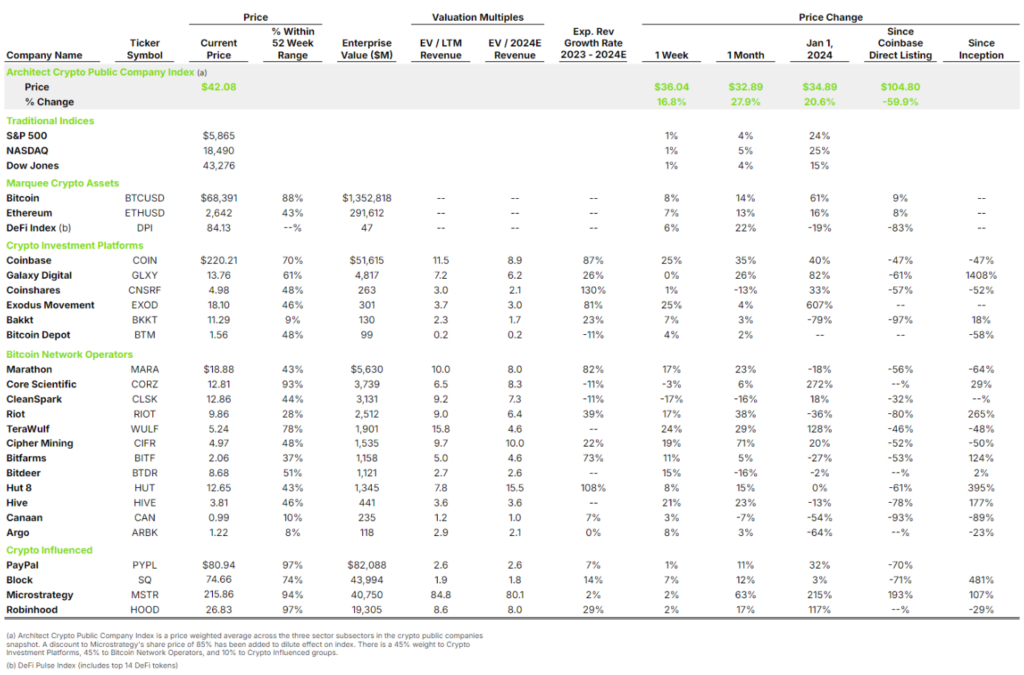

Bitcoin is up 8% since last week, so we again ask ourselves the question, how does this impact the value of public companies whose businesses tie directly to transaction volumes and price? The answer is mixed.

While the average weekly price improvement across the “Crypto-Native” groups including Crypto Investment Platforms and Bitcoin Network Operators is 10%, roughly in line with Bitcoin, there are large deltas between individual companies. Coinbase, Exodus, TeraWulf and Hive are up over 20%, while others were closer to flat or even down.

The ultimate decision for investors in the space will be whether they should invest in public companies whose equity value is decided by a combination of digital asset price performance and the operating abilities of the company or simply invest directly in digital assets to reduce the operating risk in individual companies.

This debate will continue for a period of time, but we anticipate new public companies emerging with a reduced dependency on digital asset prices and instead are focused on innovative use cases of blockchain technology. We’ve already seen use cases like stablecoins as a payment mechanism emerge with billions of dollars in transaction volume. It’s only a matter of time before companies leading these new, less price-dependent use cases go public, assuming regulators allow for it.