January 13 – January 19 (Published January 22nd)

PERSPECTIVES by Todd White

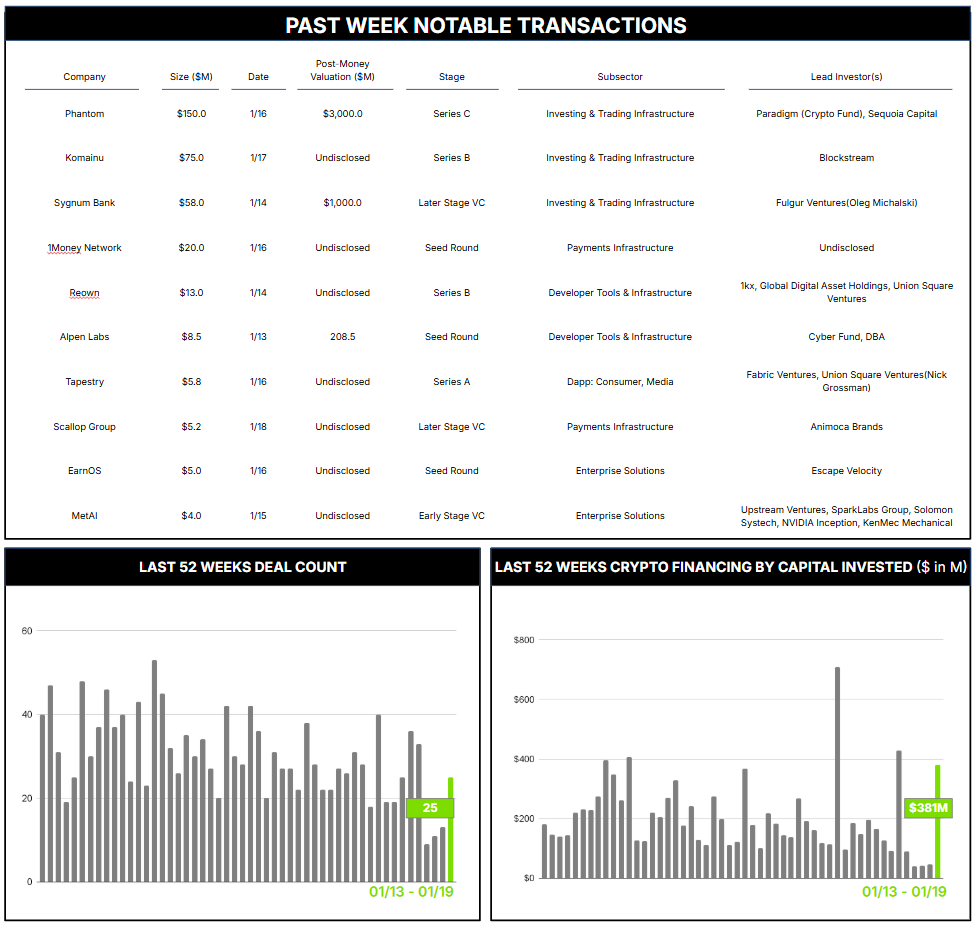

25 Crypto Private Financings Raised: $380.7M

Rolling 3-Month-Average: $161.3M

Rolling 52-Week Average: $202.3M

The crypto and digital asset industry market has faced persistent challenges in accessing global banking services. Traditional banks were initially highly skeptical of all things crypto, viewing them as risky and potentially facilitating illegal activities. This led to widespread reluctance in the provision of banking services to crypto-related businesses, exacerbated by the lack of clear regulations and concerns about compliance and AML/KYC, particularly in the US. Then, aggressive US regulatory actions, known as Operation Choke Point 2.0 — where many businesses in the US crypto industry have been systematically denied banking services — precipitated the high-profile closures of crypto-friendly banks such as Silvergate, Silicon Valley Bank, and Signature Bank in 2023.

These events seem to have reinforced the initial reluctance, with increased scrutiny and hesitancy across the banking sector to provide services to crypto firms. Yet the market has now survived the “great purge,” and current opportunities for those willing to tackle them seem myriad and compelling — for both banks and the investors who back them. A definitive movement is starting to take place.

Sygnum, a Swiss-based global digital asset banking group, has been working hard to fill the void and closed a $58 million strategic growth round this week at a post-money valuation of over US $1B. With banking licenses in Switzerland and Singapore and regulatory approvals in Abu Dhabi, Luxembourg, and Liechtenstein, Sygnum has established a broad platform for its offerings, which include institutional-grade security, regulated digital asset banking, asset management, tokenization, and B2B services such as a recently launched 24/7 multi-asset settlement network known as SygnumConnect. They now claim $5 billion in assets from 2,000+ clients across more than 70 countries.

Fulgar Ventures, a venture capital firm focusing on Bitcoin technologies, served as a cornerstone investor to close the round. Focused on infrastructure and applications that drive Bitcoin adoption, Fulgar has been active, including:

- Leading infrastructure company Blockstream’s $210m raise last October (and last week investing $75m in Komainu, a regulated digital asset services provider and custodian, backed by Laser Digital, a Nomura company).

- Leading marketplace firm STOKR’s $8m growth round the same month.

- Participating in Elysium’s March ’24 bridge as well as Amboss’ seed round in 2023.

The dynamic investor has positioned itself across the Bitcoin ecosystem, and its latest support of Sygnum may help broaden the foundational infrastructure that Bitcoin and crypto more generally need to thrive.

It is not without irony that a technology often touted for its ability to “bank the unbanked” has itself been… well… substantially unbanked. But bold moves to build secure, regulated solutions backed by investors with the belief, appetite, and available capital to support them may help change that. And with apparently dramatic shifts in regulatory winds, there is hope such moves may prove to be prescient and profitable.

Contact ryan@architectpartners.com to schedule a meeting.