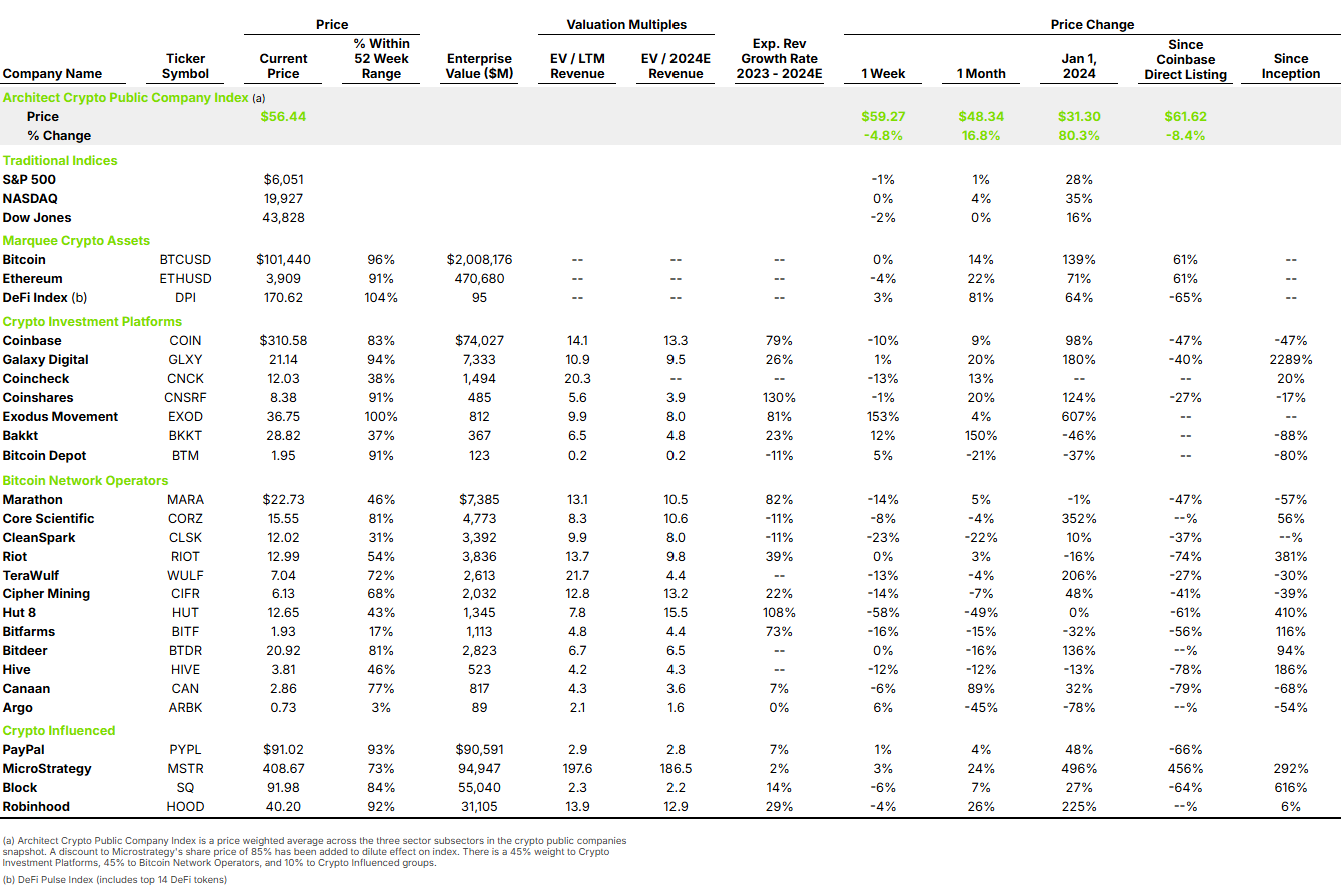

This week, Coincheck (NASDAQ: CNCK), the largest retail crypto exchange in Japan, officially began trading on the Nasdaq after a challenging de-SPAC process that commenced in March 2022. The company ended the week at $12.03, 20% higher than its initial SPAC price of $10.02, with a total enterprise value (EV) of $1.5 billion.

When the SPAC merger was initially announced, Coincheck proposed a valuation of $1.25 billion. Unlike the typical decline in valuation often observed upon the closing of SPAC deals, Coincheck’s market performance has aligned closely with its original announcement, marking a notably positive exception to the trend.

This marks the second major cryptocurrency exchange to go public, following Coinbase, and provides investors with an opportunity to geographically diversify their exposure to public crypto equity.

Coincheck currently trades at an EV/LTM Revenue multiple of 20.3x and an EV/LTM EBITDA multiple of 49.6x. These valuations appear to be quite robust, with Coinbase’s corresponding multiples being 14.1x and 49.6x.

| Financials

(FY ending in Mar.) |

2022 | 2023 | 2024 |

| Revenue

(net fees only) |

$233.9M | $55.1M | $61.1M |

| Adj. EBITDA | $118.0M | $(27.1M) | $23.3M |

We are on record, in the WSJ, saying that we expect to see more IPOs in 2025 and 2026 under the incoming administration. It’s encouraging to see more high-quality crypto companies entering the public markets, further bolstering the ecosystem through enhanced liquidity.