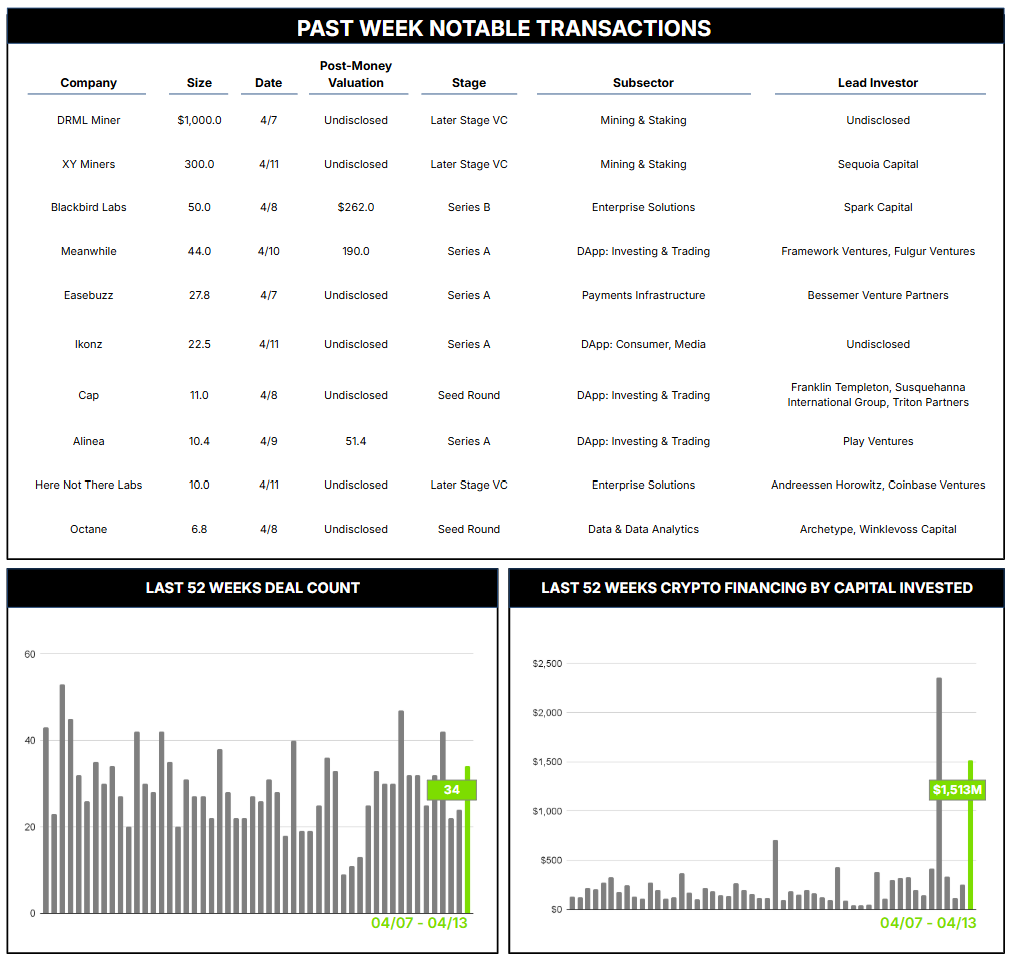

April 07 – April 13

PERSPECTIVES by Todd White

34 Crypto Private Financings Raised: $1,513.4M

Rolling 3-Month-Average: $531.8M

Rolling 52-Week Average: $267.8M

This past week saw two significant capital rounds above $100m, continuing the trend highlighted in our quarterly report marking a return of late-stage VC and growth capital to the sector. While deal count has not regained its 2022 zenith of 44 rounds, the 8 reported growth closings so far this year have already surpassed 2023 by transaction count and aggregate capital raised; they also have surpassed 2024 in aggregate capital raised. In addition, the mean deal size for 2025 is running at $493M, which is well above the peak average size of $287M in 2021.

Both of this week’s top rounds went to mining and digital infrastructure companies, a consistently popular subsector among investors. In the larger of the two, cloud mining infrastructure company DRML Miner closed $1B in later stage VC funding. Cloud-based Bitcoin mining allows individuals to participate in crypto mining by renting computational power from remote data centers, eliminating the need for personal hardware. Users purchase contracts for hash power and receive proportional rewards from mined blocks drawn from a pool of shared mining facilities that handle energy costs, maintenance, and blockchain verification processes. DRML touts its use of clean energy and high-quality equipment to provide a simple, fee-free, and stable way to mine Bitcoin profitably.

XY Miners, a UK-headquartered blockchain and high-performance computing technology company, secured $300M. The company provides a suite of services that includes: digital asset mining, cloud mining services, mining machine hosting leasing and sales, as well as advanced cloud computing solutions, particularly for AI workloads. They manage complex logistics — such as data center design and construction, equipment procurement and management — as well as data centers operations across several countries, including Kazakhstan, Norway, Russia, and the United States.

These sizable capital infusions into both DRML and XY may portend aggressive scaling efforts to capture market share in an increasingly competitive global mining and cloud computing markets.

Contact ryan@architectpartners.com to schedule a meeting.