Over the next 10 years (2025–2034), the Crypto Core will outperform the Magnificent Seven’s 697.6% combined return from 2015–2024.

What is the Crypto Core?

Last week on the Milk Road podcast, I introduced the concept of the Crypto Core: about 15 crypto-native, publicly traded companies that represent the best-operating and highest alpha-generating businesses in the crypto industry.

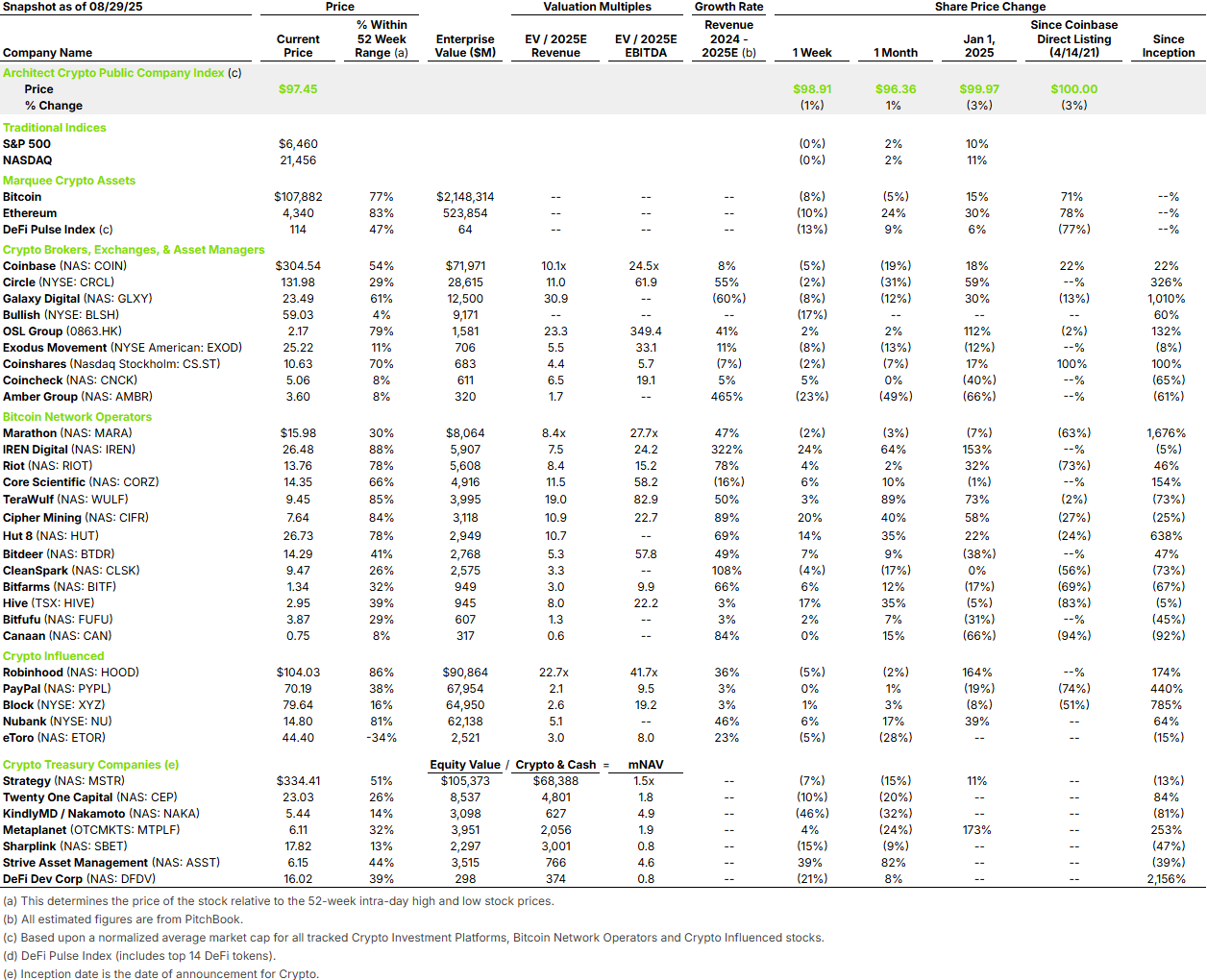

Crypto public-company activity has exploded over the last 12 months, driven by regular-way IPOs (Circle, eToro, Bullish; with Kraken, Figure, Gemini, and others upcoming), uplistings (Galaxy, Exodus, Coincheck, Amber, Sol Strategies), and Digital Asset Treasury (DAT) companies (Twenty One Capital, Nakamoto, Strive, ProBTC, SharpLink, BitMine, etc.).

For DATs, our research indicates that year-to-date, 184 publicly traded companies have announced intentions to raise $132B+ to acquire crypto assets.

With all this recent financial alchemy, it is essential to re-center on the fact that most activity in crypto is experimentation, and only the highest-performing experiments become long-term sustainable. I use 5–10% as a baseline assumption for what ultimately converts and sustains.

This long-term sustainability is what the Crypto Core seeks to represent.

While the Crypto Core’s constituents are still being established, we expect the group to include representation from exchanges, network operators (mining and staking), payments, asset managers, and DATs. MicroStrategy and Coinbase will be in this Core. Others will clearly emerge and establish themselves over the next 12 months.

Why does the Crypto Core matter?

Because the Crypto Core will generate investment alpha and significantly outperform the major equity indices over the long term (10 years).

The long-term horizon bears emphasis: although the path to 2035 will be volatile, it should still produce outperformance.

For context, between 2015 and 2024, the Magnificent Seven achieved a combined return of 697.6% and an annualized return of 23.8%, versus the S&P 500’s 178.3% and 10.8%, and the Russell 1000’s approximately 240% and 15.4%, respectively.

From another lens, the Mag 7’s estimated return for this period accounts for roughly 55–60% of the S&P 500’s return and 45–50% of the Russell 1000’s.

I expect the Crypto Core’s next 10-year performance to exceed the Mag 7’s last 10-year return attribution profile—and for its constituents to become household names.