The disparity in regulatory treatment of crypto between the US and the rest of the world is again a hot topic this week. Many laud the EU, HK and others for promoting clear rules and embracing crypto technology and innovation, and condemn the US for putative attempts to stifle innovation and chase the crypto community off of its shores. But closer inspection suggests the lines between friendly and grumpy regimes aren’t nearly so clear, with the immediate impacts on the public crypto market even less so.

The recent SEC actions against Coinbase and Binance, and the CFTC’s victory against Ooki DAO confirming that decentralized entities can be held legally accountable, represent bold moves to bring the cryptosphere within the ambit of existing US regulation. The publication of the Markets in Crypto Assets law (MiCA) on Friday, setting up new crypto services licensing framework and stablecoin issuer governance standards to take effect in late 2024, has been widely and deservedly praised for its transparent and collaborative process. And Hong Kong’s Monetary Authority’s encouragement for lenders such as HSBC and Standard Chartered to onboard crypto exchange clients may help fill a void left by the loss of US-listed banks such as Silvergate and Signature with trusted non-US institutions.

Yet the SEC this week was denied its request to freeze Binance US’s assets, and we also saw BlackRock, the world’s largest asset manager and exchange-traded fund (ETF) sponsor, file for its Bitcoin ETF using Coinbase Custody and Coinbase’s spot market data. And across the pond, Binance is pulling out of the Netherlands after a failed application for a virtual asset service provider (VASP) license, and faces scrutiny in France for alleged illegal services and aggravated money laundering in France, in spite of prior indications of AML compliance. Perhaps the distinction between friendly and unfriendly shores is not so clear after all?

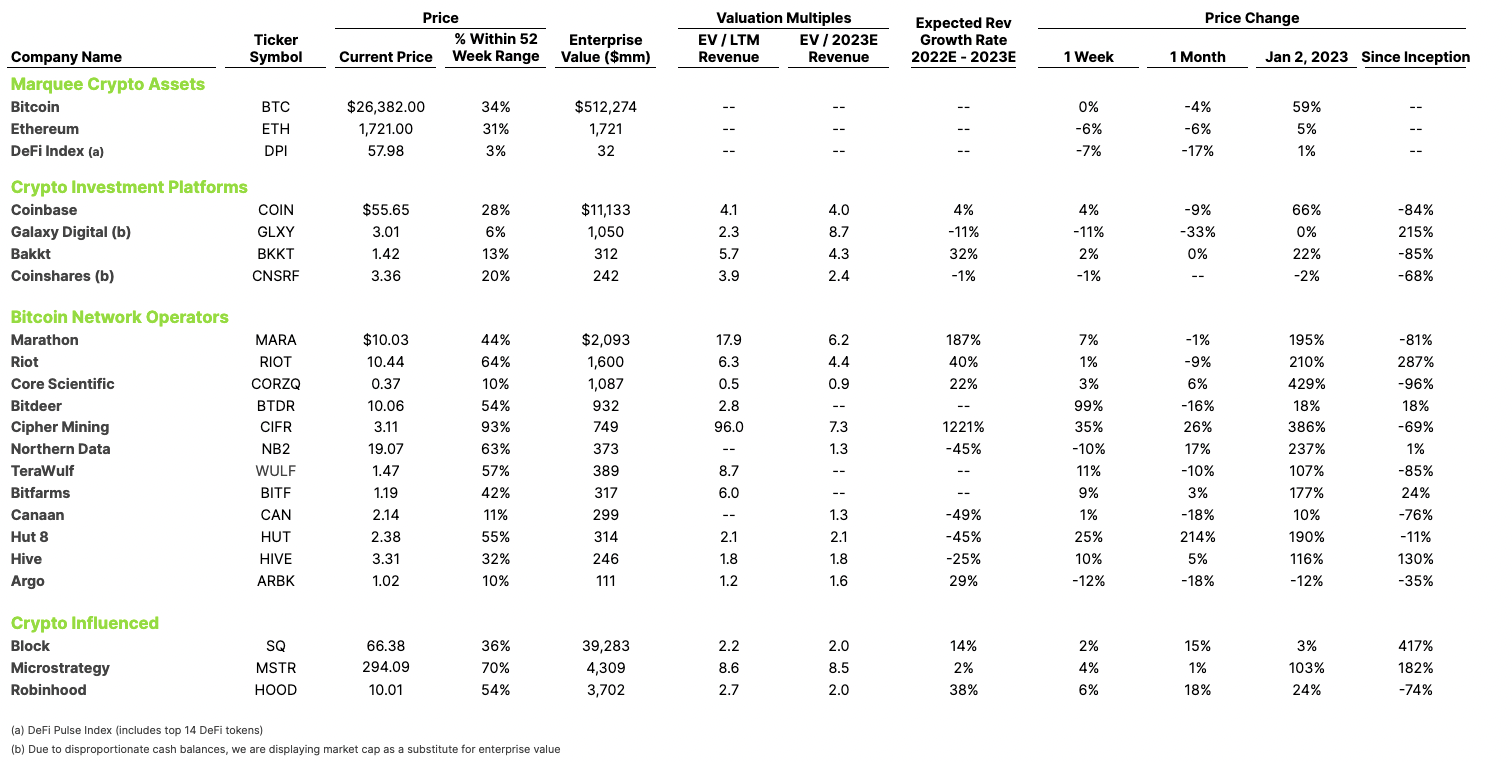

Meanwhile, it is hard to correlate these regulatory developments with actual pricing movements in the public crypto space. The biggest winner in our index is Bitdeer, a recently listed Singapore Bitcoin Network Operator that gained 100%+ this week to recover all of its losses from its debut on April 14. These fortunes are likely driven by its announced partnership with Bhutan rather than friendly regulation. Furthermore, CoinShares, a Jersey-based exchange listed in Sweden, lost 1% in spite of its favorable regime. And Robinhood, the US retail-focused trading platform, saw a strong 6% weekly improvement to top off YTD gains of 24%. This strong market performance is likely tied to increased volume in equity trading, and new products such as a cash sweep with a 5% yield, rather than HOOD’s substantial commitment and investment in crypto, which still accounts for less than 10% of revenue.