November 11th – November 17th

PERSPECTIVES by Eric F. Risley

Could this be a trend?

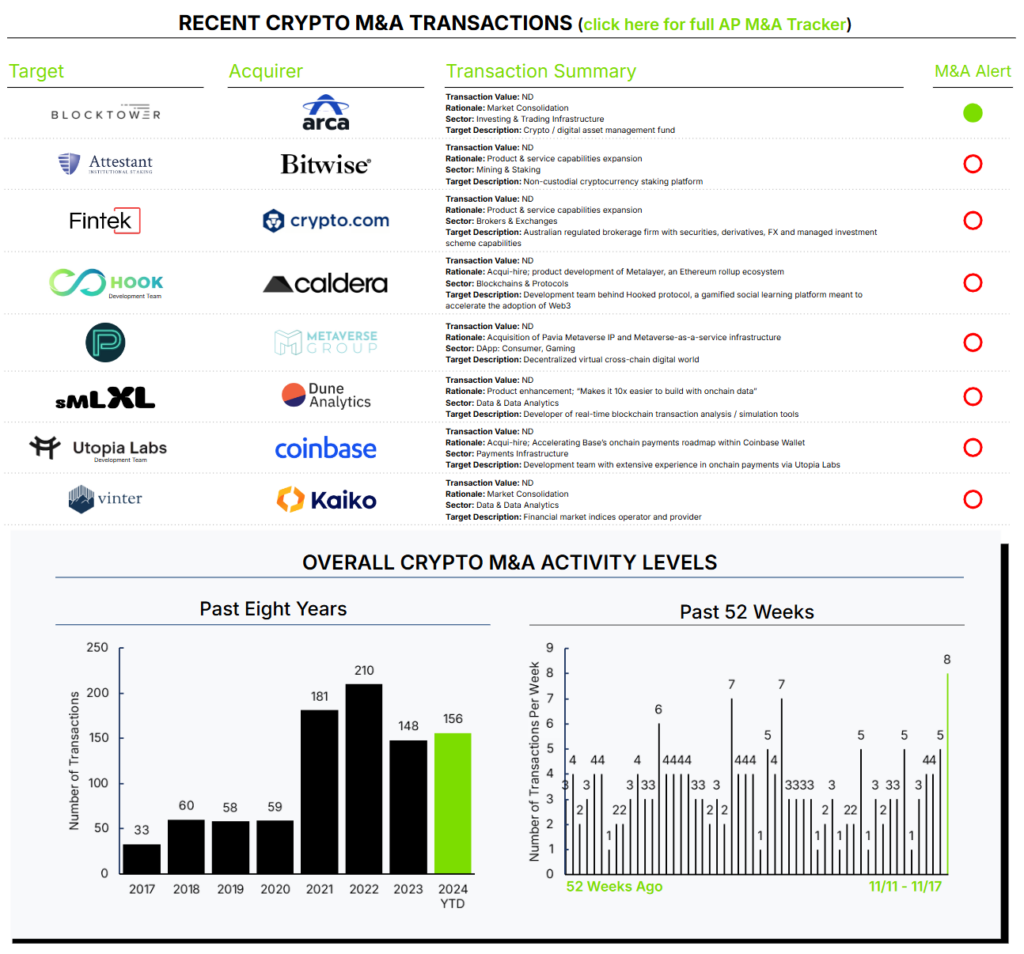

It’s been 21 months since we’ve announced transactions at this week’s pace — eight — notably many with headline-worthy counterparties. M&A transactions take months (or longer) to come to fruition, so we’re looking back in time at when the circumstances were deemed right to initiate these processes. In other words, a long time before recent market euphoria developed. Promising indeed.

As highlighted in the past, we are fans of themes. Themes help explain why things are happening and act as an an organizing principle; both represent corporate strategy unfolding. What themes were present this week?

- Scale Matters: Putting aside the insatiable desire for revenue growth that appears to have become embedded in our DNA, many businesses have economic efficiencies that emerge as they get larger. Trading and capital management are two areas with strong economic incentives to do “more of the same.” Crypto.com’s acquisition of Fintek and Arca’s merger with well-known BlockTower Capital (our M&A alert) is a great examples, in trading and capital management, respectively.

- New Products and Enhancement to Existing Products: The scope of products and solutions is continually evolving, often expanding, within technology-led businesses. This is true regardless of size. Management teams and Boards of Directors are continually considering the age-old question: buy vs. build. Top one-percent successful technology companies like IBM, Microsoft, Apple, Cisco, Symantec, Salesforce, Google, Meta, etc., have proven that well-considered and timed acquisitions are a powerful tool to ensure competitive advantage. Kaiko | Vinter (market index capabilities), Dune | SMLXL (data retrieval capabilities), Coinbase | Utopia Labs (payment capabilities & acqui-hire), and Bitwise | Attestant (staking capabilities)—we would characterize all these transactions as tactical rather than strategic in scale and impact. However, they all demonstrate the theme in action. We will tackle this topic, particularly strategic versions of this theme, in more detail at a later date.

- Acqui-hires: The majority of young technology companies fail to achieve product-market fit; however, the team is often extraordinarily talented and has proven themselves to be “risk-taking doers.” Acqui-hires are an elegant way to re-engage these talented people, often tackling similar initiatives within a larger organization with the need. These types of transactions are also a preferred method for investors to “wind down” these investments while sometimes being accompanied by a partial return of invested capital. Coinbase | Utopia Labs and Caldera | Hook are perfect examples.

This week was another milestone: M&A transactions announced this year-to-date now exceed last year. This is certainly not headline-worthy; however, let’s celebrate every victory.

Finally, many of our conversations this past week, both externally and internally, were different forms of the same question: Are M&A and financing markets for crypto | digital media | blockchain companies going to get better with new U.S. government leadership and strong asset price appreciation? Sentiment is certainly the most positive since early 2022, prior to our self-induced Crypto Winter. We are certainly hopeful and can point to plenty of evidence that the answer is yes. However, this trend is in a vulnerable, formative stage. Ben Strack at Blockworks asked us the question and published their perspective this week. However, as highlighted in our Q3 2024 Crypto M&A and Financing Report, we have had what turned out to be premature optimism before.

We choose to be pragmatically optimistic!