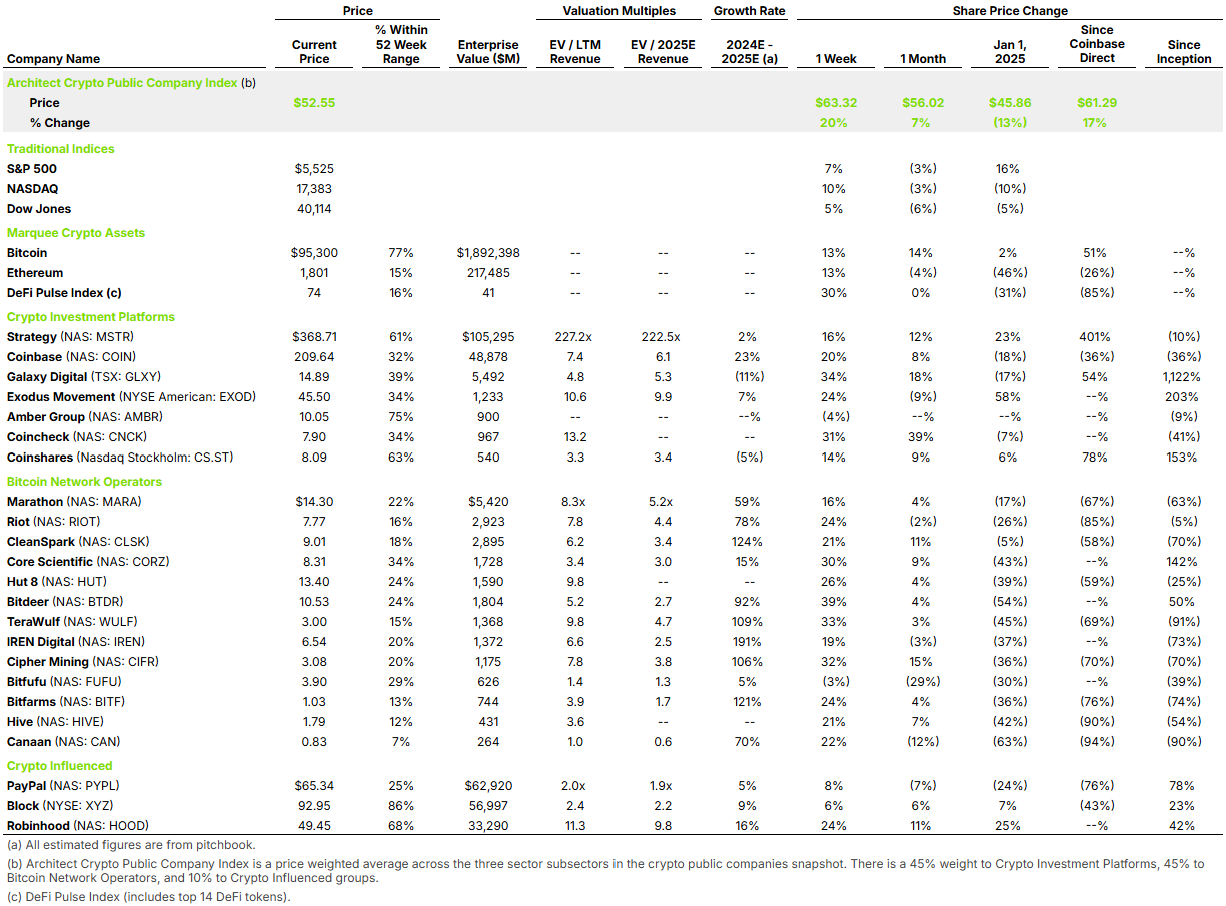

There will be, once the de-SPAC closes, a new Architect Public Company Index constituent with Twenty One, a “Bitcoin-native” company supported by Tether, SoftBank, and Cantor.

With their announced $3.6B valuation, Twenty One immediately ranks in the top 5 crypto-native constituents in our Index.

The company will initially launch with a treasury of 42,000 Bitcoin (worth approximately $4.0B based on today’s Bitcoin price) and plans to become “a singular vehicle for Bitcoin exposure, pro-Bitcoin advocacy, and Bitcoin-focused content and media with plans to explore future expansion into Bitcoin-native financial products.”

What does that mean exactly? That’s to be determined, and our initial observations include: 1) We appreciate top-tier groups of TradFi and crypto banding together to form new ventures led by proven innovators like Jack Mallers; 2) The $4B BTC on the balance sheet sets a “floor” valuation while simultaneously providing an immediate BTC treasury strategy and a war chest to fund business expansion; 3) There are intentions of building BTC-native products and services that will generate BTC-denominated revenue with BTC-denominated metrics — Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR).

In the press release, the company valued itself at $3.6B based on an $85K Bitcoin price, which means they have attributed $0 enterprise value to the company.

You may look at this business model and see similarities to Michael Saylor’s Strategy (Nasdaq: MSTR), and you would be right. The stark difference is the value per Bitcoin. MicroStrategy has 538,200 Bitcoin worth about $51B, but the company trades at a $97B market capitalization. In the case of Twenty One, they are pricing the company to trade 1-to-1 with their Bitcoin holdings. Despite this, the SPAC has increased in value by 250% since announcement, putting their market value-to-Bitcoin ratio at 3.5x, which now means they trade at a higher premium over Bitcoin than Strategy.

While the future model of Twenty One remains to be proven, the clear model today is a Bitcoin treasury company. We will see how they compete with or take market share away from Strategy.