&A and late-stage financing. Public companies generally have more active M&A strategies, and late-stage investors depend on IPO markets (and “premium-value” M&A markets) to realize returns.

While IPO market conditions are not in anyone’s control, what is controllable are business-building efforts. Fundamentally, well-run, growing, and predictable business performance is the most important determinant of IPO suitability. Dozens of crypto businesses are well along that journey. When IPO markets do become conducive, many high-quality crypto businesses will be ready.