Bitfarms Acquires Stronghold for $175M Enterprise Value in All Stock

Transaction Overview

On August 21, 2024, Bitfarms (TSE/NASDAQ: BITF), a global vertically integrated Bitcoin miner, announced its all stock acquisition of Stronghold Digital Mining (NASDAQ: SDIG), for $125M in equity value and $175M in enterprise value. The deal is expected to close in the first quarter of 2025.

Target: Stronghold Digital Mining (NASDAQ: SDIG)

Stronghold Digital Mining is a crypto miner using coal refuse to generate electricity for Bitcoin mining while rectifying the environmental damages of the last century. Stronghold owns or holds options over 1,850 acres of land in Pennsylvania operating two major plants: Panther Creek and Scrubgrass.

According to SEC filings, Stronghold reported $19.1M in revenue for Q1 2024. In recent years, the company generated $75M in revenue in 2023 and $110.2M in 2022, while incurring losses of $101.8M and $195.2M in those respective years. Stronghold currently has a hashrate of 4.1 EH/s and 165 MW with improvement potential post merger.

Stronghold Digital Mining’s industry competitors include: Riot Platforms (NAS: RIOT) TeraWulf (NAS: WULF), MARA (NAS: MARA), and CleanSpark (NAS: CLSK) amongst others.

Founded in 2021 by Gregory Beard and Bill Spence, Stronghold now has over 110 employees. The company raised $85M in a Series A round led by MG Capital and $127M through its IPO in Nasdaq. Additional smaller fundraisings have brought the company’s total capital raised to $266.5M. Since Stronghold Digital’s IPO date (October 19, 2021), the stock has fallen 98% from a price of $253 per share. At its peak, the company’s equity was valued at $3.9B.

Buyer: Bitfarms (TSE/NASDAQ: BITF)

Bitfarms is a Canadian crypto miner, established in 2017. Their main operations include a large-scale Bitcoin mining platform running vertically integrated operations with onsite technical repair, and proprietary data analytics.

The company has a presence in four countries, with eight industrial-scale facilities in Canada, one in the US, one in Argentina, and three in Paraguay. Bitfarms is focused on sustainable mining practices, with its data centers powered by over 75% renewable energy, primarily hydropower, and secured through long-term power contracts. Across these facilities, the company operates 65,400 miners, operating at 10.4 EH/s in self-mining using 310 MW of electrical capacity. With an enterprise value of $1.4B, the firm currently trades at 121x multiple of its operating EH/s and 65x its 2024E EH/s. The company is publicly traded on the Toronto Stock Exchange (TSE) and Nasdaq.

As of July 31, 2024, Bitfarm holds 1,016 Bitcoin, with a total value of $67.2M and an average of 8.2 Bitcoins mined per day, at a cost of $30,600 per Bitcoin. Bitfarms recorded revenue figures of $230.3M, $193.5M, and $198.9M in 2021, 2022, and 2023, respectively, with estimates projecting $234.6M in revenue for 2024 and a loss of $144.3M.

Founded in 2017 by Nicolas Bonta and Emiliano Grodzki, Bitfarms now has over 150 employees. The company had raised $627M over seven post-IPO private investment in public equity rounds (PIPE), with key investors including Riot Platforms, Galaxy Digital, and Dominion Capital. In 2019, Bitfarms went public on the TSE and on the Nasdaq in 2021.

Transaction Parameters

Bitfarms agreed to acquire Stronghold for $125M equity value in a stock-for-stock merger transaction, with the enterprise value being $175M including $50M of net debt. The deal is subject to regulatory approval and is expected to close in the first quarter of 2025.

Stronghold shareholders will receive 2.52 Bitfarms shares for each Stronghold share they own, equating to $6.02 per share and a 71% premium over Stronghold’s 90-day volume-weighted average price on Nasdaq as of August 16, 2024. After the transaction, Stronghold shareholders are expected to hold just under 10% of the combined company, based on the current outstanding shares of both companies.

Strategic Rationale

The acquisition aligns with Bitfarms’ strategic plan by expanding and rebalancing its energy portfolio, aiming for nearly 50% of its power capacity in the U.S. by the end of 2025. The transaction could add up to 307 MW of power capacity, with a clear path to 950 MW by year-end 2025 and the potential to reach 1.6 GW in the future. The deal secures two sites with long-term expansion potential, positioning Bitfarms to diversify its operations beyond Bitcoin mining into areas like HPC/AI, enhancing energy efficiency and hashrate.

