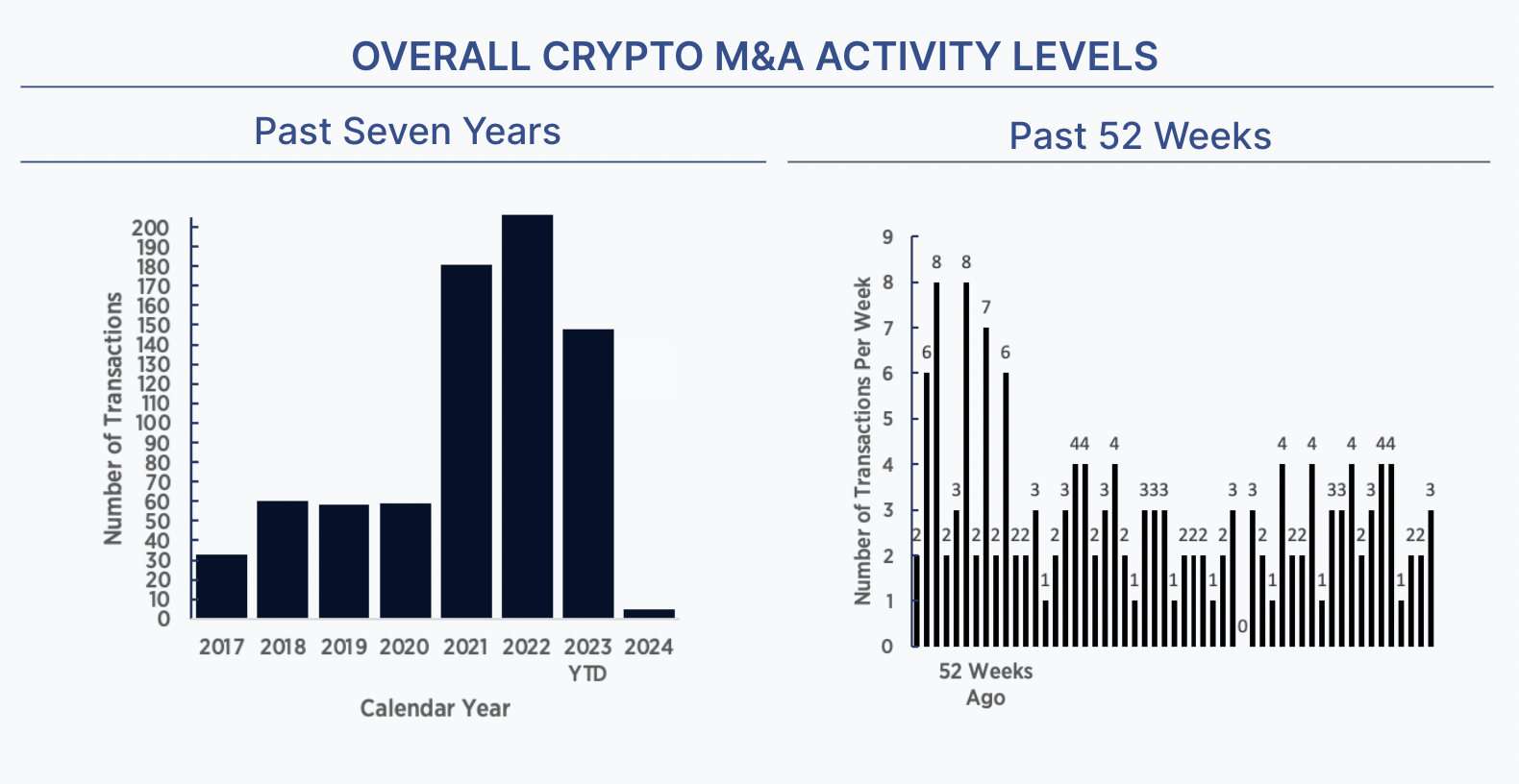

Last week we published our Year-End 2023 Crypto M&A and Financings Report which highlighted the activity of the past year, in detail and led by data, and took a look towards what is next. You can download the full report here.

The biggest news in crypto so far this young year is the approval last Wednesday by the U.S. Securities and Exchange Commission of eleven spot-bitcoin ETFs, allowing investors to buy and sell bitcoin as easily as stocks and mutual funds. Crypto pundits overwhelmingly viewed this as a watershed moment in making crypto more accessible and more broadly held. Bitcoin has since fallen 15% in value – go figure.

