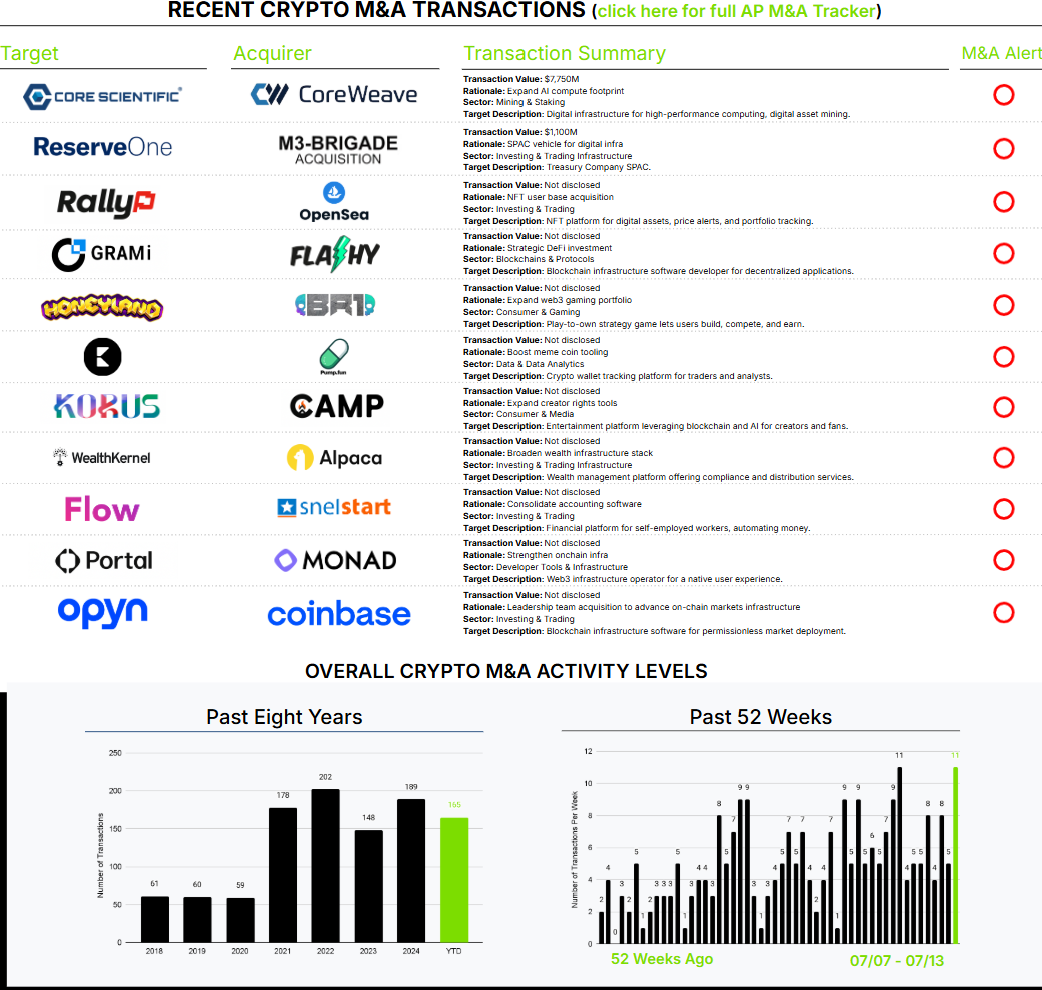

July 7th – July 13th

PERSPECTIVES by Eric F. Risley

Context, and therefore insight, is often lost when using a microscope. Our weekly reports suffer from this challenge by virtue of the micro‑scale time frame. Let’s step back and consider year‑to‑date 2025 to better understand the current crypto M&A markets.