Architect Partners’ Observations

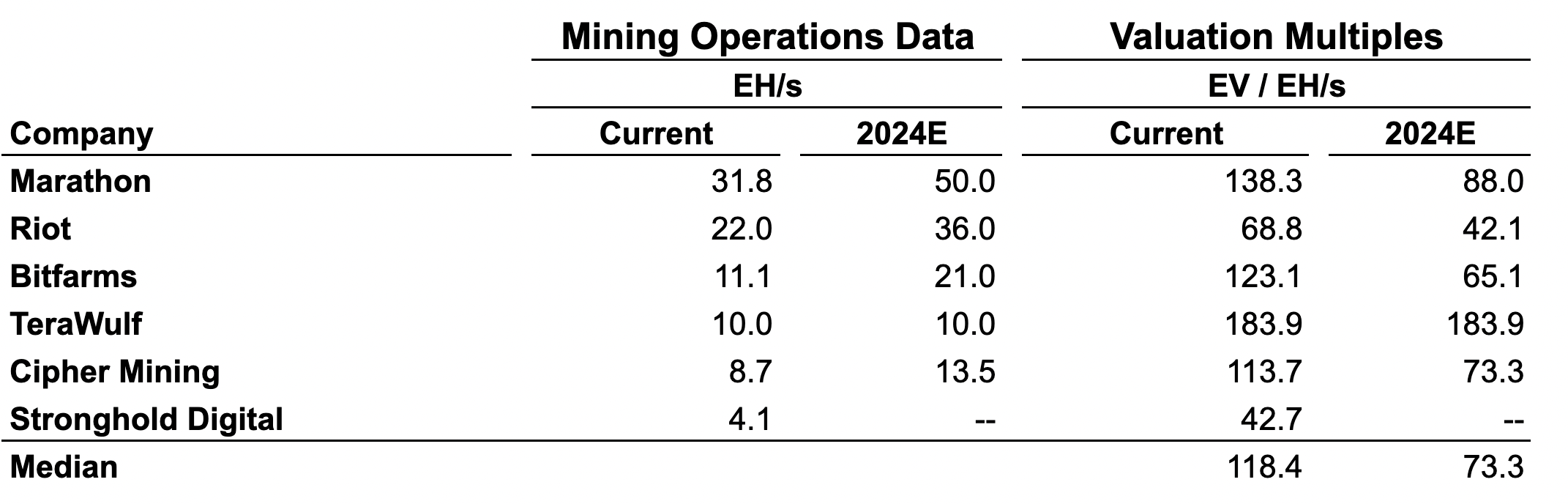

The thesis here is simple: Bitcoin miners are highly leveraged, asset-intensitve business in a market where rewards are limited, but competition is fierce. As we see in this case, with $50M in high interest debt and only $5M in cash, taking losses of over $100M per year was simply not sustainable for Stronghold. What will naturally play out is “surivival of the fittest” and only the best financed groups in the space will be able to survive and will subsequently acquire the assets of those that are not able to hold out. With 4.1 in EH/s, the company traded at 42.7x EV / EH/s, significantly lower than the peer group that trades at an average multiple of 146x.

Sometimes the best defense is offense. In this case, Bitfarms has announced the acquisition of Stronghold along with management and board of director changes. Hostile M&A is tricky and can have unintended consequences as is likely the case from Riot’s perspective here. As a rule, hostile acquisitions are anathema to businesses that rely on the talent of people, which makes them very unusual in technology and financial services businesses. However, Bitcoin mining is very different with physical facilities with access to electricity and widely available computing equipment the core assets.

The irony of this consolidation phase is that Satoshi Nakamoto’s initial vision was that anyone and everyone with interest could set up a computer to mine Bitcoin. Everyone could run the Bitcoin network and no one would control a major proportion of the “hashrate”. This is fundamental to the design and ensures that the blockchain is a consensus of many, not a few. The implication of mining concentration remain to be seen, however, some like Jack Dorsey and Block, are seeking to reverse this concentration, building semiconductors and systems to support a return to mining decentralization.