May 26 – June 01 (Published June 4th)

PERSPECTIVES by Todd White

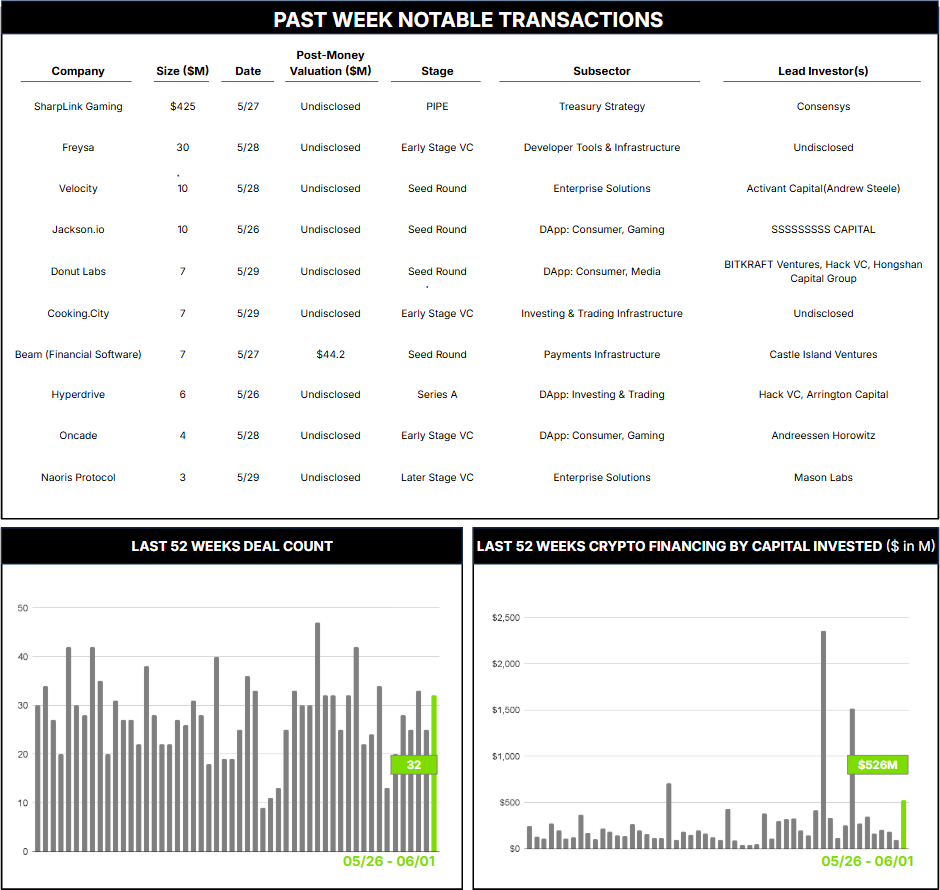

32 Crypto Private Financings Raised: $526.3M

Rolling 3-Month-Average: $530.6M

Rolling 52-Week Average: $274.5M

The adoption of crypto-treasury strategies (where companies allocate a portion of their balance sheet to digital assets like Bitcoin, Ethereum, Solana, and even stablecoins) has accelerated since 2021, with both tech giants and smaller firms participating. This trend has the potential to reshape corporate finance, but it also brings significant risks.

Several prominent companies have pioneered or adopted crypto-treasury strategies, most focused on Bitcoin. Strategy (fka MicroStrategy) is the most notable example and now holds the largest Bitcoin treasury among public companies, with 580,955 BTC as of June 2025, purchased at an average price of $70,023. The company began aggressively accumulating BTC in 2020 under CEO Michael Saylor, who views Bitcoin as a superior store of value and has emerged as a vocal advocate for Bitcoin as a treasury asset. Other groups focused on Bitcoin treasuries include miner Marathon Digital, which accumulates and retains BTC as part of its core mining activities; LatAm fintech giant MercadoLibre, which integrates crypto into its payment ecosystem and uses its crypto holdings for transactions in addition to holding the assets on its balance sheet; and 21 Capital, a newly formed Bitcoin-native financial company created by Tether, Bitfinex, and SoftBank through a reverse merger with Cantor Equity Partners, Inc. (CEP), a Nasdaq-listed special-purpose acquisition company (SPAC) sponsored by Cantor Fitzgerald, and positioned to be led by Jack Mallers, a prominent Bitcoin advocate and CEO of Strike.

Other assets are also being utilized, including ETH, SOL, and XRP. SharpLink Gaming, a Nasdaq-listed marketing company servicing the online sports-betting and gaming sectors, is emerging as a leading advocate for Ethereum-based treasury strategies with its announced $425 million PIPE financing this week in order to acquire Ethereum as the company’s primary treasury-reserve asset. There are numerous other examples; by our count, at least 36 groups have announced crypto-based treasury ambitions over just the last few months.

Amid this surge, there are, of course, numerous advocates and skeptics alike. Advocates often cite several putative benefits, including the potential for high returns, hedging against inflation and currency debasement, portfolio diversification, and even strategic branding as an innovative company. Detractors quickly counter with the risks of extreme volatility, uncertain regulatory and accounting treatment, inherent security and custody challenges, operational complexities, and more.

However the debate unfolds, the public markets appear to approve for the moment. Investors currently trade crypto-treasury companies at a notable premium, between two and three times the price of the underlying asset. Most adopters, SharpLink included, intend to continue operating their core businesses rather than pivot entirely to crypto accumulation. Even 21 Capital, launched on the basis of its BTC strategy, intends to complement its treasury activity by developing a suite of BTC-enabled financial products that will provide a core level of business activity. Strategy, on the other hand, has pivoted to an almost pure treasury play.

Whether, and when, the music will stop and the trading premium diminishes (or worse) remains to be seen. For now, momentum seems to be increasing, and we will track the relative wisdom or folly of this growing cohort with keen interest.

Contact ryan@architectpartners.com to schedule a meeting.