Where have all the crypto SPACs gone?

In 2020 and 2021, there were a massive eruption of SPAC announcements. Since then there have been 20 crypto companies that were supposed to go public at egregious valuations and eventually only 8 closed.

Crypto SPAC announcements include:

- Bitcoin Network Operators: TeraWulf, Cipher Mining, Core Scientific, Bitdeer, BitFufu, Coincheck, Fold, PrimeBlock and Future Dao.

- Crypto Investment Platforms: Bakkt, Bitcoin Depot, Griid Infrastructure, Bullish, Circle, eToro, Qenta Inc., DLTx ASA, W3bcloud, Apifiny Group, and Roxe.

Note that those in italics are still in progress, while those in bold have failed their attempted merger.

Despite struggles, CoinCheck has beat the odds and continues with their $1.3B De-SPAC that was first announced in March 2022. After a two year battle with the SEC, CoinCheck has now received SEC approval to be listed on the Nasdaq and anticipates debuting in early December.

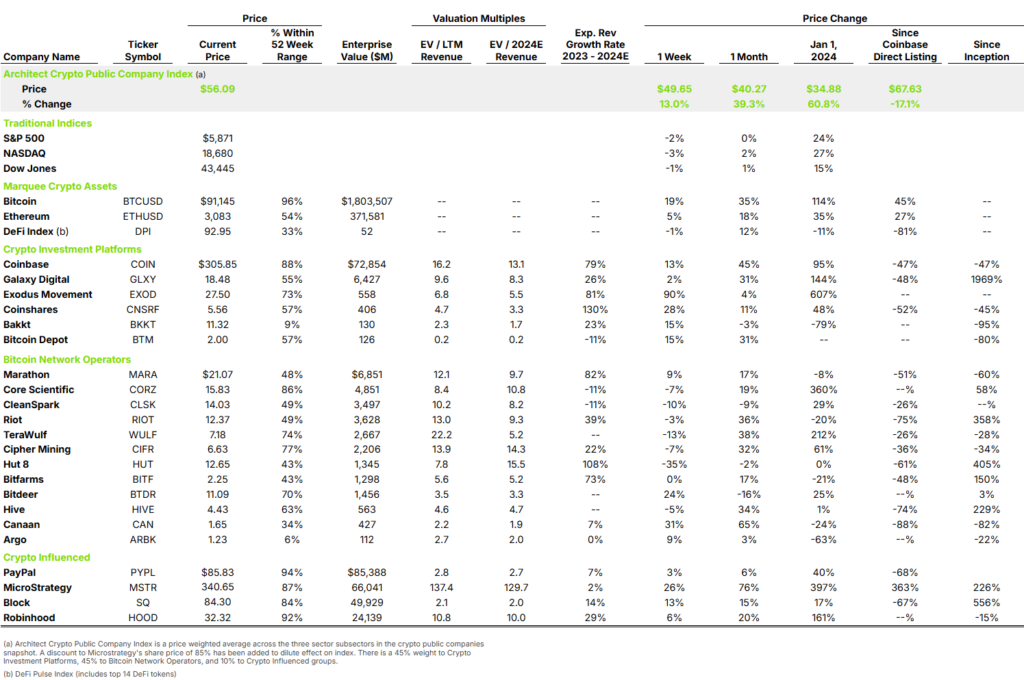

Looking at our index today, those that have did close are down an average of 38%, since their initial stock price at the close of their De-SPAC. Overall it’s been quite a mixed bag for SPACs in crypto, with most going poorly. We believe the next round of crypto companies going public will take the traditional IPO path and will begin gearing up for that as markets start to improve.

We know many like Kraken, FalconX, Fireblocks, Chainalysis, Anchorage Digital, BitGo, NYDIG, Ledger, and others have already announced their intentions of going public through the traditional IPO path.