Today, competition among crypto exchanges is fierce and continues to intensify by the week. What we’re seeing is a familiar market dynamic: a clear, phased evolution of players entering the space. This isn’t unique to crypto; it mirrors how innovation adoption has unfolded in other industries.

First Movers

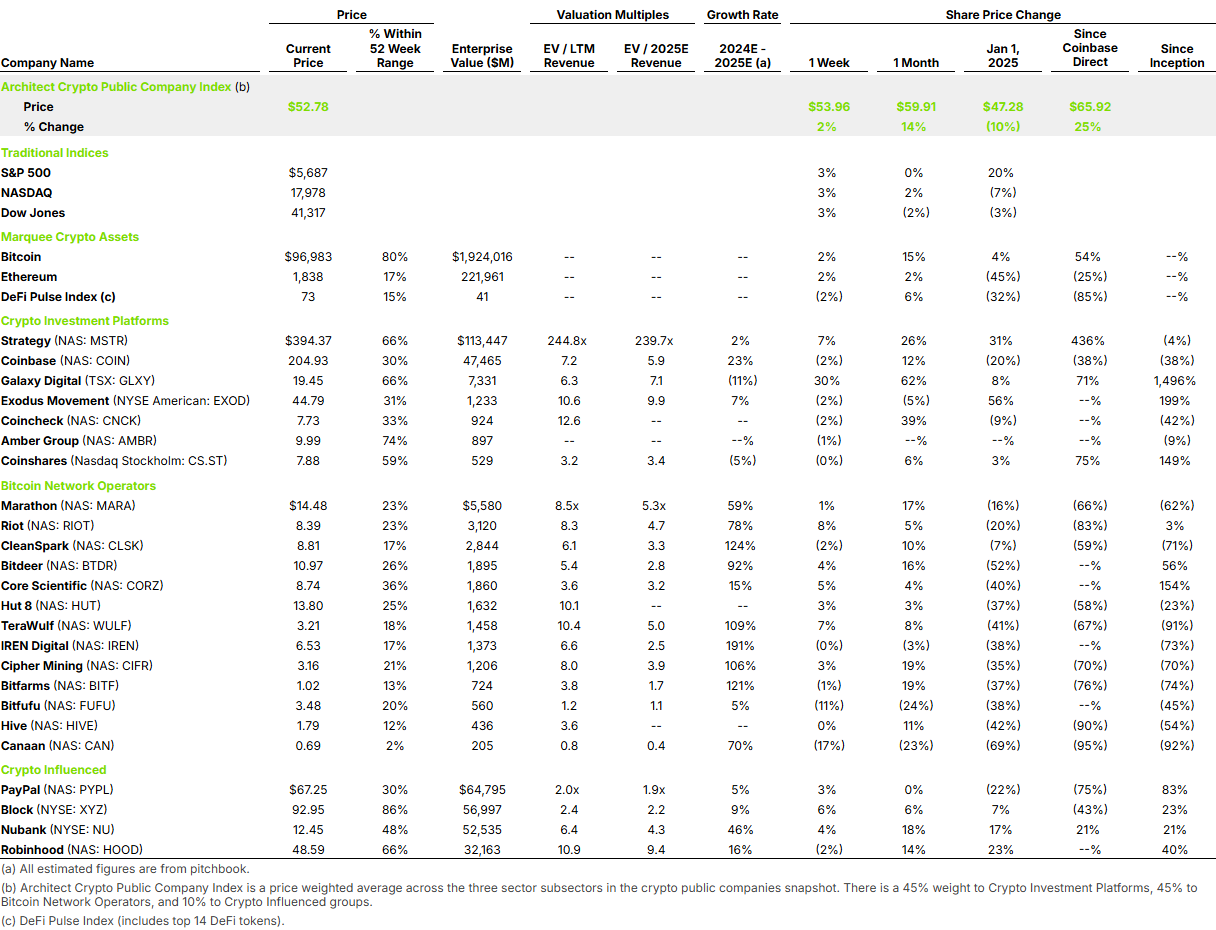

Exchanges like Coinbase, Kraken, and Binance were early entrants that captured significant market share by launching before widespread adoption. Their early positioning gave them brand dominance, regulatory head starts, and lasting influence. They will continue to operate on the leading edge and bring new coins and innovations ahead of other, slower entrants.

Fast Followers

Next came tech‑forward brokerages such as eToro, Robinhood, and Fidelity, along with neobanks like Revolut and Nubank. These companies quickly adopted crypto, integrating it into sleek, user‑friendly platforms. They capitalized on existing user bases and modern fintech infrastructure to scale rapidly. Today, crypto is an ever‑expanding part of their business and is highly prioritized.

Late Entrants

Now, established financial giants are entering the space. Firms like SoFi, E*TRADE, Charles Schwab, and notably Morgan Stanley all announced crypto initiatives this week. Though late, they bring credibility, trust, capital, and large customer networks, positioning them to gain share quickly as mainstream adoption accelerates. Of course, at this point, the market share will predominantly come from the existing players in the two groups above.

What’s Next?

The crypto industry still has a lot of growing up to do, but these trends are beginning to play out, and one can see a path toward maturity. Each platform must work tirelessly to build out ecosystems that encourage user retention and give customers a reason to stick with one provider over another. A good example of this is Coinbase, similar to Apple, which is building an entire ecosystem of products that supports its customers in every way. The company offers everything a retail, institutional, or even merchant customer could want, and it provides it in a very simple, relatively easy‑to‑use platform.