June 09 – June 15 (Published June 18th)

PERSPECTIVES by Todd White

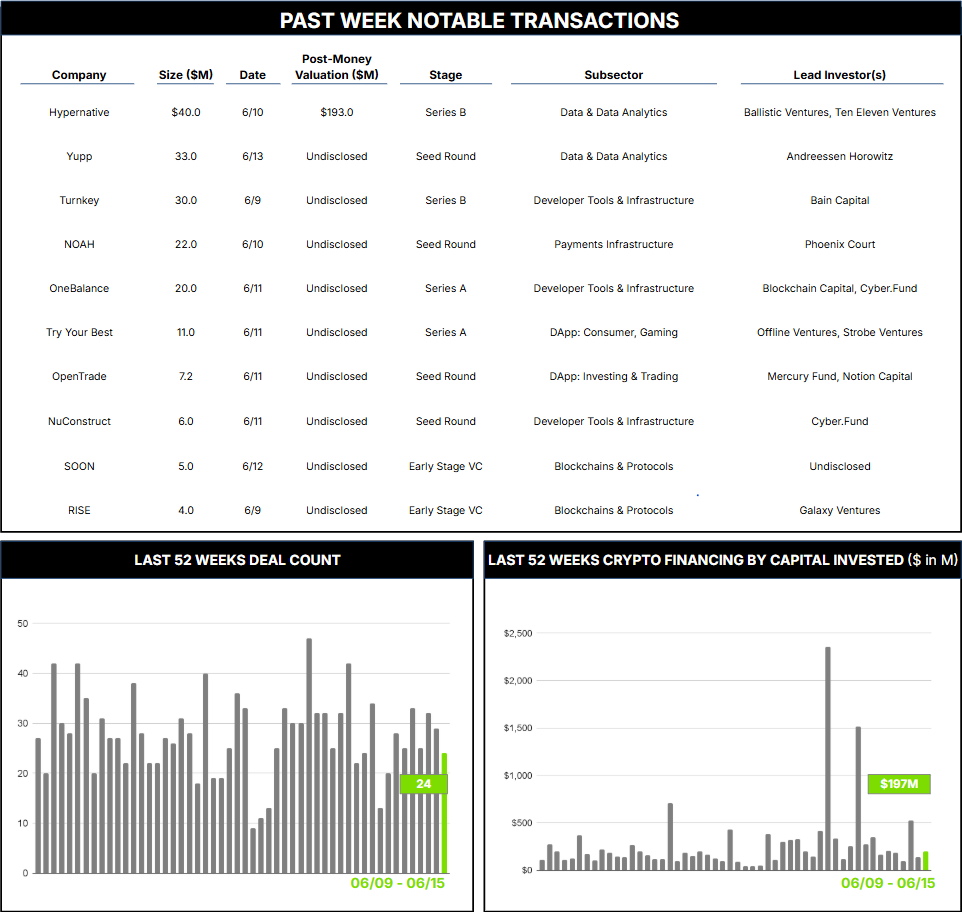

24 Crypto Private Financings Raised: $196.9M

Rolling 3-Month-Average: $333.8M

Rolling 52-Week Average: $273.8M

Members of the Architect Partners team will be in New York for Permissionless next week, as well as in London for other industry events. Please reach out to schedule a meeting.

As we go to press, the U.S. Senate just passed its version of the GENIUS Act stablecoin bill, marking the first time the Senate has cleared any piece of crypto legislation and representing a potentially significant move toward increased regulatory clarity in the U.S. Meanwhile, the CLARITY Act market infrastructure bill was introduced in the House of Representatives in late May, offering a framework for classifying and regulating crypto assets, with the goal of providing clear legal pathways for both institutional and retail adoption. The lack of regulatory clarity in the critical U.S. market is often cited as a principal impediment to broader user adoption of crypto technologies. Taken together, the bills could do much to address that concern.

Yet a clearer regulatory framework is not, alone, sufficient for mass crypto adoption. Several other barriers have impeded adoption, including scalability, high implementation and transaction fees, security and trust issues, and perhaps most importantly, the dizzying complexity and poor usability of on-chain tools and solutions. The good news is that each of these is related in some fashion to the infrastructure underlying use cases and protocols. While regulatory opacity has, until recently, been the result of political dysfunction and intransigence beyond our industry’s control, improving the infrastructure and poor user experience can be addressed with the right combination of smart minds and smart capital focusing on the right problems.

We’ve seen this play out in financing trends over the last several years, with infrastructure investments retaining persistent and durable favor throughout the chilly downturn and into the currently warmer season. By our numbers, total digital asset infrastructure investments have represented roughly one-third of all financings from 2021 to present, and only a slightly lower percentage of transaction values across the same period. This consistent support appetite is impressive, but it also makes sense. Clunky and confusing systems will never reach broad adoption, no matter how favorable the regulatory winds may be. The teams who hunkered down to build solutions that address the clunks and improve the experience, things that we could control, should now be poised for (hopefully) sensible regulatory frameworks that may be emerging. We see this trend emerging not just in financings, but also in the M&A space, with the acquisitions of Web3Auth and Privy occurring over the past couple of weeks.

But it will only matter if non-crypto-native people and institutions can migrate into the tech easily, and without getting spooked, spoofed, or scammed. One of the most important components for this migration is the usability of crypto wallets, the essential tools that enable users to interact with blockchain networks by generating the information needed to send, receive, and manage crypto assets, generally by managing the cryptographic keys needed for cryptocurrency transactions. Yet the technical complexity of key management and the vulnerabilities inherent in wallet storage solutions, especially those connected to the internet or lacking robust security protocols, can be daunting for the crypto cognoscenti, let alone the skeptics and uninitiated.

Turnkey, a company dedicated to verifiable key management infrastructure, raised $30M this week to help address this problem. The company develops embedded wallets that don’t rely on phishable seed phrases, potentially addressing both usability and security concerns. Their clients include prediction market platform Polymarket, NFT marketplace Magic Eden, and Web3 development platform Alchemy. Their Series B round was led by Bain Capital Crypto, with participation from Sequoia Capital, Galaxy Ventures, Lightspeed Faction, Variant, and Wintermute Ventures. Impressive names across the board for a team that emerged in 2022 from Coinbase Custody to identify, and work to solve, the limitations of “old school” custodial infrastructure. They intend to deploy their new capital into more open-source tools, deeper integrations, and modular infrastructure for payments, AI agents, and decentralized finance. We hope companies like turnkey and others can reduce friction and enhance adoption with the regulatory tailwinds at their back.

Contact ryan@architectpartners.com to schedule a meeting