September 15 – September 21 (Published September 24th)

PERSPECTIVES by Steve Payne

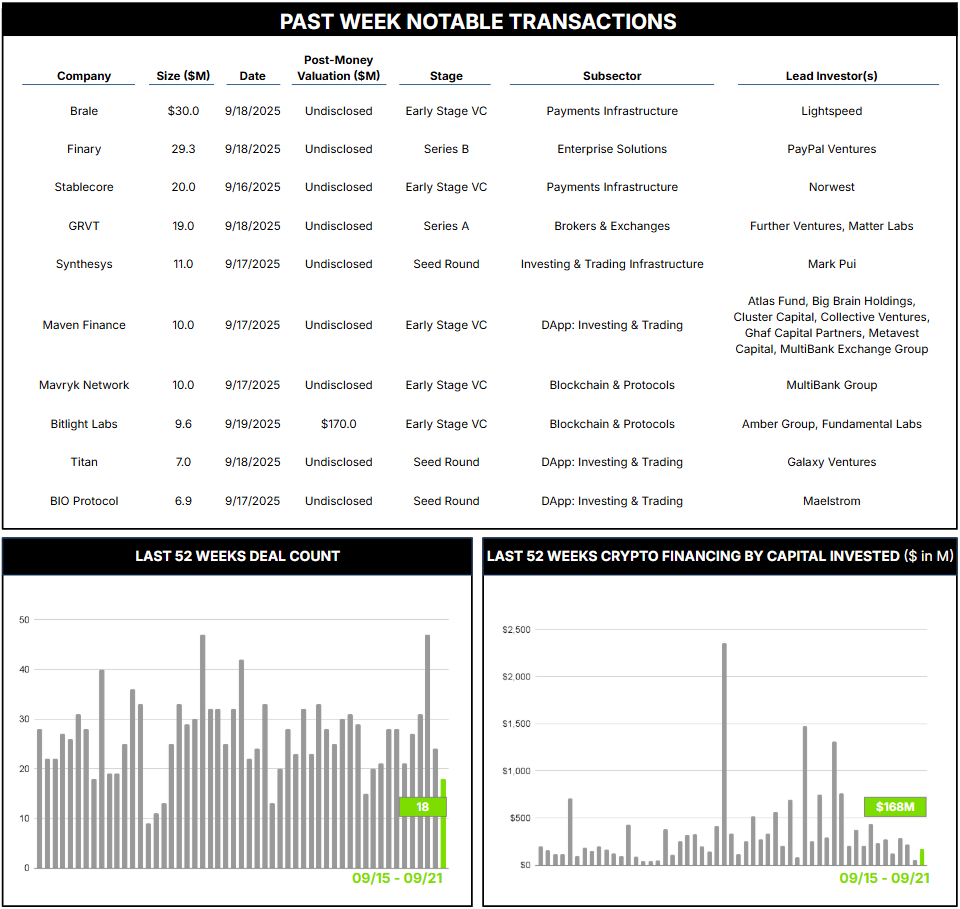

18 Crypto Private Financings Raised: $168.3M

Rolling 3-Month-Average: $357.6M

Rolling 52-Week Average: $343.8M

Starting off this Weekly Financing Snapshot with thanks to my colleague, Todd White, who has filled this space with his learned commentary for the past handful of months.

Looking at last week’s transactions, three main takeaways stand out:

Trendlines. Last week’s reported private company financings were below half the level of our rolling average (that’s why we report a rolling average…). This is not a cause for concern, since short-term fluctuations don’t matter, and because of the strength of these rounds and the quality of investors (see paragraph below). And since this week ended, we’ve already seen multiple $100M+ financing rounds – could it be that growth stage investing is back? More on this next week.

Investors Matter. The top 3 investments last week were led by quality, mainline investors, not crypto-native VCs or angel investors. Why is this noteworthy? Nothing against the latter groups (they often are prescient early movers), but deals led by Lightspeed, PayPal Ventures, and Norwest are another indication that the crypto/blockchain ecosystem is growing up and moving beyond speculative use cases to real financial and enterprise use cases. When we see participation by “institutional” stalwarts such as these plus co-investors like NEA, Foundation Capital, NFX, and Peterson Partners, we expect to see portfolio companies with solid traction and strong growth potential.

Stablecoin Summer. We’ve written this year about payments becoming a driving use case, underlaid by stablecoins, and also published a three-part report on blockchain in payments last quarter (linked here). Last week, Brale raised $30M, led by Lightspeed, to expand their enterprise platform for issuing and operating regulated, multi-chain stablecoins. Stablecore raised $20M, led by Norwest, to grow their digital-asset platform that allows banks to create, manage, and integrate stablecoins and digital assets into existing bank products and systems.