June 9th – June 15th

PERSPECTIVES by Eric F. Risley

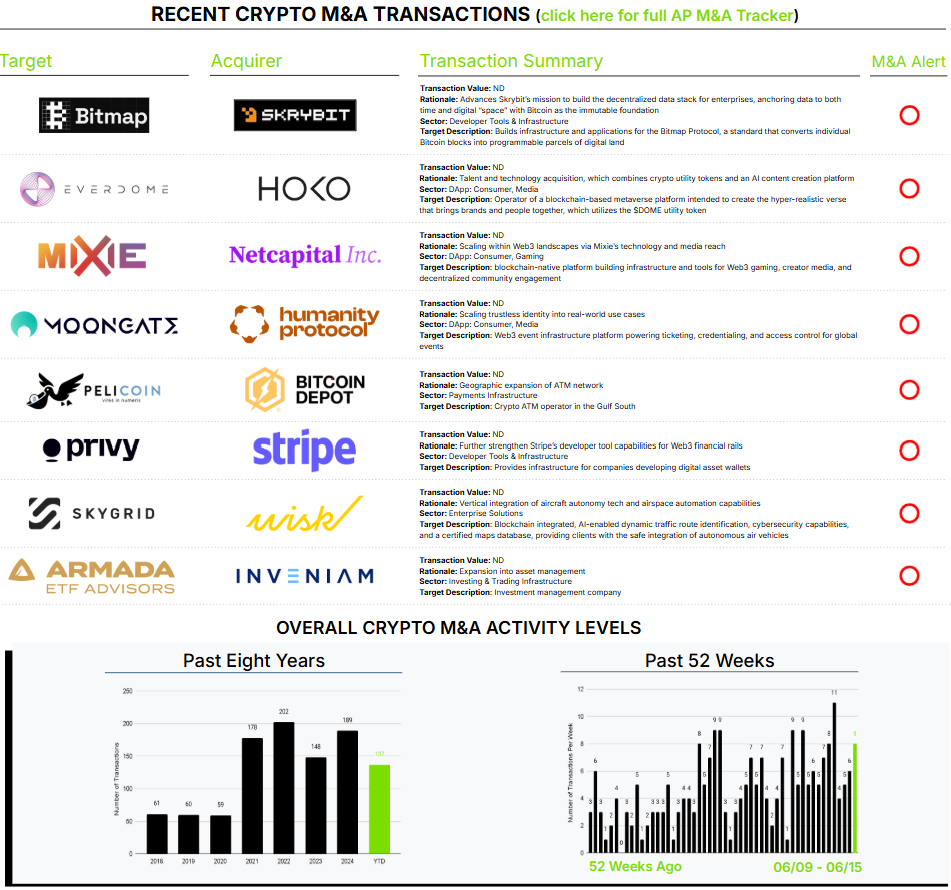

Spotlight: Stripe Acquires Privy – Accelerating Crypto’s Integration into Mainstream Applications

Simplicity, an essential theme in crypto, was on display this week.

“When we started in 2021, wallets were powerful but inaccessible to all but power users. Developers had to send users off-platform to get started, breaking flows and killing conversion. That friction fundamentally constrained what could be built in crypto.”

– Henri Stern, Co-Founder & CEO, Privy

This week, Stripe announced the acquisition of Privy. Privy offers a simple API that allows both Web3 and traditional Web2 app developers to securely create crypto wallets, sign transactions, and integrate with any onchain system. The result is that users can create and use crypto wallets within familiar apps, without navigating external services or complex security steps. This “invisible” approach is essential for mainstream adoption, as it makes using crypto as intuitive as any digital service.

The approach has gained market validation, with Privy now powering over 75 million accounts and supporting billions in transaction volume for clients. While the acquisition consideration was not disclosed, Privy’s June 2025 equity financing, which valued the company at $230 million, suggests the acquisition valuation was above that level.

Why is abstracting away the complexity of crypto important? It’s simply too complicated for most users, as highlighted last week and evident in the acquisition of Web3Auth by Consensys. Additionally, the number of users of traditional Web2 applications (including e-commerce, gaming, social, and finance platforms) vastly outnumber those of native Web3 or crypto apps. For crypto to achieve true scale, its capabilities must be seamlessly integrated into the platforms where users already spend their time.

This transaction is yet another example of bridging traditional and crypto finance, or what we call “bridge transactions.” This will continue.