June 2nd – June 8th

PERSPECTIVES by Eric F. Risley

This past week demonstrated the “builders keep building” truism despite the deep shade cast by Circle’s IPO debut.

Let’s be honest: the user experience for most crypto/Web3 applications sucks. Part of this challenge stems from the core crypto philosophy of “self-custody” or “self-sovereignty.” Corresponding phrases like “my keys, my coins” and words like “trustless” have deep ramifications. Both demand uncompromising responsibility from the user for safekeeping. As nicely articulated by Kain Warwick, founder of Infinex, “the industry wasted years trying to educate users about why seed phrases were important to ‘chisel into a stone and bury in your backyard,’ but it didn’t work.”

Retreat from these core philosophies isn’t the answer, but improvement is clearly necessary to attract the oft-repeated Next Billion Users. Imagine processing the five stages of grief experienced by the holders of between 2.3 million and 3.7 million bitcoins (worth $2.4-$3.9 billion today) that are permanently lost.

Joe Lubin and Consensys have a clear, admirable, and consistent vision: helping developers build great Web3 applications. This vision and the company behind it are without peer today and are crucial to crypto’s future. As is very well articulated in plain English on their website:

“Our applications, tools, and infrastructure make Web3 easy to use and build on. But the future won’t be made by us: it will be made by you, and a growing global community. Great things are being made, and this is just the beginning.”

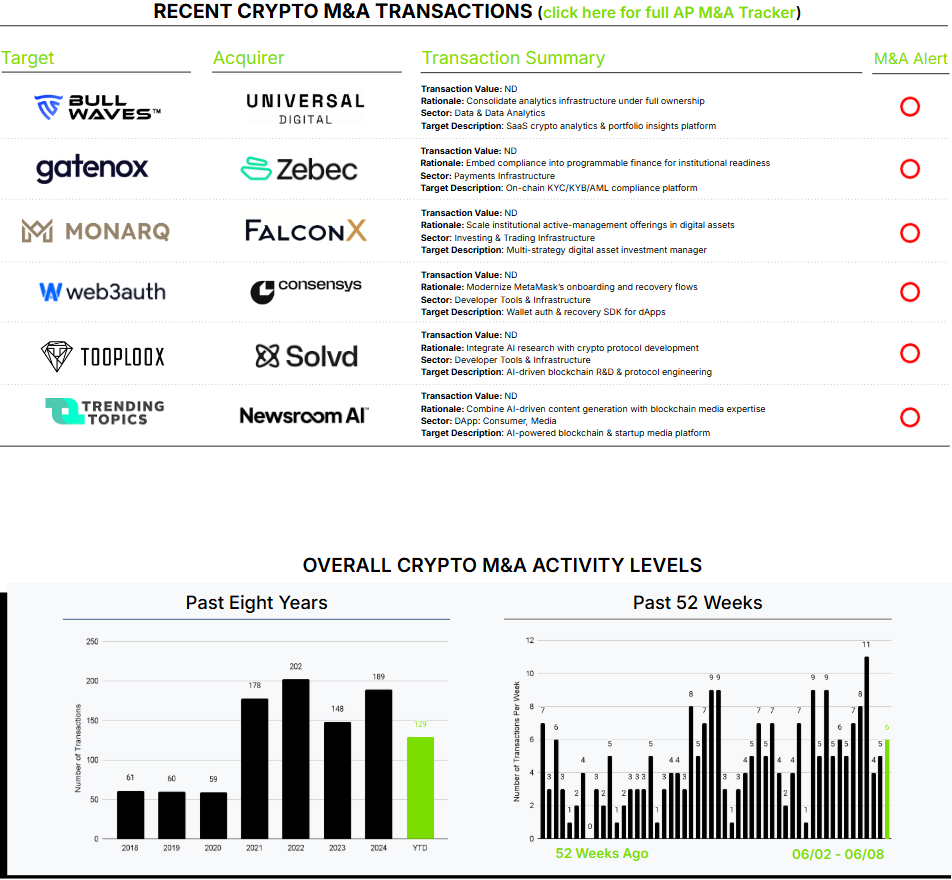

This week Consensys announced the acquisition of Web3Auth with the intention of addressing one of the biggest risks in self-custody today: seed-phrase management. Usually, press releases and blog posts are overly technical and lingo-heavy, but not so with Consensys:

“Recent data shows that 35% of users do not back up their seed phrases, putting them at risk of fund loss. By integrating Web3Auth’s capabilities, MetaMask users will be able to create and recover wallets using familiar web2 authentication methods, such as social logins and device-based authentication, eliminating the requirement for users to manually back up seed phrases, reducing the likelihood of lost funds.”

Thank you, Consensys, for modeling clarity, purpose, and conviction for all of us to emulate.