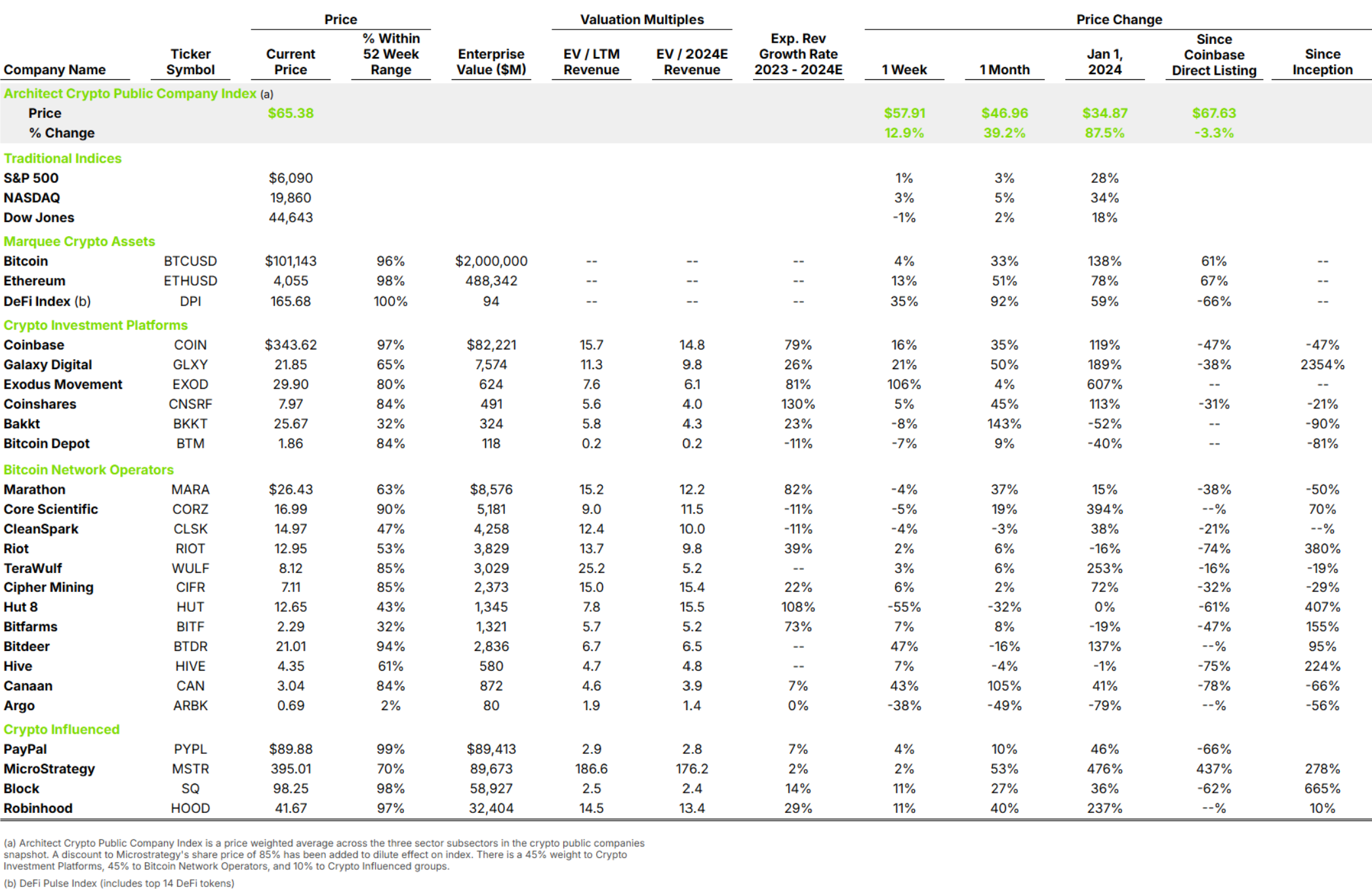

Let’s compare the digital exchange leader, Coinbase, with the physical exchange leader in crypto, Bitcoin Depot.

Coinbase is a household name, but as a reminder, Bitcoin Depot operates an 8,000-machine Bitcoin ATM network across North America. This network allows customers to buy and sell Bitcoin at convenient locations, essentially offering a similar service to Coinbase but primarily through hardware. Bitcoin Depot went public on July 1, 2023, via a SPAC merger (M&A Alert).

| Coinbase | Bitcoin Depot | |

| Enterprise Value | $82,221M | $118M |

| EV / LTM Revenue | 15.7x | 0.2x |

| EV / LTM EBITDA | 34.3x | 3.3x |

| Median Quarterly Revenue Growth (2022 – 2024) | -7.1% | -1.6% |

| Stock Performance YTD | 120.8% | -41.4% |

The takeaway from these numbers is clear: the market values software significantly more than hardware. This trend has been evident over the past couple of decades with the rise of the software business model. Coinbase is trading at a revenue multiple 79 times higher than Bitcoin Depot, despite Bitcoin Depot’s revenue being much less volatile since 2022.