Coinbase is carrying the entire crypto sector on its back while playing chess.

Count the ways:

- Transparency: Their quarterly shareholder letters are the gold (Bitcoin?) standard in clarity and disclosure, regardless of industry.

- Embracing Regulation: From founding has worked to find the path that embraces the recognition that “fair and balanced” regulation and guideposts are good for the industry.

- Leading These Regulatory Efforts: Coinbase has invested $100s of millions to lead and build a policy initiative seeking this regulatory clarity across the globe. Undoubtedly Coinbase has by far the largest people and capital investment driving this industry critical initiative.

- Beyond Speculation: Coinbase, a business built to trade crypto assets, recognizes that asset value speculation is simply the path to something much more important. Brian Armstrong often calls it “driving crypto utility”. Perhaps a simple way to say it is “do something useful for normal people”. Base, USDC in partnership with Circle, Smart Wallet and embracing third party developers to build non-speculation-based applications are part of their “beyond speculation” strategy.

- The Strategy of Simple: No normal human cares about the fancy blockchains, algorithms, cryptography, tokens, bridges, seed phrases, identity verification, bridges, transaction throughput, gas fees, mining and staking, KYC/AML, … Normal people simply want to “do something useful”, safely and easily.

- The Real Prize High in Mind: Coinbase is one of very few that are focused on the billions that can benefit from the “do something useful” vs. the perhaps million (less than one million?) people globally that drive 90% of crypto value speculation and resulting fees from this speculation. The big picture matters most.

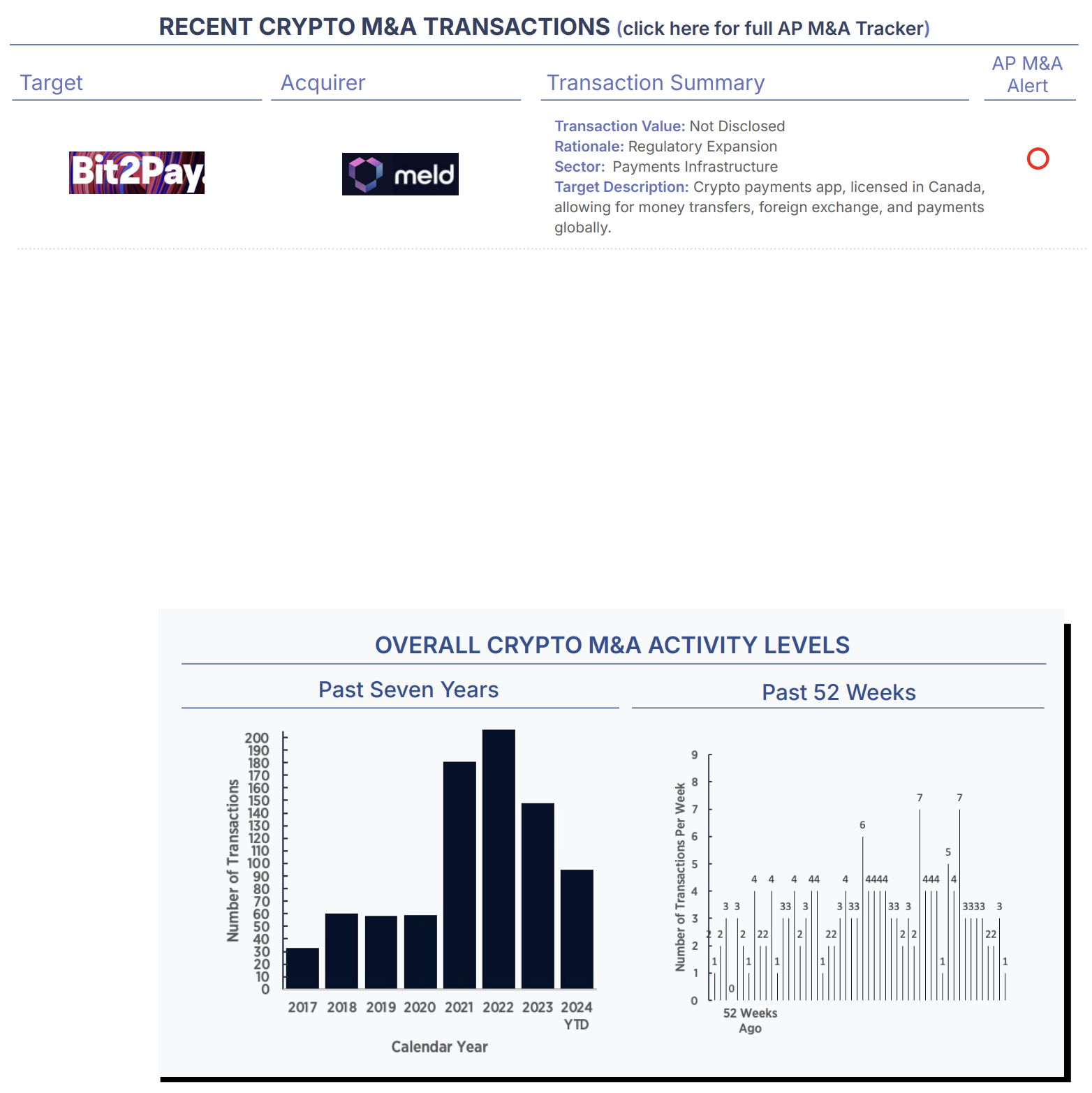

These thoughts follow Coinbase’s Q2 2024 earning announcement this past week where all the above was apparent. Also, this week a small M&A transaction was announced between two companies embracing crypto based payments. As highlighted last week, transferring money between people or paying for goods and services supports a multi-trillion dollar global banking system. What happens if a payment can be made simply, with confidence and safety and instantly without the complexity of the current banking system? Payments are a great example of “do something useful”, one of many. Easy to say, hard to do, however, the prize is massive.