July 07 – July 13 (Published July 16th)

PERSPECTIVES by Todd White

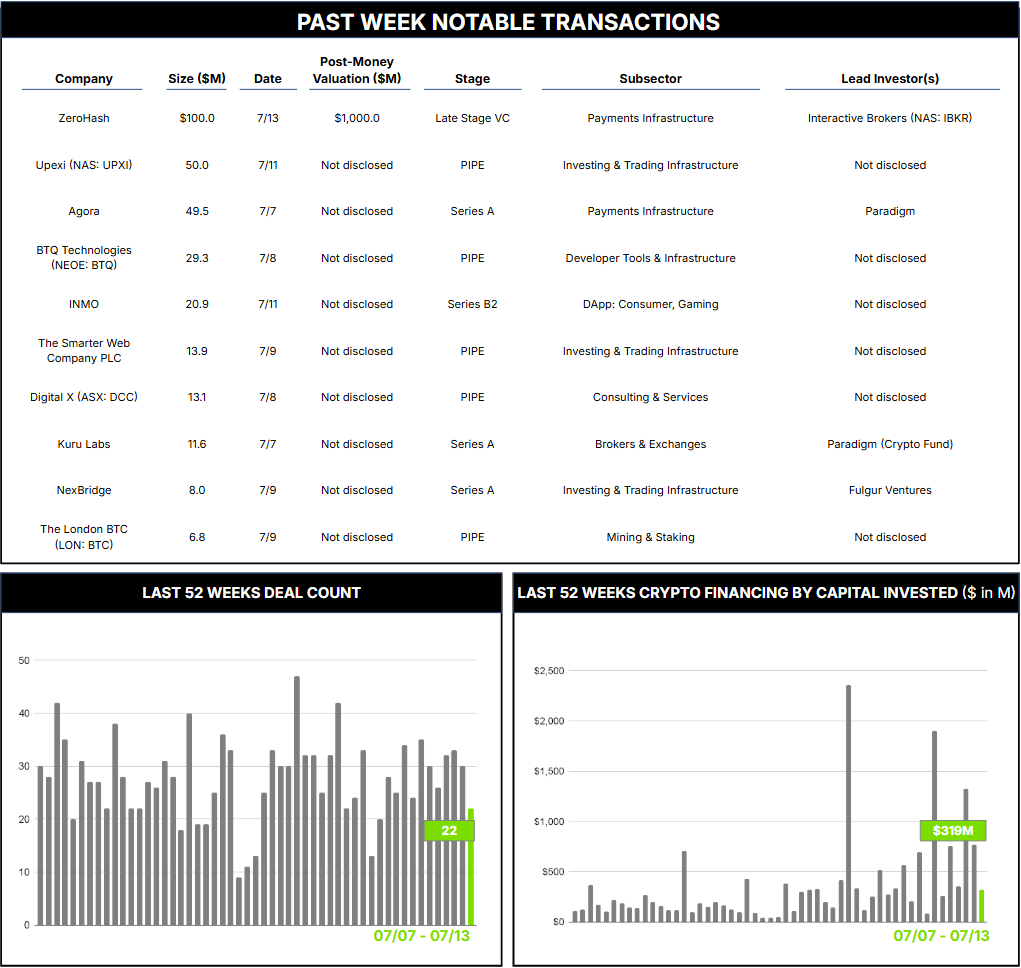

22 Crypto Private Financings Raised: $318.5M

Rolling 3-Month-Average: $601.3M

Rolling 52-Week Average: $346.1M

Private investment in the crypto and blockchain sector continues to focus on core digital‑asset infrastructure, with stablecoins and digital payments emerging as some of the fastest‑growing segments. Stablecoins such as USDT, USDC, and DAI have seen explosive growth in both market capitalisation and daily trading volumes, bolstered by prospects for regulatory clarity (though potentially dimming at the time of this writing), demand for liquidity and a safe haven within digital assets, and trends in DeFi, lending, and payments infrastructure. Beyond stablecoins, core digital infrastructure, including custody, compliance/AML, cross‑chain interoperability, and payment rails, remains in demand.

ZeroHash appears well positioned at this crossroads. Founded in 2017 as a crypto and stablecoin infrastructure provider, it offers back‑end solutions that enable banks, brokerages, and fintech companies to provide cryptocurrency, stablecoin, and tokenised‑asset services to their clients. Through compliance‑ready APIs for custody, settlement, liquidity, and regulatory infrastructure, ZeroHash seeks to bridge traditional finance and the digital‑asset ecosystem, allowing customers to integrate digital assets into their offerings without managing complex technical or regulatory responsibilities. Partnerships announced in 2024 with major industry players such as Stripe and Securitize underscore ZeroHash’s fit in this role.

ZeroHash raised USD 100 million this week in a funding round led by Interactive Brokers (IBKR) that values the company at nearly USD 1 billion. IBKR, one of the world’s largest electronic brokerages, offers a wide range of asset classes on a single unified platform. It began offering crypto to investors in 2021 and now collaborates with both ZeroHash and Paxos Exchange for crypto functionality within IBKR’s existing transparent commission structure.

This week’s sizable round and valuation reflect growing interest in stablecoin and crypto‑infrastructure among established financial institutions, as traditional market players increasingly embrace the asset class and seek solutions to integrate it within their offerings. For IBKR, an early mover in the crypto sphere, the investment should deepen its crypto and stablecoin services, allowing it to leverage ZeroHash’s expertise and licences to scale without assuming direct blockchain or regulatory overhead. It may also fortify IBKR’s ability to compete with brokers such as Fidelity, Robinhood, and Charles Schwab as demand for integrated crypto services is expected to increase.