February 17 – February 23 (Published February 26th)

PERSPECTIVES by Todd White

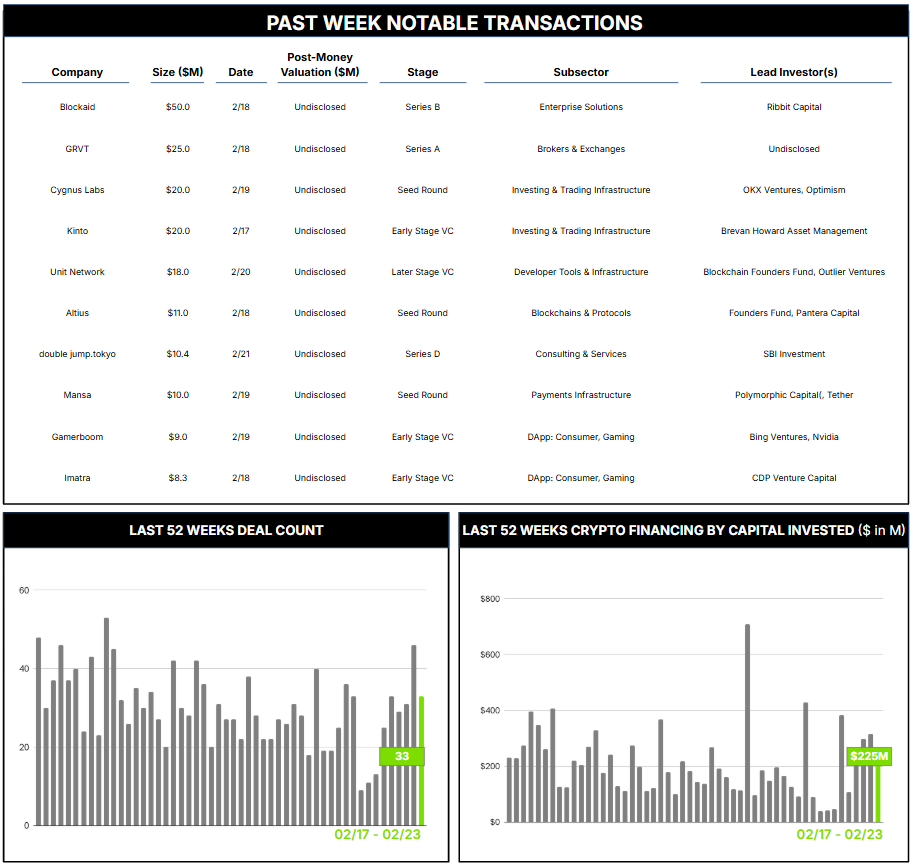

33 Crypto Private Financings Raised: $225.0M

Rolling 3-Month-Average: $192.9M

Rolling 52-Week Average: $209.4M

On February 21, 2025, Bybit, a prominent cryptocurrency exchange based in Dubai, experienced the largest digital heist in crypto history—an approximately $1.5 billion theft of Ether (ETH) from Bybit’s cold wallet during what was supposed to be a routine transfer. The breach, which has been attributed to North Korea’s Lazarus Group, was linked to a vulnerability in SafeWallet rather than Bybit’s own infrastructure, with malicious code injected two days prior. Real-time threat detection and prevention firm Cyvers wrote on their blog about how they detected—and could have prevented—the loss.

While Bybit swiftly replenished its reserves through a combination of emergency loans and significant deposits from partners and whales—enabling the exchange to maintain customer withdrawals and continue operations—the incident had a significant market impact, leading to a drop in Ether’s value. The incident may demonstrate the impressive resilience of a major exchange responding and maintaining operations despite significant losses, but it also spotlights the persistent security challenges in the industry, the sophisticated tactics employed by cybercriminals, and the constant and evolving need for real-time security monitoring and fraud detection.

The crypto security landscape can be broadly divided into two key areas: proactive risk assessment and real-time monitoring for breach and fraud detection. Smart contract audits, formal verification, and bug bounty programs form the foundation of proactive security, designed to identify errors, inefficiencies, and security vulnerabilities. Advanced monitoring tools and analytics provide real-time detection of—and hopefully protection against—breaches and fraud.

Security is mission-critical for our sector to survive and thrive, now more than ever. This is apparent to both strategic and financial investors alike, with some exciting activity on both corporate development and financing fronts. The market-leading forensics team at Chainalysis has demonstrated the former with its recent acquisitions of the fraud detection startup Alterya (covered here) and the Web3 security solutions provider Hexagate (covered here). Examples of the latter include Sardine.ai’s $70M round, which we covered just last week, and a $50M raise locked in for Blockaid this week.

Blockaid is a blockchain security company formed in 2022 to detect and prevent fraud, scams, and other security threats in the crypto and blockchain sectors. Founded by ex-Israeli military intelligence personnel, Blockaid’s platform integrates directly with wallets and decentralized applications to offer both AI-driven threat-prevention tools—scanning transactions and simulating potential outcomes to prevent attacks before they occur—and real-time monitoring, detection, and response solutions. Their approach seems to resonate, as they have quickly developed a client base that includes sector leaders such as Coinbase, MetaMask, Uniswap, Starknet, Safe, and Immutable. The new funding will be used to scale productivity and engineering teams, strengthen go-to-market operations, and expand research capabilities to stay ahead of evolving threats.

The recent activity reflects the increasing demand for robust and responsive security solutions. This is particularly important with financial institutions and fintech companies poised to expand their blockchain initiatives, and effective strategies will likely leverage both proactive auditing and reactive monitoring, coupled with immediate incident response and remediation. We’ve seen this play out recently with Bybit’s management of the Lazarus breach and a flurry of M&A and financing transactions. But the space is sure to evolve and accelerate, with ample room for numerous players and persistent innovation.

Contact ryan@architectpartners.com to schedule a meeting.