January 20th – January 26th

PERSPECTIVES by Eric F. Risley

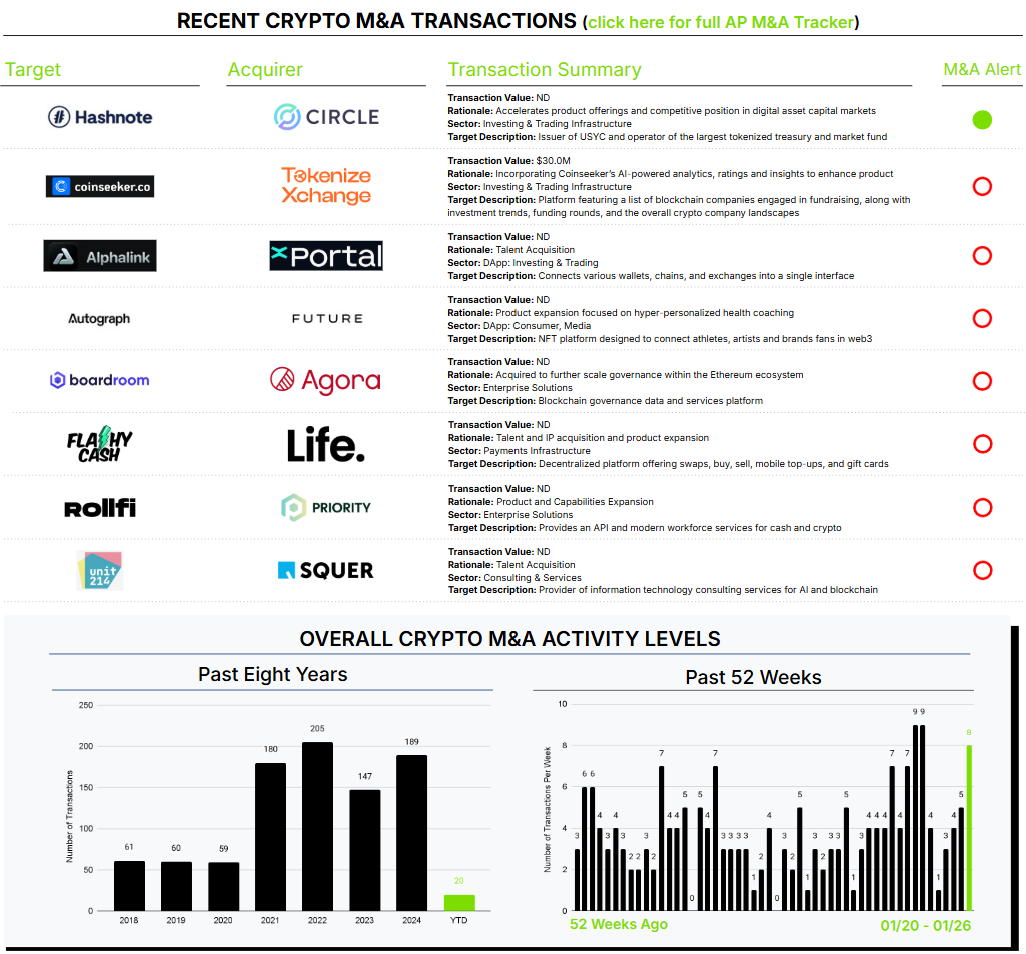

Circle announces its first acquisition in two and a half years, acquiring Hashnote, the issuer of the tokenized money market fund, USYC.

This acquisitions sits on the bleeding edge of many very interesting topics, in fact far too many to tackle in this note directly. However, topics that come to mind include:

Does this suggest that paying yield (financial return) to holders must be in the form of a traditional security like a 40 Act money market fund?

Inversely, does this suggest stablecoins, in their current form, will be restricted from offering holders a portion of the yield (financial return) earned from investment in short-term treasuries?

Do these statement above imply that a two tier stablecoin market emerges. One being for “money in movement” (no yield) and one being for “money at rest” (earns yield)?

Does this further blur the distinction between traditional financing and crypto asset-based finance? Do they co-exist separate or just become one?

Is this the beginning of crypto businesses embracing traditional finance in recognition of necessity?

Does this spur those with the deepest and longest institutional investor relationships, traditional financial services institutions, to issue their own “money in movement” stablecoin as defense against their $2T+ payment businesses?

My partner, Todd White, offers a bit of perspective on the acquisition of Hashnote by Circle in our M&A Alert.

Let the Games begin.