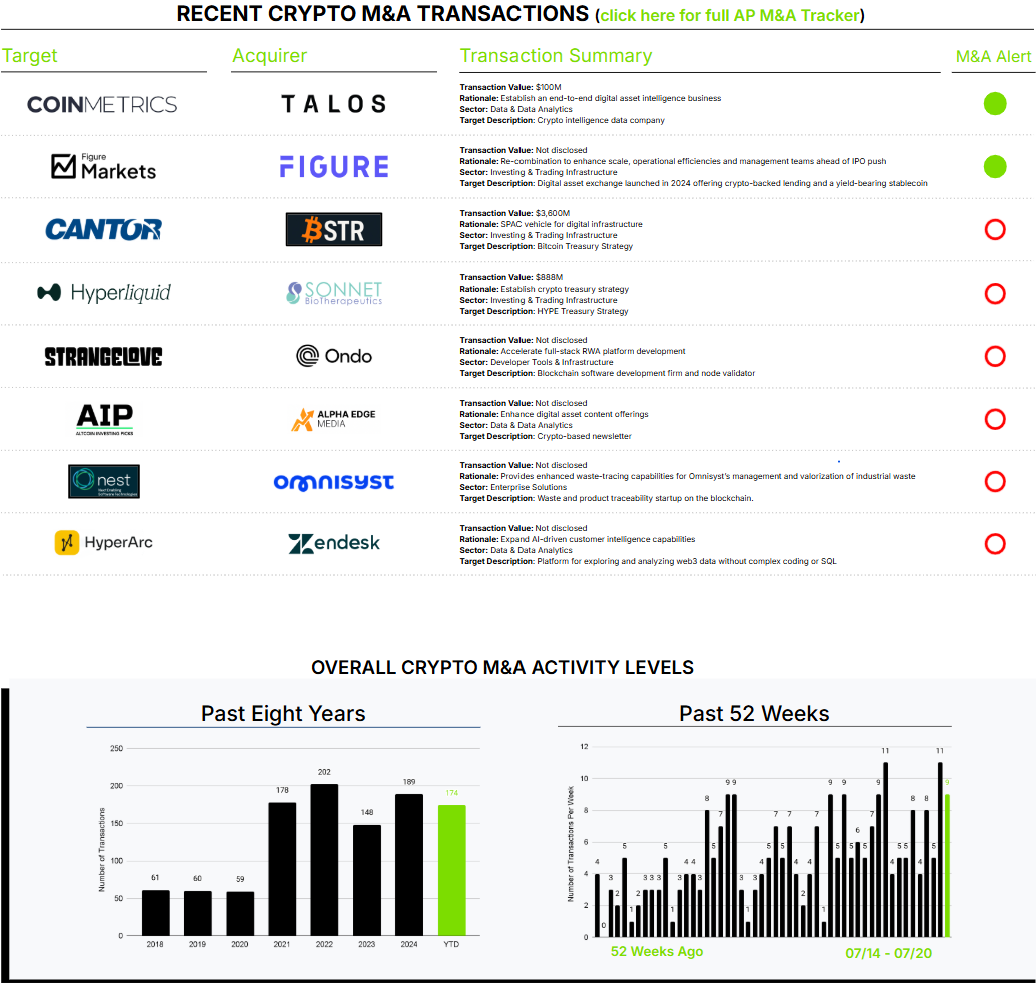

Another very active week for crypto M&A.

The headline announced transaction was another Bitcoin treasury strategy transaction, now over $91 billion by our count. In this case, an Adam Back and Cantor Fitzgerald–controlled entity is merging with another Cantor Fitzgerald–controlled special purpose acquisition corporation (SPAC) in a $3.6B transaction.

Separately, the extension of the treasury strategy continues to expand to other tokens. Architect Partners has identified over 30 companies whose token accumulation strategy includes tokens other than Bitcoin or Ethereum. This week the Layer 1 blockchain, Hyperliquid, with an unfortunately named token, HYPE, was the center of attention. The other curious trend is that cash-flush companies without viable businesses are active participants in this phenomenon, in this case Sonnet BioTherapeutics, in a transaction valued at the “lucky number” of $888M.

Now back to real, substantive, operating strategy–driven M&A, two notable transactions this week, Figure’s re-merger of previously spun out Figure Markets and the acquisition of Coin Metrics by Talos.

Figure Technologies has built one of the most impressive “real world” blockchain-based businesses by offering and powering the infrastructure for tokenized second mortgages. As highlighted in our M&A Alert (here), Figure has funded over $16B of HELOCs, making them the largest non-bank originator in the US. Stablecoins are getting the attention, rightly so, however, Figure is demonstrating the value proposition of tokenized instruments, at scale, in the real world.

Lastly, smart order routing specialist, Talos, announced the acquisition of data supplier Coin Metrics in a great example of “vertical consolidation”. As highlighted in our M&A Alert (here), strategically, at its simplest level, Coin Metrics supplies Talos with real-time pricing data across multiple execution venues. This data feeds Talos’s smart order routing algorithms, allowing it to offer best execution services to institutional investor clients.