June 02 – June 08 (Published June 11th)

PERSPECTIVES by Todd White

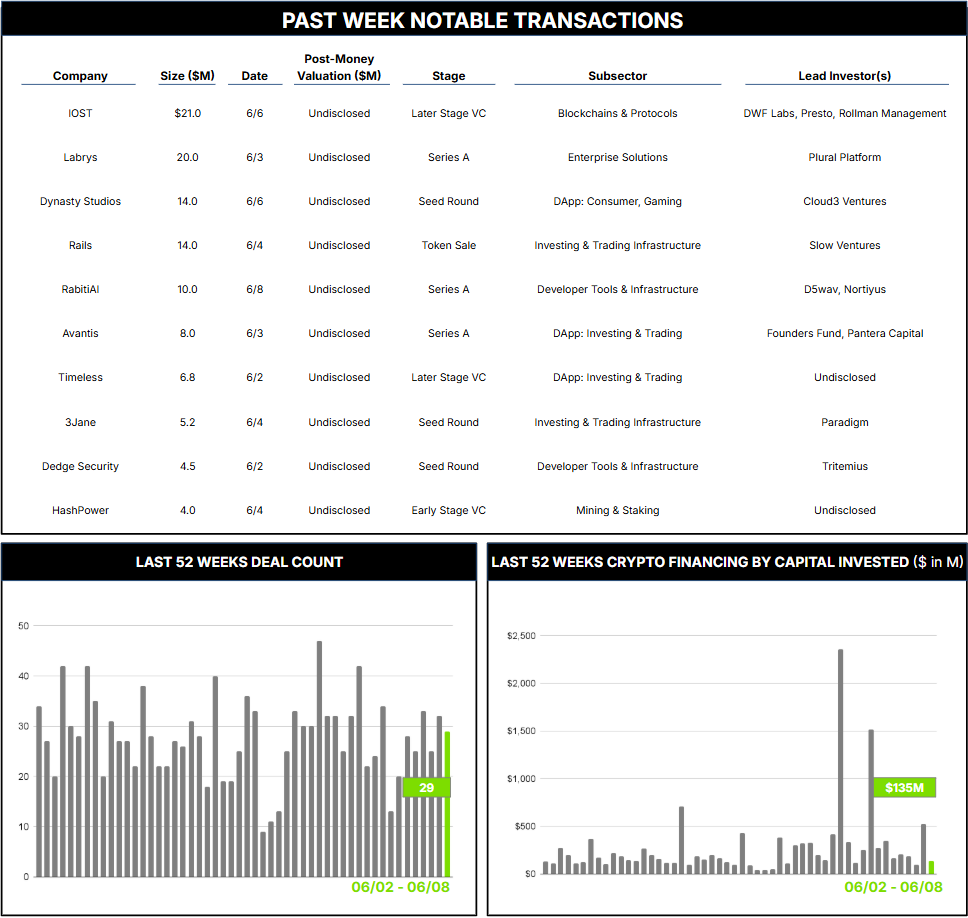

29 Crypto Private Financings Raised: $135.4M

Rolling 3-Month-Average: $345.4M

Rolling 52-Week Average: $272.5M

We’ve been thinking a lot about payments recently. As highlighted in our latest Architect Insights research on Crypto Payments & Infrastructure: The Strategic Opportunity (link to Part I and Part II), the legacy payment infrastructure suffers from fragmented standards, entrenched participants, and substantial complexity. Blockchain-enabled solutions are poised to solve these issues, and while there is still far to go, adoption is gaining momentum. We remain convinced that the promise of crypto payments will inevitably be realized, but it will take time and further innovation to do so.

One area that seems particularly ripe is the management and payment of a globally distributed workforce. The space has evolved significantly over time, driven by numerous technological advancements and shifting workplace dynamics. The early days of telecommuting in the ’70s and ’80s were hampered by slow connectivity and very limited tools for scalability. While technological advancements such as broadband connections, cloud computing, real-time communications, and SaaS tools for collaboration and project management certainly helped, remote work largely remained a niche phenomenon concentrated in tech and consulting roles. This of course changed dramatically during COVID, with remote working becoming the norm and many employers now embracing remote work, expanding international workforces, and leveraging freelancers and remote hubs. Yet technical pain points abound, including asynchronous communication across time zones, inconsistent or outdated hardware and software solutions, and fragmented system integration, accompanied by nearly ubiquitous cybersecurity risks. Logistical challenges are also pervasive for organizations that must navigate different cultural styles, multiple languages, and legal compliance with local tax and labor laws. Finally, the ability to efficiently and compliantly pay remote workers is paramount.

Labrys.tech is a London-based company building infrastructure to manage globally distributed teams. Its flagship product, the Axiom platform, is an enterprise management platform that integrates onboarding, compliance, geospatial tracking, and encrypted communications for managing distributed teams in real time. Axiom combines stablecoin payments and blockchain verification with other technologies such as biometrics, geotagging, device verification, and AI-enabled translation that supports 249 languages to address the unique challenges faced by globally dispersed teams in sectors such as humanitarian aid, defense, crisis response, and logistics. Payments made through the platform are fully auditable and programmable, reducing compliance risks and the need for intermediaries, and ensuring the transparency and control over funds crucial for operations in sensitive or regulated environments, or even in sanctioned regions where conventional financial systems are inaccessible or untrusted. The use of blockchain also combines tamper-proof identity verification with an immutable ledger for secure and verifiable records of task completion, payments, and communications.

The company secured $20 million in Series A funding on June 3, led by Plural Platform with participation from AlbionVC, Project A Ventures, and others. Labrys’ combination of advanced verification, real-time coordination, and blockchain-powered payments in a single, secure platform could present a core use case that helps propel digital payments into broader adoption.

Contact ryan@architectpartners.com to schedule a meeting