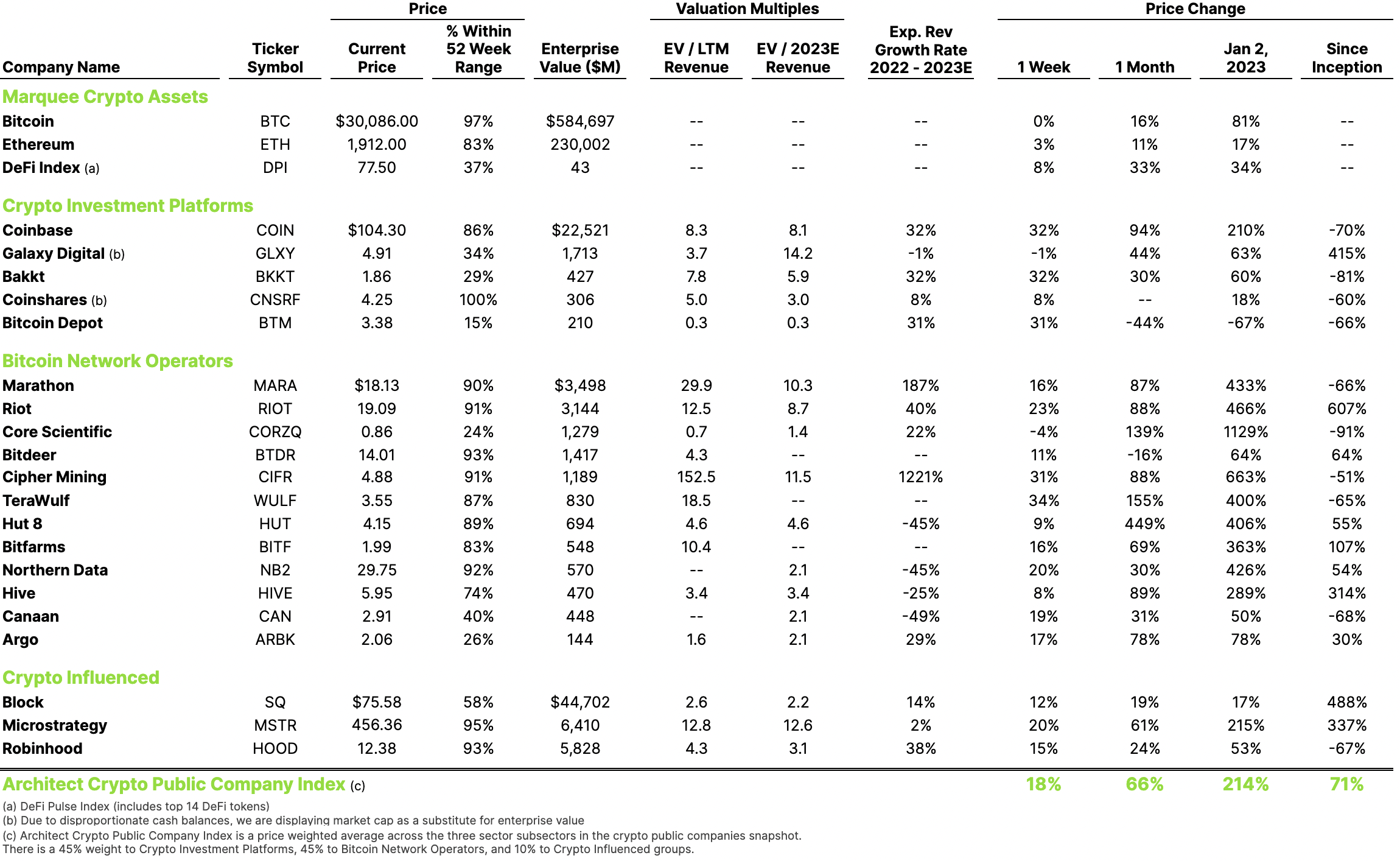

This week we’ve introduced the “Architect Crypto Public Company Index”, a price-weighted average across our three public crypto subsectors. Our new index applies a 45% weight to Crypto Investment Platforms, 45% to Bitcoin Network Operators, and 10% to Crypto Influenced groups.

We’ve also added Bitcoin Depot to the Crypto Investment Platform subsector. Their de-SPAC was completed with the company listing on NASDAQ under the ticker “BTM” and trading beginning July 1st. The stock is trading today at $3.38 resulting in a market capitalization of $210M.

Meanwhile, over in the Southern District of New York…

The most notable event of the week was yesterday’s District Court ruling in the SEC suit against Ripple Labs, initiated in August of 2022. Judge Torres ruled that the XRP token is not inherently a security, and the sale of XRP tokens on exchanges and through algorithmic trading are not investment contracts. The SEC also scored a partial win in that institutional sales did constitute unregistered securities offerings. The core premise is that the underlying asset is not dispositive, and the context and circumstances of a transaction are critical. These include the nature of an offering and the reasonable expectations of the parties, so that some sales of a crypto asset may, while others may not, constitute regulated securities transactions.

The ruling is full of nuance. It will undoubtedly take time to fully digest its implications, and it remains subject to appeal. But the notion that it is not the token but the transaction that matters seems a palpable blow to the SEC’s recent enforcement efforts. It has been lauded as a victory by the industry, and several exchanges including Coinbase, Kraken, Bitstamp and Crypto.com moved quickly to relist XRP. The market response was equally swift, with XRP and Coinbase posting strong immediate gains, before losing ground in what seems a broad market pullback as of the time of this writing.

These are indeed exciting and informative times for the crypto universe. We may finally begin to descry glimmers of the U.S. regulatory clarity that the market has been seeking.