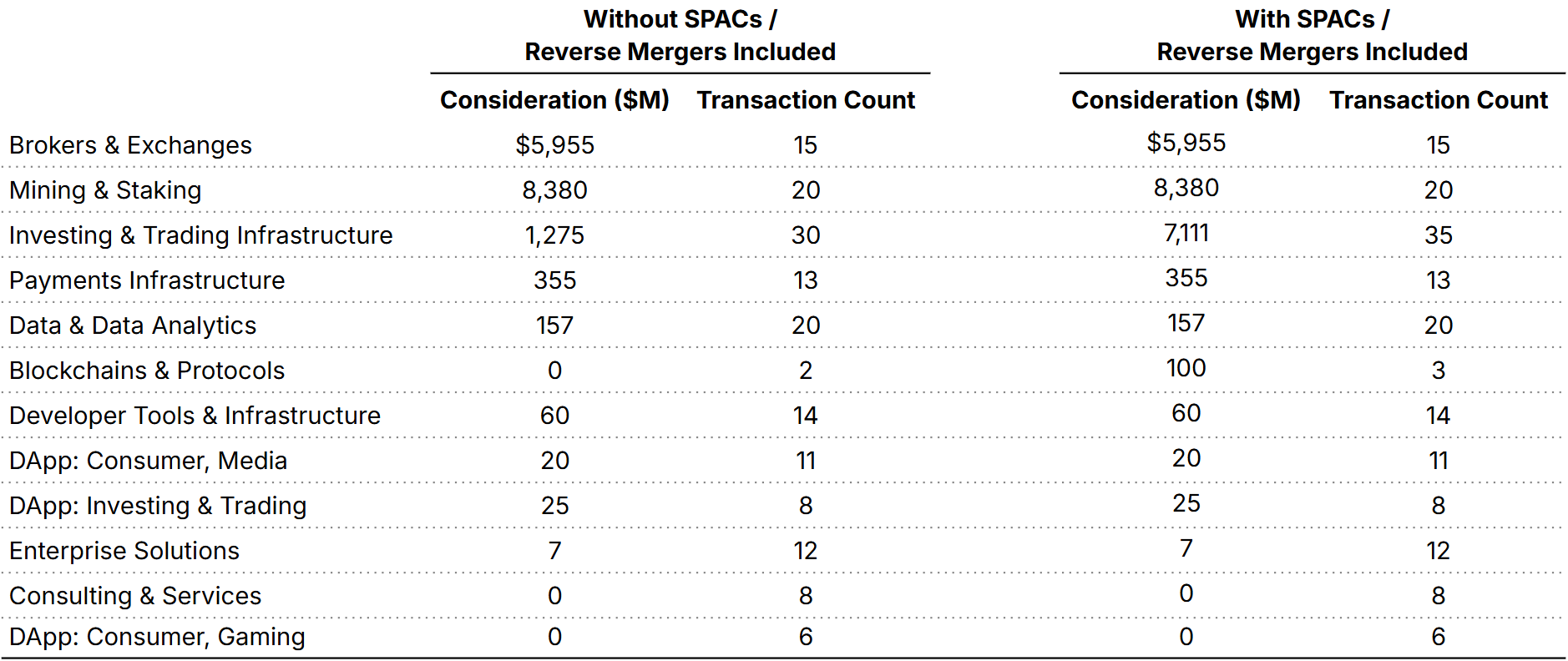

As we highlighted in our Q2 Crypto M&A and Financing Snapshot, published last Tuesday, the crypto M&A market is hitting its stride, and records have been falling each quarter. However, activity, and particularly the consideration paid, is not evenly distributed across the sub‑sectors we track. In fact, it is extremely biased, as shown in the chart below.

The Brokers and Exchanges sub‑sector is generally the strongest when considering both consideration paid and activity levels. This is not surprising, as it is by far the most mature segment within crypto and generally where the largest businesses have been built.

Blockchain Network Operators, primarily Bitcoin miners, fall into the second category. Last week’s Core Scientific | CoreWeave transaction does skew total consideration above Brokers and Exchanges; however, that deal is an anomaly, given both companies’ strategic shift to high‑performance computing (HPC) from Bitcoin mining. AI workloads are driving tremendous demand for data‑center capacity and raise the question, “What is the highest and best use of a data center?” Right now, HPC is winning.

Lastly, the Crypto Treasury Strategy phenomenon has affected our Investing and Trading Infrastructure sub‑sector. These companies are fundamentally capital aggregators, better known as asset managers. The trend has appeared in M&A through reverse mergers into public entities and de‑SPACs. Why? Because having a publicly traded equity is central to the treasury‑strategy model: equity valuations often trade at large multiples of the value of assets under management, commonly referred to as net asset value (NAV), an anomaly relative to how asset managers are usually valued in equity markets. Time will tell how persistent this premium to NAV becomes.