News on Macro Economic Data

There wasn’t much economic news this past week. The economic picture shows signs of improvement, but also persistent headwinds. Recession fears are receding, as a survey of economists believe the likelihood of a recession in 2024 is only 42%, but only project a 1.6% growth rate.

Jamie Dimon, CEO of JP Morgan, made news by suggesting he is “…a little skeptical of this kind of Goldilocks scenario. I still think the chances of it not being a soft landing are higher than other people”. The Conference Board also believes it is more probable that the US will slip into a short and shallow recession than not in 2024.

San Francisco Fed President and voting member today said that inflation is not down to 2%, there is a lot of work left to do, and suggested it’s too early to suggest rate changes are around the corner.

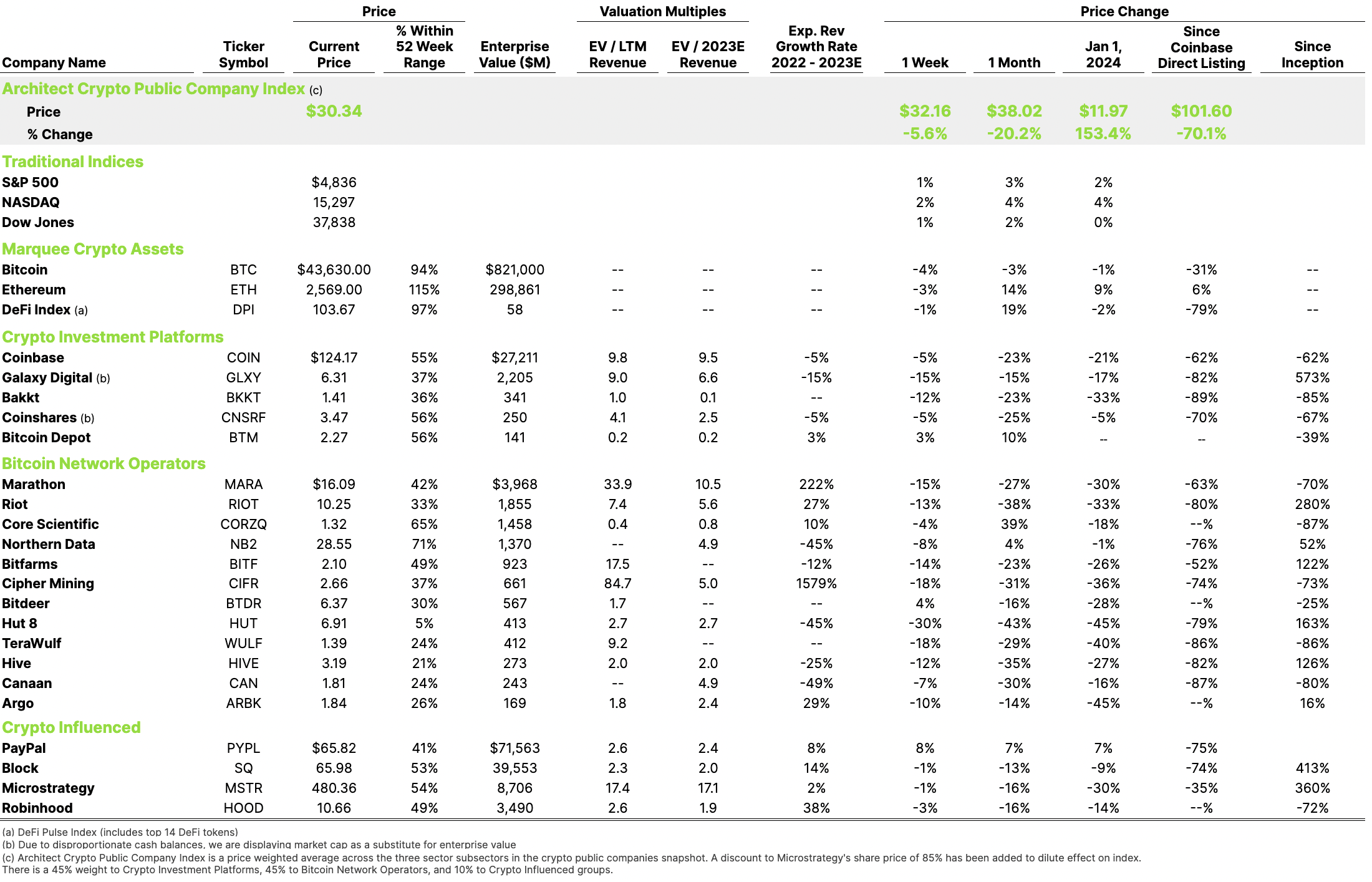

Crypto Public Company Activity

Stock in the top 12 Bitcoin miners fell sharply this week and are down about $6B in market capitalization since January 1 according to TheMinerMag. This drop is certainly the result of a confluence of factors rather than a singular event. A few possible catalysts include:

- Miner revenue does fluctuate, but the trend line has been declining in recent weeks. Total fees have fallen over the past 30 days from ~$60M per day to ~$40M per day according to YCharts

- The Expected April Bitcoin halving will reduce mining rewards in half which investors could believe will adversely affect profitability and negatively impact stock prices

- Bitcoin ETFs enable a direct, efficient, and liquid investment in Bitcoin that may be reallocating funds away from mining stocks. It would be a justifiable rotation to reallocate profits from the Q4 2023 runup in mining stocks to the current increasing value of Bitcoin

- Negative news within a sector generally has a corresponding negative effect on an entire sector. Hut8 fell 20% on Thursday alone, as unverified reports emerged of financial misbehavior regarding its recent $742M merger with US Bitcoin Corp. The allegation came from J Capital Research – a short seller of Hut8 stock

The world of crypto mining is complex, and this short-term move is worth keeping an eye on. Like any risk asset, there are always both positive and negative movements. And, in the volatile world of crypto, all investments carry above-average risk and deserve deep diligence.