January 20 – January 26 (Published January 28th)

PERSPECTIVES by Todd White

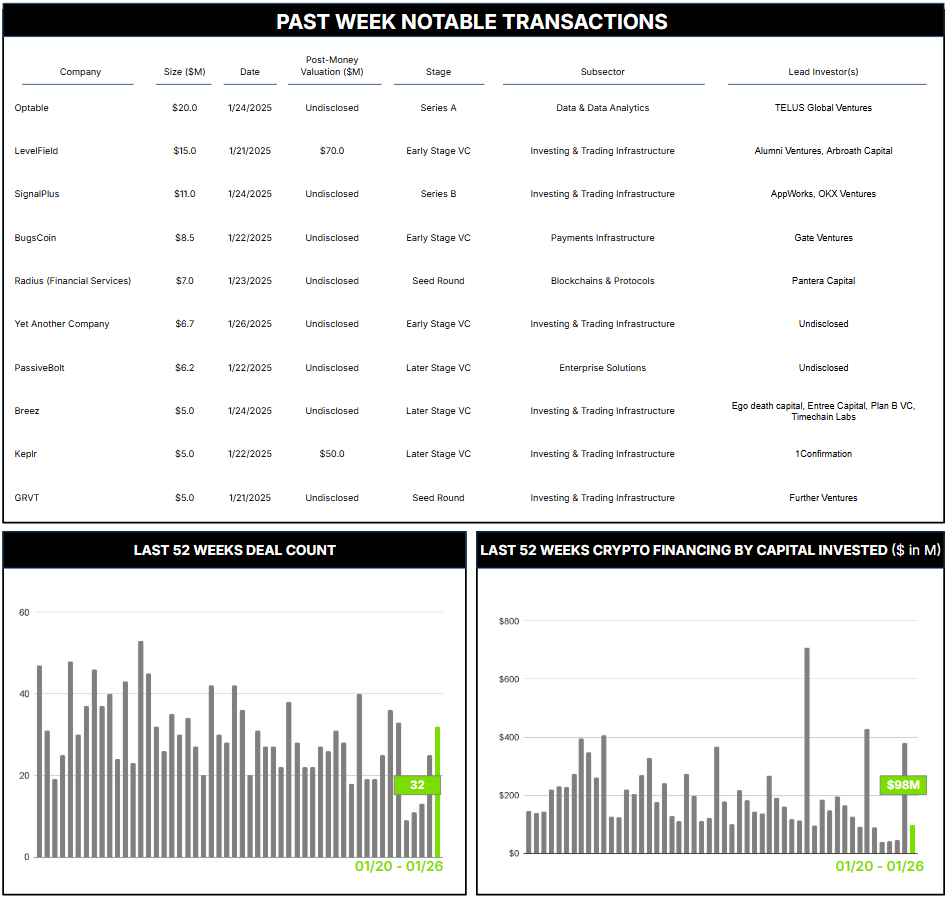

32 Crypto Private Financings Raised: $98.2M

Rolling 3-Month-Average: $154.2M

Rolling 52-Week Average: $200.7M

The crypto derivatives market has experienced significant growth in recent years, with trading volumes having long surpassed the spot market. According to CCData, the Chicago Mercantile Exchange’s derivatives trading volume alone reached a record $264 billion this past December. In many ways, this makes sense, as the inherent and well-known volatility creates opportunities for derivatives traders to execute trades, as well as significant demand for hedging.

Several factors contribute to this trend, including increased institutional participation in the crypto markets, the ability to use derivatives for leverage and capital efficiency by allowing traders to amplify their exposure to price swings with smaller capital outlays, and risk management and hedging opportunities afforded by derivatives (e.g., using forward contracts to manage downside price volatility).

The market is led by some of the biggest names in crypto, such as Binance, GME Group, OKX, and Bybit. Yet there remain opportunities for smaller players to bring solutions to the market. One such example: Singapore-based SignalPlus closed a $11 million Series B this week, led by AppWorks and OKX Ventures, with participation from Avenir Group and HashKey. SignalPlus develops digital asset trading software and infrastructure products that have been implemented across some of the largest exchanges—including Binance, Bybit, Deribit, OKX, and Paradigm—and plans to use their new capital to expand both product offerings and marketing reach.

As regulatory clarity starts to take shape, and institutional adoption of crypto assets seems poised to expand, the need for sophisticated trading and market making activities should also grow. Teams that invested the time, energy, and capital during the market downturn to build institutional-grade tools to execute high-touch trading and volatility hedging should now be well poised for this growth.

Contact ryan@architectpartners.com to schedule a meeting.