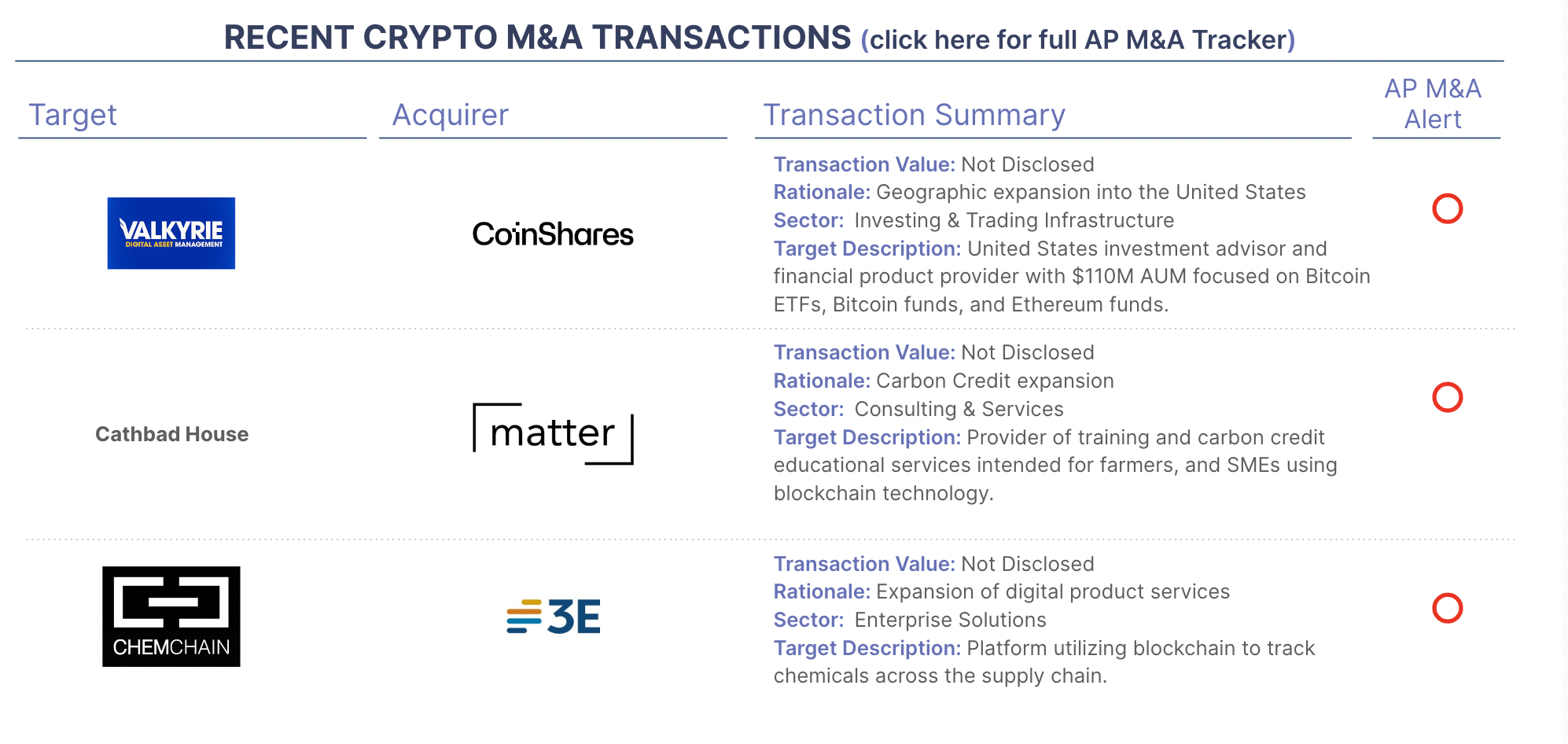

Related to the above news, CoinShares exercised an option to acquire Valkyrie Funds, one of the eleven groups approved to offer a spot bitcoin ETF last week. CoinShares, headquartered in Jersey, is a leader in European digital asset management, claiming over 40 percent of all assets under management in crypto ETPs. CoinShares launched several ETPs in Europe in the past two years and plans to use Valkyrie, one of the smaller fund groups launching ETFs last week, as an entry point to the U.S. market.

In other market news, carbon credit marketplace Matter Now, Inc. announced it had acquired Cathbad House, a carbon credit education and technology developer. Matter Now allows users to list, sell and trade carbon credits, one of many carbon marketplaces powered by blockchain technology. We are a fan of efficient markets for carbon, but the challenge to date has been more around the quality (and reality) of voluntary credits, not a lack of marketplaces. Matter Now appears quite small – it has only a few projects listed on its rudimentary website.

One bridge acquisition was announced this week – product safety, compliance and supply chain solution provider 3E acquired ChemChain, a Luxembourg-based developer of blockchain tracking technology for supply chain management. 3E, headquartered in Carlsbad CA, serves more than 5,000 customers worldwide, including many of the world’s leading chemical manufacturers, retailers and pharmaceutical companies. Verisk spun out 3E to New Mountain Capital in 2022 for up to $950M.