Architect Partners’ Observations

Bitcoin Depot has built a successful, rapidly growing, and profitable business. Physical fiat cash remains a popular form of payment in the U.S., representing 20% of all consumer payments in 2021 according to the Federal Reserve. Bitcoin Depot and others have built an impressive fiat-to-crypto onramp that physically resides in an ATM machine at the largest chain retailers in the U.S. Why do people buy Bitcoin at retail ATMs? (28% of Bitcoin Depot’s volume comes from retail chains) According to their survey data, the main driver of purchases are to: 1) Send money to others (remittances) 2) Purchase goods online, and 3) As an investment. What is also impressive is that transaction volumes have remained remarkably resilient through “Crypto Winter”, quite the opposite of popular online and mobile options like Coinbase and Kraken. In fact, BTM’s revenue and profits were up, from Q1 2022 to Q1 2023, while Coinbase’s revenue was down 34% over the same period.

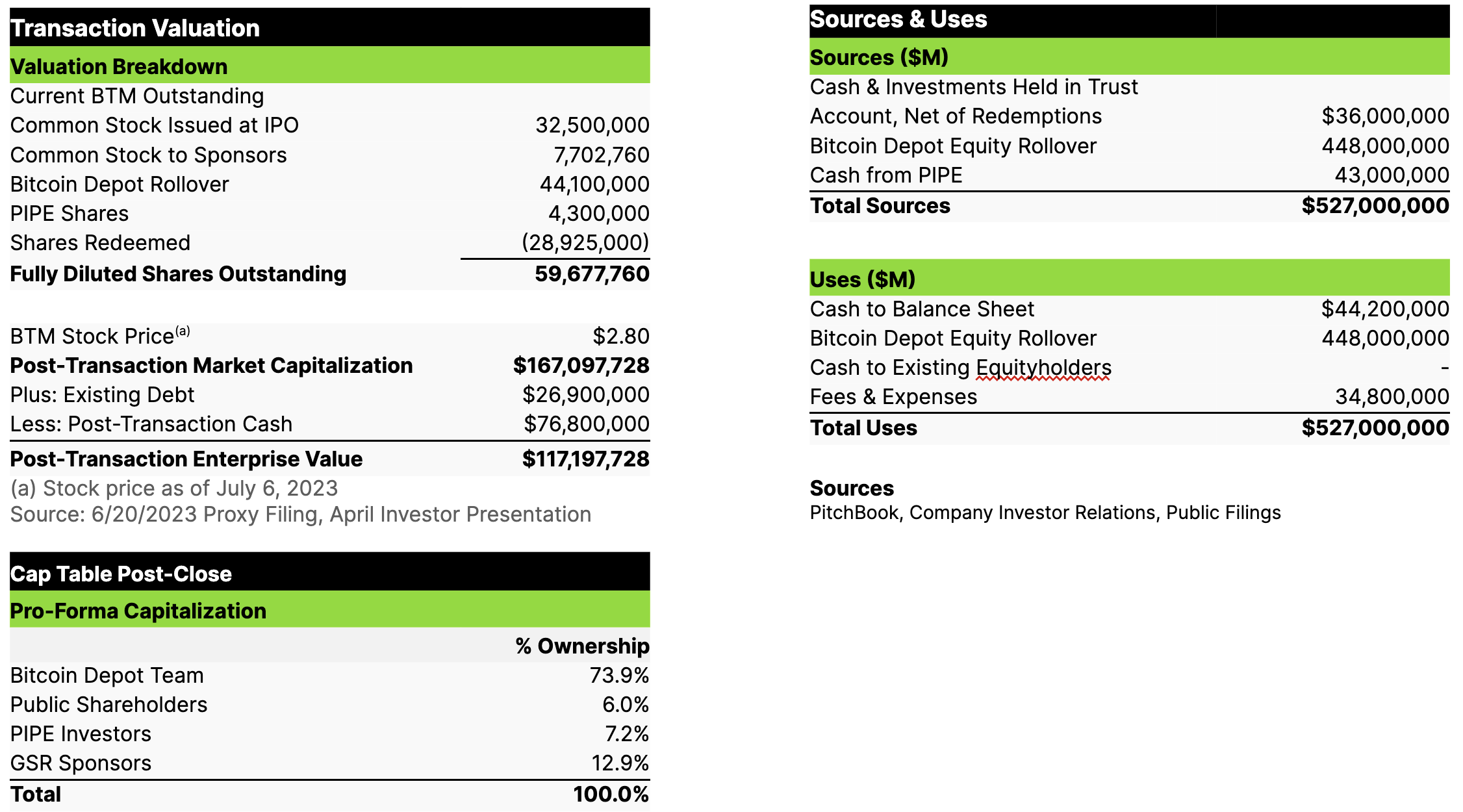

Despite BTM’s solid growth and profitability, completing its de-SPAC merger with GSR proved to be difficult. SPACs have been out of favor for over a year, as investors have shown skepticism toward all SPAC transactions. This negative sentiment caused GSR and BTM to compromise on several key points to finalize the deal. Specifically, GSR had to invest more money, BTM shareholders (primarily Mintz) sold fewer secondary shares than originally negotiated, the bankers took lower fees, and the stock is trading at very low multiples of revenue and EBITDA. Currently, there are more sellers than buyers of BTM, but we believe that there is a real need and use case for Bitcoin ATMs and that BTM is a growing and profitable leader in the space.

Bitcoin Depot De-SPAC Detailed Analysis